Bitcoin has been known to lead humanity to a trustless digital payment mechanism, but what kind of problems can or does bitcoin solves? There are many kind of problems financially, socially, culturally etc that bitcoin solves. Lets take a look at a few:

I. The Double Spend Problem

The Double Spend Problem describes the difficulty of controlling or preventing the duplication of digital content, especially with regards to digital money. Traditional financial systems solve this problem by employing trusting third parties, such as banks and payment processors, and relying on governments to keep the trusted third parties honest. Several attempts at digital currencies preceded Bitcoin, but none were able to solve the Double Spend Problem without a trusted authority. Satoshi Nakamoto cited this trusted authority as the critical flaw in each of Bitcoin’s predecessors. Solving the Double Spend Problem in a trustless manner was one of Bitcoin’s greatest innovations.

Bitcoin uses a distributed ledger to record all transactions in the network. This ledger takes the form of a blockchain, a large database. This database is composed of time-stamped batches of transactions, called blocks.

The blockchain is a distributed ledger and is stored independently by tens of thousands of computers, called nodes, across the world. Each node stores the entire history of transactions, and all nodes collaboratively update each other with new transactions and blocks as they are produced.

Nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

- Satoshi Nakamoto

Since each node independently stores their copy of the blockchain, there must be a way for nodes to agree on the valid state of the blockchain and the ownership of each bitcoin. The rules of the Bitcoin network specify an objective method for determining the valid instance of the blockchain.

Because each node maintains a full history of Bitcoin transactions, they can verify that no coin was double spent, and that all coins were minted in accordance with Bitcoin’s emission schedule. A user who runs a node is able to verify their ownership of bitcoin without relying on any third party.

A blockchain is composed of blocks, and each block is time stamped. Thus, blocks are strictly linear and chronological. In case two transactions attempt to double spend the same bitcoin, this design allows all nodes to objectively decide which of the two transactions is valid. On the Bitcoin network, unlike with traditional payment systems, there can be no disputes over which transactions are valid and which are not. Thus, there is no need for authorities or trusted arbitrators to resolve disputes.

If a transaction is included in a block in the blockchain, it is objectively valid. Any future transaction attempting to double-spend the same bitcoin will be rejected by all nodes on the Bitcoin network.

Bitcoin transactions are considered final and immutable once settled. However, a Bitcoin transaction is not immutable immediately after it is broadcast to the network. First, it is added to the mempool, a list of pending transactions. Once a transaction is added to a block it is considered “confirmed”. Each block that comes after the block containing a transaction is counted as a confirmation for that transaction. While a Bitcoin transaction is official once it has a single confirmation, it is generally not considered final until it has achieved six or more confirmations.

Most Bitcoin users wait for six confirmations because the most recent block can be removed from the blockchain if it is no longer part of the longest chain. In this case, all transactions included in the removed block, called an orphan block, are returned to the mempool and must await confirmation again. This is called a reorganization, and it is a rare occurrence. Reorganizations can resurrect the Double Spend Problem. For example, imagine Alice creates a transaction sending Bob 1 BTC. While this transaction is in the mempool awaiting confirmation, Alice creates another transaction sending the same 1 BTC to Charlie. Alice’s transaction to Bob is then included in a block. However, by chance, or by Alice’s malicious intent, a different miner mines two blocks in a short time span, one of which included Alice’s transaction to Charlie. Bob’s transaction would be unconfirmed and Charlie’s transaction would be confirmed.

In order to avoid the risks caused by reorganizations, Bitcoin users usually wait for 2-6 confirmations to consider a transaction final. The likelihood that six blocks will be reorganized out of the Bitcoin blockchain is extremely miniscule. In the example above, if Bob waited for six confirmations, he would have seen his transaction arrive, but then be quickly unconfirmed. He would safely know that Alice had not yet paid him.

II. Reversibility of electronic payments

According to the bitcoin inventor Satoshi Nakamoto, online commerce relies almost exclusively on financial institutions acting as trusted intermediaries to process electronic payments. As a result, ensuring completely irreversible transactions is not possible. That creates room for malpractices such as fraud and theft, amounting to huge losses.

That is one of the problems that bitcoin seeks to solve. Unlike fiat currency exchanges based on trust, bitcoin transfers rely on cryptographic proof. The bitcoin network uses proof-of-work to secure and validate transactions without any third-party involvement. Bitcoin’s use in financial transactions cushions sellers and buyers from fraud since no third party can willingly or unwillingly reverse the payments.

Blockchain technology does more than just secure and validate payments. It also keeps a shared digital ledger with all the transaction data, making it very hard for users and unauthorized parties to manipulate transactions. Even if the network experiences glitches, it will not cause inconsistencies in the digital ledger, hence, the impossibility of reversing electronic transactions.

If there is an attempt to alter the ledger, the entire network will reject the copy since it would not match the data shared by the other nodes on the web. That makes it impossible to counterfeit bitcoin.

III. Inflation

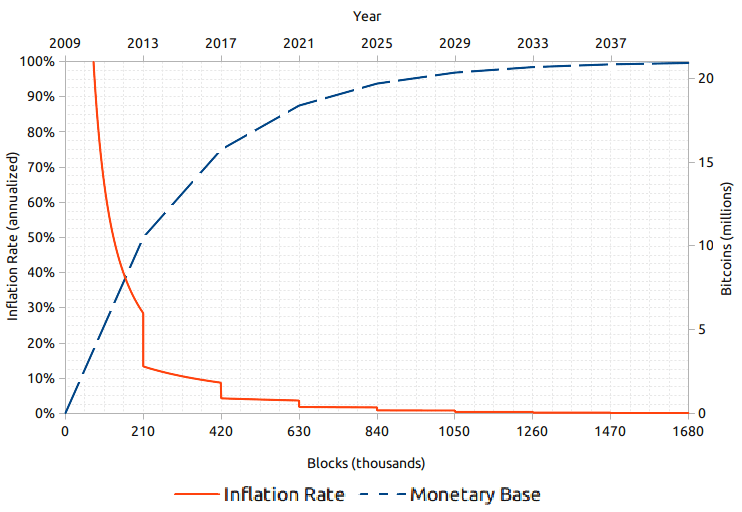

Bitcoin’s supply can’t exceed 21 million, which means only that amount of bitcoin will ever be in circulation. Miners have already produced about 18 million bitcoins to date, which leaves only 3 million more. Since free markets usually fluctuate based on supply and demand, the increasing demand for an asset in limited supply like bitcoin would undoubtedly drive its unit price up.

The bitcoin mining process also contributes to its scarcity. In the first four years of bitcoin’s release, miners received 50 BTC. That limit was halved in 2012 and will continue to decrease by half every four years. The most recent one was in 2020, with bitcoin miners receiving 6.25 BTC. That indicates it would take until 2140 to attain the 21 million bitcoin cap. The halving makes bitcoin scarcer, thereby increasing the value of the available reserves.

Bitcoin’s capped supply and halving create a long-term value growth system, which helps keep inflation in check.

IV. Transparency and accountability in financial transactions

Bitcoin’s underlying blockchain technology also ensures greater transparency and accountability in all financial transactions. It maintains a public digital ledger with all the users’ details, including transaction records, which they can access via the internet anytime. Even if you use multiple key pairs for different transactions, the bitcoin network will still capture the data in the ledger.

Blockchain ensures that all bitcoin transactions are public, traceable, and permanently encrypted in the bitcoin network. Bitcoin’s transparency and accountability are among the reasons why reputable platforms such as the bitcoin revolution continue to attract traders and investors from all over the world. Despite the high-level transparency, bitcoin users can remain anonymous.

V. The Unbanked

2 billion people don’t have access to a bank account. In this day and age, one should think this should be a thing of the past but no, it is not. Being unbanked is discriminatory. Everything has to be done in cash and even that’s difficult to manage in remote places. This is one of the reasons why in countries like Kenya, people have been using N-Pesa — a phone payment system — since cash is not widely available. M-Pesa is better than nothing but it can’t be compared to having a crypto wallet. With this, you can save, transfer, pay, send, borrow and lend money in a fast, secure and inexpensive way.

This is a great opportunity for many developing countries that finally have a chance to function normally with services we take for granted. With crypto, you become your own bank and gain access to all the opportunities provided by banking minus the gatekeepers. A $50 phone is all that is needed to enter the financial opportunities provided by the crypto ecosystem. This is already changing the lives of many in places like Nigeria, Venezuela, El Salvador, or India.

VI. Remittances

The market for remittance will reach $1 trillion in the near future. About 20% of it gets lost in fees and commissions by intermediaries and middlemen and never gets to the people most in need.

This is easily fixed by Bitcoin. On a peer-to-peer network, transactions are permissionless, instantaneous, and virtually free.

But it’s not just the fees, having to deal with Western Union and similar intermediaries is slow, bureaucratic, and cumbersome at both ends. Doing the same transaction from wallet to wallet is seamless once the system is properly set up and running.

VII. Energy Storage

Contrary to popular belief, Bitcoin could solve many of the environmental problems we have around the usage of energy.

Energy can’t be easily stored so a big percentage of it gets inevitably wasted at power stations. One way to deal with this would be to mine Bitcoin during off-peak periods and then use some of those coins to pay for electricity when it gets more expensive. This not only avoids waste but also makes Bitcoin function as a giant battery.

Bitcoin has been criticized for its intense energy consumption but in reality, it consumes far less than banks, credit cards, payment rails, or gold mining. Besides, since miners need cheap energy, and solar, wind, and hydro are among the cheapest sources, Bitcoin is effectively promoting the use of renewables driving prices even lower.

Sovereign Monk

Bitcoin, Privacy & Individual Sovereignty Maximalist | Founder of European Bitcoiners - for Free and Open Bitcoin Education.

follow me :

Related Posts

How does Bitcoin Mining Work?

Jul 05, 2025

7 Bitcoin Scams You Need To Be Aware Of

Jul 05, 2025

What is Bitcoin?

Jan 16, 2025