Bitcoin isn’t merely a currency or even just a technological innovation. It is an unstoppable force that taps into something much deeper—something that speaks to the essence of value, security, and the power of individual sovereignty. For centuries, mankind has struggled to find a reliable store of value, yet each attempt has fallen short. Gold, while historically valued, is burdened with logistical constraints and vulnerabilities; it can be seized, is almost unpossible to move over large distances, and its supply remains uncertain. In contrast, Bitcoin, with its fixed 21 million limit and unparalleled security derived from unchallangable amount of computational power, provides a true savings technology for the first time in history.

This new system isn’t merely about replacing money; it’s about reinventing what savings and ownership mean in the digital age. While every fiat currency eventually erodes, Bitcoin stands resilient, a fortress untouched by the risks that plague traditional assets. Stocks, fiat, and even real estate are inherently vulnerable to market fluctuations, legal constraints, and control by external authorities. Bitcoin, however, is fundamentally different. It operates beyond the reach of any single institution, government, or military. Its security isn’t born out of protection by gunpower, but rather from the boundless electric energy poured into it—an impenetrable network grounded in real world energy and global computation of code. The electric power that fuels Bitcoin’s network is its form of defense, an unyielding shield that protects the value contained within.

“Energy cannot be created nor destroyed, it can only be changed from one form to another.”

— Albert Einstein

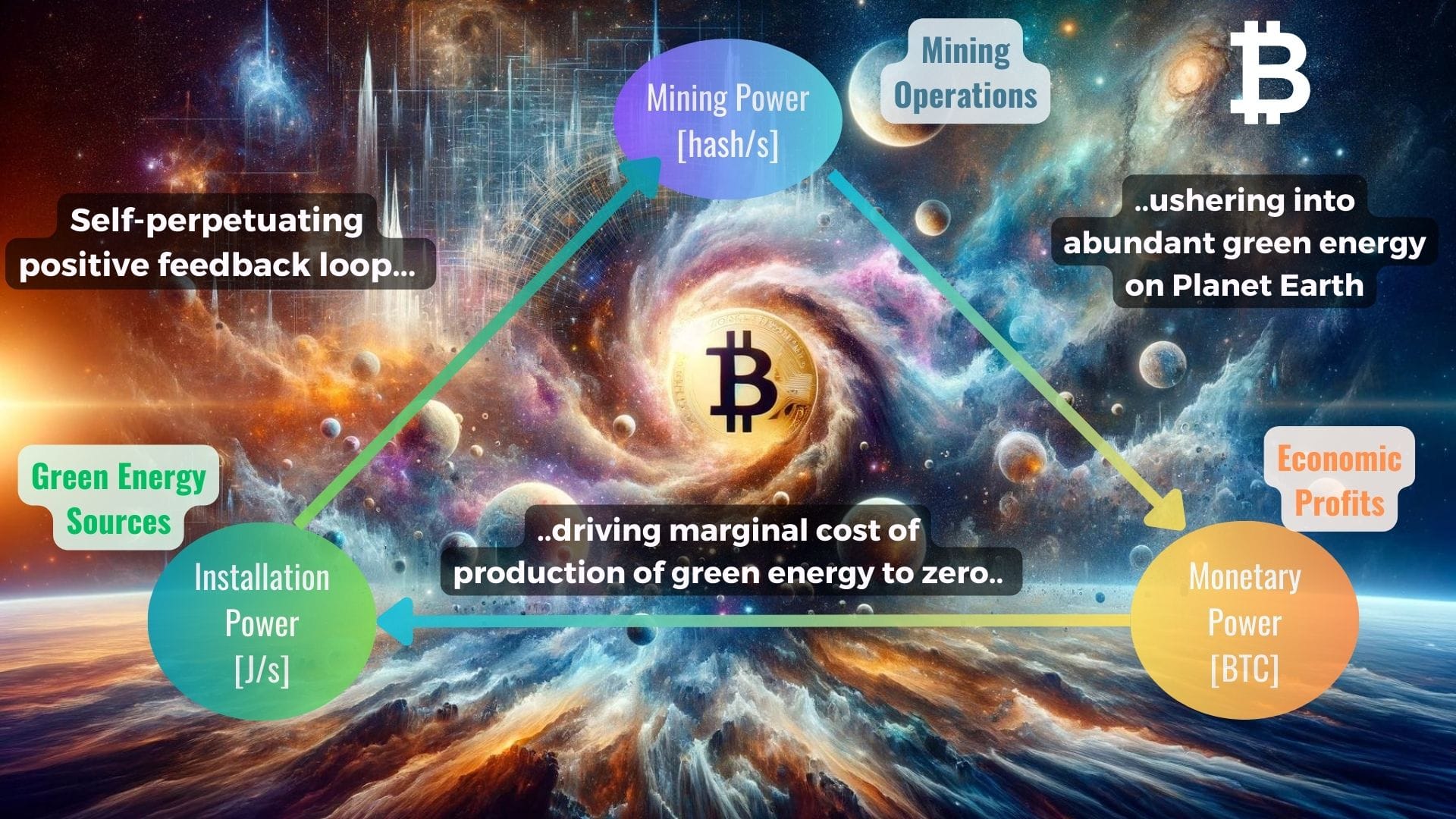

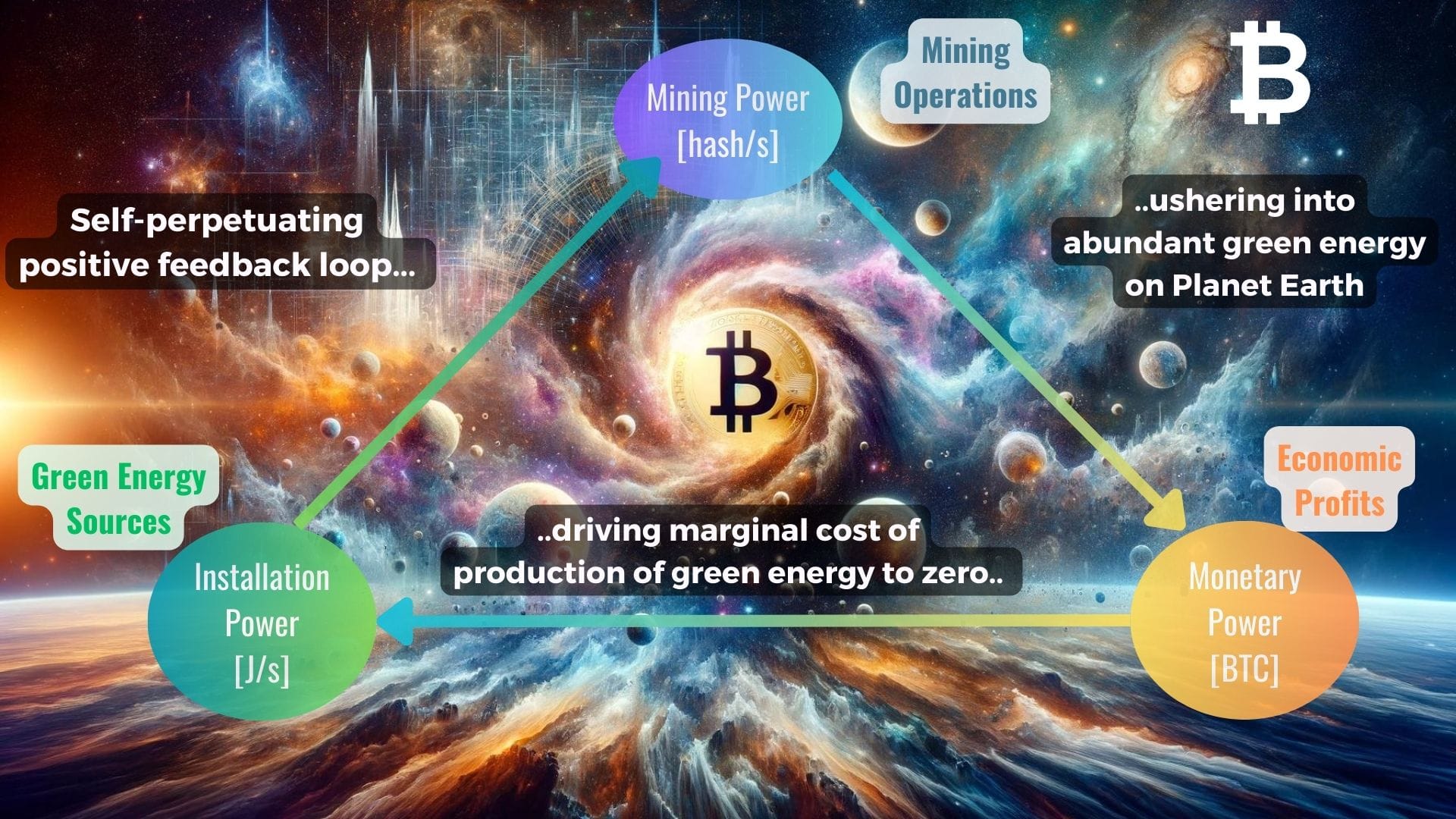

Remarkably, Bitcoin’s impact goes even further. The mining process itself has created a unique feedback loop with renewable energy production. The decentralized nature of mining, its flexibility in location, and its sensitivity to energy costs mean that Bitcoin is naturally drawn to abundant, often underutilized or completely untapped green energy sources. As mining profits fuel further investment in green energy hardware, we approach a paradigm where energy costs plummet, fostering an age of abundant, affordable electricity. This evolution marks Bitcoin not just as a financial innovation but as a driver of green energy adoption, creating a future where the energy needed for everyday life could be supplemented by the excess from Bitcoin mining, fostering a more sustainable world.

Bitcoin’s vision reaches beyond economic stability; it touches on the philosophical. It represents the ability to protect assets without physical harm, a non-lethal protocol of security and value preservation. In the realm of property protection, most conventional means rely on military power—missiles, bombs, or armed forces—to ensure safety. Bitcoin redefines this with electric power, channeling computational energy rather than military might. This shift signifies a profound evolution: a network that safeguards assets with a force that is impenetrable, non-violent, and liberated from territorial or political interests.

Bitcoin is more than just technology—it’s a powerful reminder that in a world constantly pushing for greater centralization and control, there exists something that remains steadfast, independent, and entirely unyielding to outdated financial paradigms. It’s not only money but a resilient system, a form of property that offers unparalleled security. It’s not just a store of value, but a declaration of independence, an asset that aligns with our inherent desire for sovereignity and freedom.

In the end, Bitcoin represents a shift in the very fabric of society. As more people come to understand this, they’ll see Bitcoin not as a passing trend or a speculative asset but as a lighthouse guiding us towards a future of unseizable value, abundant green energy, and individual sovereignty.

Sinan M

Born in Germany. Raised in a turkish-german family. Free thinker, writer, co-founder of primal-vanguard.com

follow me :