I. The time-dependent potential model: Bitcoin as a deepening energy well

The basic analogy

Let's imagine the global financial system as a three-dimensional energy landscape, where each point represents a possible monetary configuration. Bitcoin initially appears as a flat, barely perceptible area within this landscape. Over time, however, this area deepens into an increasingly pronounced potential well—an energetic "valley" that attracts economic actors with increasing force.

The deepening of this Bitcoin potential well is not linear, but rather driven by several simultaneous forces: Network effects increase the attraction with each new participant, technological improvements reduce friction, and institutional adoption legitimizes Bitcoin as a monetary alternative. These forces are self-reinforcing and accelerate the deepening of the potential well exponentially.

Time dependence and irreversibility

What's special about this model is its time dependency: The Bitcoin potential well is not only getting deeper, but also broader. What does this mean in concrete terms? Initially, only technically savvy individuals could use Bitcoin—the "entrance" to the potential well was narrow. Today, pension funds, companies, and even nation states can adopt Bitcoin—the well has opened up to a wide variety of players.

This development is thermodynamically irreversible. Once a potential well has been deepened, it cannot be returned to its original state without enormous energy expenditure—just as the Bitcoin infrastructure, the accumulated knowledge, and the institutions created cannot simply be "undone."

II. The Protein Folding Analogy: Levinthal's Paradox and Bitcoin Adoption

The fundamental problem of complexity

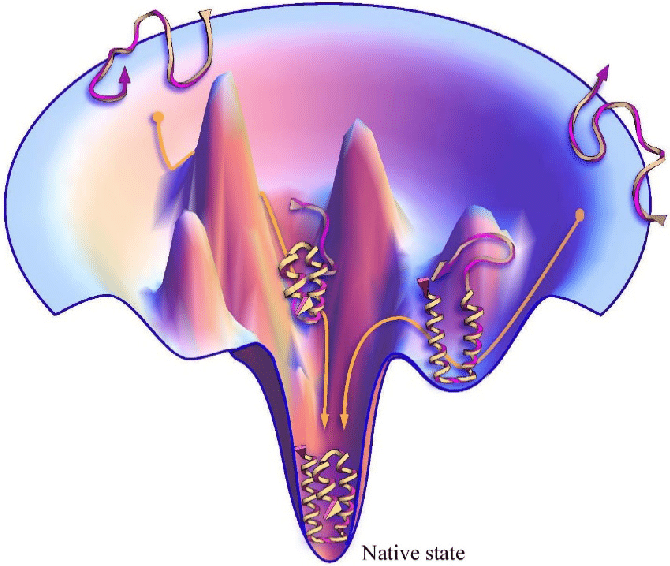

In the 1960s, Aaron Levinthal discovered that, theoretically, proteins would need millions of years to find their correct three-dimensional structure if they randomly sampled all possible conformations. In reality, however, they fold within seconds or minutes. The solution to this paradox lies in the fact that proteins don't search randomly, but rather follow a "folding funnel"—an energy landscape profile that systematically leads them to their energetic minimum.

The parallel to Bitcoin adoption is striking: Theoretically, the global financial system could take millennia to find the optimal monetary system if it were to randomly test all possibilities. In practice, however, it follows a structured path—the Bitcoin "convolution funnel"—shaped by economic incentives, technological development, and network effects.

The convolution funnel of hyperbitcoinization

Just as a protein finds its native structure through various intermediate states, the financial system goes through structured phases of Bitcoin adoption:

Early Phase (Nucleation) : Individual "nucleation cores"—early adopters, crypto enthusiasts, and libertarian thinkers—begin to form around Bitcoin. This phase is characterized by high energy barriers and low adoption.

Middle Phase (Cooperative Folding) : Institutional players begin to adopt Bitcoin. Like the cooperative bonding in proteins, each new adoption not only strengthens their own position but also stabilizes the entire system. Companies like MicroStrategy, and institutional investors act as "folding facilitators."

Late Phase (Native Structure) : The state of hyperbitcoinization – a stable, energetically optimal state in which Bitcoin functions as the global monetary standard.

III. Metastable states and kinetic traps

The inertia of existing systems

Just as proteins can be "trapped" in suboptimal conformations, metastable states exist in the financial system - energetically unfavorable but temporarily stable configurations:

Fiat currency systems represent such kinetic traps. They are fundamentally unstable (inflationary, politically manipulable), but temporarily stabilized by institutional inertia and network effects. Overcoming these metastable states requires energy—in the form of crises that tear the system out of its inertia.

Regulatory misfolding: Faulty or restrictive regulation can lead to "protein misfolding" – suboptimal structures of the Bitcoin ecosystem that hinder its native development.

Technological Intermediate States: Centralized exchanges, custodial services, and other compromise solutions act as intermediate states on the path to full decentralization—necessary for adoption, but not the final state.

Chaperone mechanisms in the Bitcoin ecosystem

In cell biology, molecular chaperones prevent protein misfolding and assist in proper folding. In the Bitcoin ecosystem, various actors perform similar functions:

Educational institutions and educators act as chaperones, preventing people from making wrong decisions about Bitcoin due to ignorance or misinformation.

Open-source developers create protected spaces for innovation and prevent the Bitcoin protocol from being "denatured" by harmful modifications.

Bitcoin maximalists —often ridiculed—fulfill an important chaperone function by defending the integrity of Bitcoin's "conformation" against dilution by altcoins and compromised implementations.

IV. Network effects as cooperative bonds

Metcalfe's law and quadratic gain

Metcalfe's law states that the utility of a network grows proportionally to the square of the number of participants. This nonlinear amplification is also found in protein folding: The stability of protein complexes increases disproportionately with the number of stabilizing interactions.

With Bitcoin, this means that every new user not only strengthens their own "bonding experience" but also stabilizes the entire network. A company that adopts Bitcoin as a treasury asset makes it easier and more attractive for other companies to follow suit.

Critical mass and percolation

Bitcoin adoption follows percolation principles: Below a critical threshold, only isolated "clusters" of Bitcoin users exist. These clusters are separated from each other and cannot influence the overall system.

Above the critical threshold, however, a cluster emerges—an interconnected network that permeates the entire system. At this point, hyperbitcoinization becomes a self-sustaining process: The Bitcoin network has become so large and interconnected that the traditional financial system can no longer ignore it.

V. Thermodynamic considerations: Entropy and order

Entropy reduction through Bitcoin

The modern financial system is characterized by enormous entropy: thousands of currencies, complex derivative structures, opaque monetary policies, and unpredictable regulatory interventions create a system of maximum disorder and uncertainty.

Bitcoin represents the thermodynamic opposite: a deterministic, predictable system with clear rules, a limited money supply, and transparent "physics." Hyperbitcoinization leads to a dramatic reduction in systemic entropy.

The hyperbitcoinized ground state

In physics, systems strive toward their ground state—the state of lowest energy and highest stability. The hyperbitcoinized state of the global financial system corresponds to this thermodynamic ground state:

All economic actors use the same monetary standard, price signals are clear and undistorted, capital allocation occurs efficiently without political intervention, and the system exhibits maximum stability with minimum complexity.

VI. Self-organization and emergent properties

Spontaneous order formation

Hyperbitcoinization is not a planned process, but an example of spontaneous self-organization. Just as snowflakes develop their hexagonal structure without a central designer, the Bitcoin-based financial system emerges from the decentralized decisions of countless individuals.

This self-organization shows characteristic properties of critical systems: small changes can have large effects (avalanche effect), the system shows long-range correlations, and emergent properties arise that were not present in the individual components.

Feedback loops and homeostasis

The Bitcoin system exhibits remarkable homeostatic properties:

Mining difficulty adjustments ensure that the block time remains constant, regardless of the network hash rate.

Halving cycles systematically reduce the inflation rate and create predictable supply shocks.

Lightning Network development arises as an emergent response to scaling problems, without central planning.

VII. Critical phenomena and phase transitions

The S-curve as a phase transition

The characteristic S-curve of Bitcoin adoption corresponds to a classic phase transition. Just as water spontaneously turns into steam at 100°C, Bitcoin adoption passes through critical thresholds at which the system develops qualitatively new properties.

The early phase is characterized by slow growth and high volatility—the system is still "searching" for its optimal state. The middle phase shows exponential growth through positive feedback loops. The final phase reaches a new level of stability at a higher level.

Universal scaling laws

What's remarkable is that Bitcoin adoption follows universal scaling laws found in other complex systems—from the spread of epidemics to the adoption of new technologies. This universality suggests that fundamental physical principles are at work.

VIII. The Inevitability of Hyperbitcoinization

Thermodynamic imperative

The analogy developed leads to a provocative conclusion: Hyperbitcoinization is not one possible scenario among many, but a thermodynamic imperative. Just as proteins spontaneously find their native structure because it corresponds to the state of minimal free energy, the global financial system converges on Bitcoin because it represents the system of minimal economic entropy.

This convergence occurs not through human planning or preference, but through the fundamental laws of information theory and statistical mechanics. Bitcoin solves the "folding problem" of money—it finds the optimal structure for transferring and storing value in a decentralized system.

Evolution as an optimization process

Protein folding teaches us that evolution develops highly efficient solutions to complex optimization problems. The 3.5 billion years of biological evolution have produced proteins that solve their folding problems in fractions of a second.

Bitcoin represents an analogous evolutionary solution to the problem of money. It did not emerge by chance, but rather as a response to the fundamental problems of centralized monetary systems. "Selection" occurs through economic efficiency, not political power.

IX. Practical implications and timeframe

Predictable milestones

Based on the protein folding analogy, certain milestones of hyperbitcoinization can be predicted:

Nucleation phase (completed): Critical mass of early adopters reached.

Cooperative Folding (current): Institutional adoption accelerates, governments begin to build Bitcoin reserves.

Structural stabilization (future): Bitcoin becomes the dominant global reserve currency, fiat systems become secondary means of payment.

Native conformation (final state): Complete hyperbitcoinization with Bitcoin as the universal measure of value.

Resistance and energy barriers

As with protein folding, there are energy barriers that must be overcome. In Bitcoin's case, these are mainly:

Regulatory resistance : Established institutions resist the loss of their monetary control.

Technological hurdles : Scaling and usability need to be further improved.

Psychological barriers : The understanding of decentralized, digital currencies must be established in society.

X. Temporal Projection: The Kinetics of Hyperbitcoinization

Analysis of historical folding speed

Bitcoin adoption data through August 2025 show striking similarities with protein kinetic measurements. In 2025, approximately 28% of American adults own cryptocurrencies, while the global cryptocurrency ownership rate averages 6.8%, with over 560 million users worldwide.

These data correspond to the "cooperative folding phase" of our model. Bitcoin is currently trading at around $117,000 and exhibits characteristic features of a system approaching its critical transition point: lower volatility and more stable trading volumes compared to previous years.

The protein folding timescale applied to Bitcoin

Proteins typically reach their native structure in a time range between microseconds and minutes, depending on their size and complexity. Applied to the macroeconomic timescale, this corresponds to a hyperbitcoinization process of approximately 30-50 years since the genesis block in 2009.

Current indicators suggest that we have moved about 50-60% through the "folding funnel":

Nucleation energy exceeded (2017): The critical mass of early adopters was reached, and first institutional interest arose.

Cooperative Bonding Phase (2020-2025): Institutional demand for Bitcoin increases sharply, ETFs record continuous inflows.

Critical transition imminent (2025-2035): Based on S-curve dynamics and current adoption rates.

Quantitative projection of folding velocity

Bitcoin adoption follows a typical diffusion dynamic with a characteristic half-life. Given the current global adoption rate of 6.8% and the exponential phase we are currently experiencing, a time projection can be made:

Phase 1 (completed, 2009-2020) : Nucleation and early secondary structure formation

Phase 2 (current, 2020-2030) : Cooperative folding and tertiary structure formation

Phase 3 (projected, 2030-2040) : Quaternary structure stabilization and hyperbitcoinization

Phase 4 (2040-2050) : Native conformation and systemic stability

Critical thresholds and tipping points

Based on percolation theory and current data, we can identify critical thresholds:

First critical mass (achieved): Approximately 5% global adoption - enough for self-sustaining network effects

Percolation threshold (next phase): Approximately 15-20% global adoption - emergence of the connected cluster

Dominance transition (2035±5 years): Approximately 35-40% adoption - Bitcoin becomes systemically relevant

Hyperbitcoinization (2045±10 years): >80% adoption - Fiat systems become secondary

Acceleration factors and kinetic catalysis

Several factors can significantly accelerate the folding rate, analogous to chaperones in protein folding:

Regulatory clarity : Like chaperones, clear regulatory frameworks can prevent system misfolding and accelerate correct adoption.

Technological breakthroughs : Improvements in scaling and privacy (Lightning Network and ECash), as well as usability and free education, as well as mentors and advocates act as kinetic catalysts.

Macroeconomic crises : Currency crises or hyperinflation can act as "thermal shocks" and free the system from metastable states.

Generational change : The "digital natives" generation shows significantly higher Bitcoin affinity, which corresponds to a natural generational transition.

Probability distribution of hyperbitcoinization

Taking into account the uncertainties in the modeling, a probability distribution for the time of complete hyperbitcoinization can be created:

Optimistic scenario (10% probability): 2035-2040 - Catalyzed by a severe fiat crisis.

Most likely scenario (60% probability): 2040-2050 - Natural adoption.

Conservative scenario (25% probability): 2050-2060 - Delayed by regulatory resistance .

Pessimistic scenario (5% probability): >2060 - Fundamental technological problems caused by a global panopticon of totalitarian governments.

The thermodynamic clock is ticking

Analysis of historical data up to August 2025 confirms that the Bitcoin system follows the laws of statistical mechanics. The "thermodynamic clock" of hyperbitcoinization ticks with the precision of a physical process.

The system is currently in the most critical phase of its development—the transition from cooperative folding to structural stabilization. The next 10-15 years will be crucial and determine whether hyperbitcoinization occurs on an optimistic or conservative timeframe.

However, physics leaves no doubt: the process has begun irreversibly and will evolve with the relentless logic of thermodynamic systems to its most energetically favorable state.

XI. Conclusion: The physics of monetary change

The analogy between Bitcoin adoption and protein folding reveals the underlying physical principles that shape monetary systems. Bitcoin is not just a technological innovation but represents the thermodynamically optimal solution to the problem of decentralized coordination of value and trust.

The time-dependent deepening of Bitcoin's potential well is making alternative monetary systems increasingly unstable and driving the global financial system toward a new, stable equilibrium configuration. This development does not follow human preferences or political decisions, but rather the fundamental laws of complex adaptive systems.

Protein folding shows us that nature finds elegant solutions to seemingly intractable problems. Bitcoin embodies such a solution to the millennia-old problem of money—a solution that is not only possible, but inevitable under the laws of physics and information theory.

Hyperbitcoinization is thus not a speculative dream, but a thermodynamic reality unfolding with the inexorable logic of statistical mechanics. The only question is not if, but when, this fundamental transformation of our monetary system will be completed.

Sinautoshi

#Bitcoin only - #GetOnZero - united we fix the money (supply to 21M BTC)

Related Posts

The plebs who make Bitcoin shine

Dec 28, 2025

Die Plebs die Bitcoin zum Leuchten bringen

Dec 28, 2025

Plebs zünden den Doppelwumms

Aug 05, 2025