Publication: Philip Charter | Author: Prashanth Chandrashekar, founder of Bringin | Date: 7/17/2025

Technology grows exponentially.

Looking at past developments in depth does not help us see exactly where we're going. It’ll likely bring us to what’s already in development.

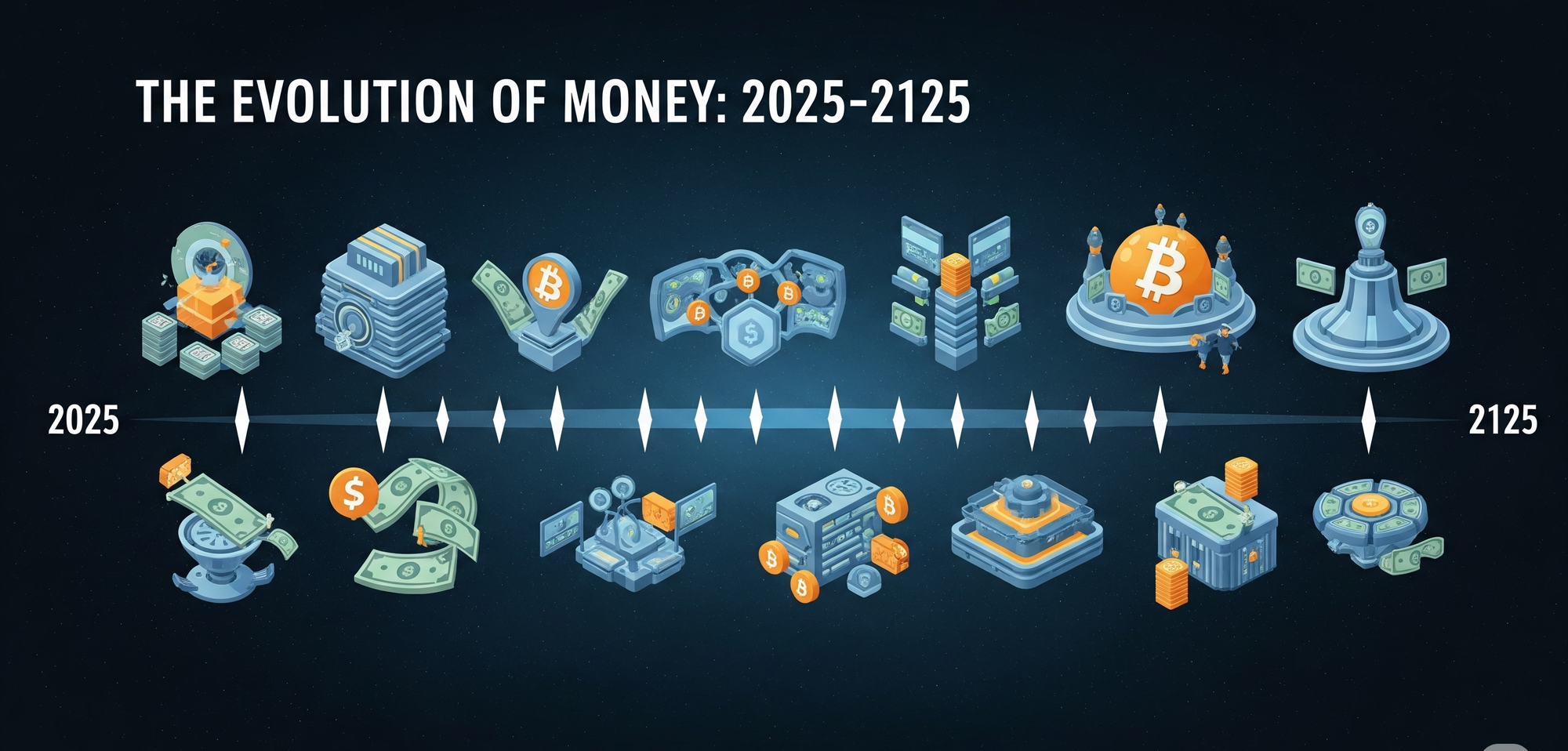

Long-term predictions require the understanding of other exponential developments. Innovation leads to more innovation. Of course, it’s a big ask to accurately predict what money will be like in 2125, but hey, I probably won’t be around then either. Nobody remembers wrong predictions, so let’s go for it.

These predictions are based on my understanding of computational and mobile fintech growth. Get ready for more tools, more creativity, and endless possibilities.

The Next 5 Years:

It might surprise you to learn that in 2024, only 66.2% of the world’s population were internet users. Tech adoption is not always as fast as we think in the West. Bitcoin’s adoption curve is roughly on par with the Internet in 2001. This means that in 5 years time, adoption will be approaching 20%.

As such, Bitcoin will co-exist with other currencies for some time. It won’t immediately replace our payments infrastructure, despite its superiority for speed, access, cost, and simplicity.

I believe that by 2030, most merchants will accept both Bitcoin and fiat, just as they began to accept both card and cash modes of payment in the 1990s and 2000s.

Why will this happen?

People will pay attention when the exchange rate continues to rise. Media outlets will not be able to resist covering $1m per coin and after 20+ years of existence, the talk of a ‘bitcoin bubble’ will die down.

Education, onboarding, self-custody, and transactions will all be much easier in five years due to the many tools and services already in development.

At Bringin, we are already in partnership with companies to create a flywheel effect for payments adoption — all that is required is the right incentive model for merchants and a great user experience (scan and pay).

Finally, self-custody Lightning will scale for retail customers and will help large enterprises settle funds (especially across borders).

My prediction for regulation is that the path to on/off-ramp will become simpler. Companies will learn how to best comply with MiCAR and law-makers will seek to clear any pinch points (which risk a lack of compliance). In five years, I’m sure that movement between Bitcoin and trad-fi will be even easier than it is today. Bitcoin is regulatory-friendly compared to centralized stablecoins (which will be of lesser importance in 2030).

I think that freelancers and knowledge workers in the Global South will greatly benefit from price arbitrage (currently hindered by archaic or failing currencies and monetary systems). As it becomes seamless to move funds from developed countries to the developing world, value and wealth can begin to transfer.

The use cases for Bitcoin will only become more obvious by 2030 — helping the unbanked and in places with little card infrastructure, use-based pricing (micropayments), integration with AI agents, and value streaming.

Three Predictions for Money in 2125

Here we go. Now it’s time for some bolder predictions.

Prediction 1 — Money will be borderless.

By the middle of the 21st century, Bitcoin will be the global default unit of account for all goods and services. Prices could be listed in sats, ‘bitcoins’, or something else entirely, but they will relate to fractions of btc.

Just as the internet serves information everywhere and to everyone, bitcoin will become the decentralized value transfer around the world. Digital coins can move over the internet with millions of micro and macro payments. Instead of video or podcast being streamed in real-time, we’ll see micro sats moving in a constant flow from person to person, business to business. This kind of deflationary value transfer incentivises sustainability, long-term relationships and a flight to quality. For more on the deflationary aspect of bitcoin and its effects, read the excellent Price of Tomorrow by Jeff Booth.

Prediction 2 — Banks will die.

Maybe not all banks, but the retail banking sector will wither as bitcoin adoption grows.

Consumers simply won’t need ‘trusted’ third parties as self-custody wallets develop tools to allow users simple and convenient interfaces. The amount of open source software will only grow, furthering innovation and helping people to become their own bank by integrating the tools that work for them.

The fintech and payments ecosystem built on open monetary protocols will be fully interoperable. No more blocks, headaches, or delays. Irrespective of what tool you use to store your keys and funds, you’ll be able to interact with all products and services. Just as every business has an online presence, finance and value-transfer will be automatically embedded into every service we interact with. This may even manifest in physical appliances too.

Prediction 3 - Money will be permissionless.

Very few transactions will require ‘approval’. Only major purchases like houses, cars, will need signing and authenticating, whereas most everyday purchases will be completed by AIs (together with AIs which deliver the products/services). Of course, this will only be possible due to cryptographic signatures on Bitcoin, Lightning and many more layers that may best suit self-custody.

Imagine the time saved if humdrum shopping could be automated. Plus, though using optimized purchase flows, we will secure the best value or optimal conditions. Payment hardware (card readers, physical wallets, safes) may all become redundant.

Importantly, our identities will be decentralized. I believe that by the 22nd century, we will not be completing social authorizations, filling in forms or providing our dates of birth. All data will be held against your private keys in decentralized systems that you control (share / revoke access). We may see governments attempt to control this space with CBDCs and other blockchains, but there are already freer and better systems like Bitcoin and Nostr in play.

There may be new open-source protocols which gain adoption faster, but Nostr already has a core of dedicated users and an army of developers building tools to help decentralize social media, personal identity, and to do away with big tech’s algorithmic control.

It’s no surprise that my monetary predictions are bitcoin-based. My conviction is not based on idealism or blind faith. It’s based on 16+ years of data which has seen Bitcoin transform from ‘$0.01 magic internet money’ to a $100,000 store of value that acts as permissionless world currency. Imagine how far this system could take us in 100 years.

Having said that, Bitcoin itself is not the biggest revolution. The real wins will be the side effects — automation, deflation, and decentralized identity, all of which return control of monetary policy to the people who use it every day.

- Originals

- Bitcoin

- economics

- english

- opinion

- lang:en

- level:advanced

- read:short

- author:philip

- topic:economics

- topic:basics

- topic:opinion

Philip Charter

Philip Charter is a full-time writer and part-time cat herder. As well as writing content for bitcoin founders and companies, he runs the 21 Futures fiction project.

follow me :

Related Posts

Die Philosophie der digitalen Souveränität

Feb 22, 2026

Inflacija: Skriti davek, ki požira vašo kupno moč – kako jo premagati s trdnim denarjem - Burek zgodba

Feb 15, 2026

Mediji lažejo o Bitcoinu — resnica o pranju denarja, ki jo skriva finančni sistem

Feb 08, 2026