At the end of June, during a follow-up meeting, they presented a revised ZDDOKS, in which we believe the changes are insufficient and that current political will is prevailing over the professional arguments presented. A longer dialogue and serious reflection on the government’s side would be necessary.

Ljubljana, July 2, 2025 – On Monday, June 30, 2025, members of the Bitcoin Slovenia and Blockchain Alliance Europe common initiative, along with other organization and initiative representatives, participated in the second working meeting at Slovenian Ministry of Finance. Ministry representatives orally presented the revised draft of the Slovenian crypto tax law, where we were disappointed to find that the new version completely preserves the essence of the previously proposed law, with only minor changes.

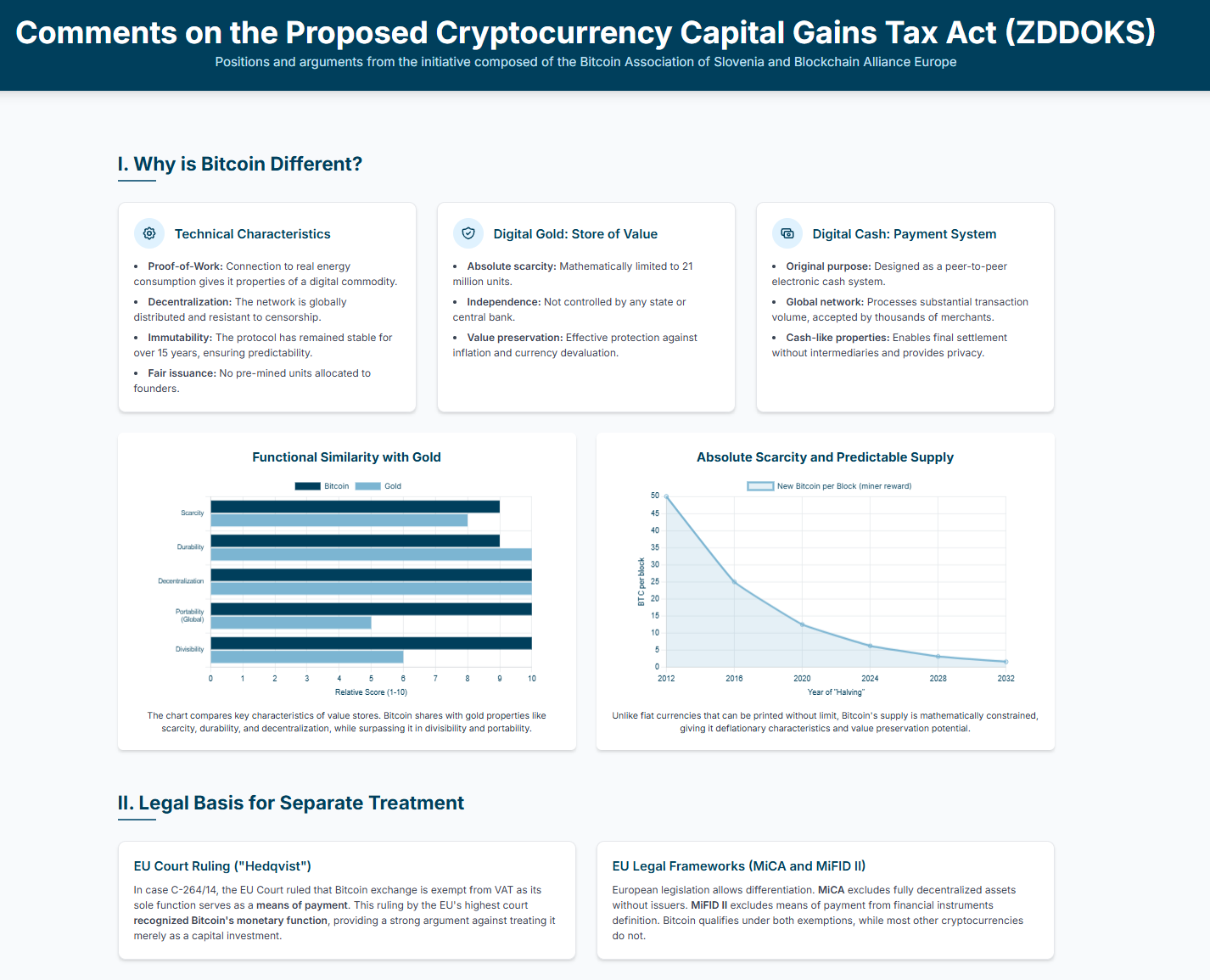

Bitcoin Association of Slovenia (BDS), with support from Blockchain Alliance Europe (BAE), prepared a 33-page document of professionally substantiated remarks, addressing the proposed classification of crypto assets into two classes, a detailed explanation of bitcoin as an investment and payment tool and a store of value, excessive intrusion into privacy and documentation of Slovenian citizens’ crypto holdings, and the lack of a time-based tax exemption (holding period relief).

Slovenia Is Not Ready to Pass a Progressive Law on Crypto Asset Disposal

While European countries (e.g., Germany) are updating and amending laws relating to crypto asset disposal, Slovenia has opted to adopt one of the more rigid laws in the wider European area. The idea is to equalize the taxation of crypto asset disposal with the taxation of derivative financial instruments.

Members of BDS and BAE presented the Ministry with specific and professionally reasoned arguments on why not all crypto assets should be treated the same and proposed a simplified two-class categorization. We also gave a detailed presentation of bitcoin as an investment and payment medium, including examples and reasons why countries include it in their strategic reserves.

We recognize that our proposals represent a pioneering approach to taxation and that passing such a law requires a deep understanding of the field and progressive thinking on the part of the government. Slovenia is undoubtedly a pioneer in implementing bitcoin and crypto innovations and still boasts the world’s oldest operating crypto exchange (Bitstamp) and one of the oldest active bitcoin NGOs. Since 2019, numerous merchants in Slovenia have accepted crypto payments, and Ljubljana was declared the most crypto-friendly capital in the world. Based on these facts, we believe a progressive legislative approach in this area would be appropriate.

No Time-Based Exemption for Crypto Holders – Despite Detailed Record-Keeping

We noted that the main objective of the Slovenian crypto tax law is to equalise the taxation of crypto asset disposal with that of derivative financial instruments, arguing they are comparable asset classes due to their inherent risk, though with a significant difference.

In the case of derivatives, a time-based tax reduction is anticipated: In Slovenia, tax rates decrease from 40% to 10%, depending on the length of ownership, while there is a complete tax exemption for holding periods over 15 years. For crypto assets, no such exemption is planned, which the ministry justifies by claiming simplified reporting. Yet the same law requires crypto holders to record every transaction, essentially matching the reporting obligations of financial derivatives. There is, therefore, no valid reason not to apply a holding-period tax reduction for crypto assets as well.

Details on the Paradox of Simplicity and Record-Keeping

The bill’s drafters explain that, after studying various models, they selected the “appropriately adjusted net cash flow model” as most suitable for the Slovenian legal framework. This model taxes annual profits as the difference between fiat payouts and the cost of acquiring crypto assets during the tax year.

It is explicitly stated that profits from exchanging one crypto asset for another are not taxed under this model. Administrative simplicity is highlighted as a key advantage.

However, Article 13 of the ZDDOKS proposal imposes exceptionally detailed record-keeping requirements on taxpayers, completely contradicting the simplicity the law promises. Taxpayers must chronologically log every transaction, including tax-irrelevant crypto-to-crypto swaps.

This creates an internal contradiction in the draft law and an illogical situation. It imposes a burdensome administrative duty on taxpayers to document transactions that do not generate a tax liability. Such a level of reporting is characteristic of far more complex tax models (e.g., realisation-based systems) and is at odds with the goal of simplification. As a result, the argument justifying the less favourable tax treatment of crypto compared to other investments with time-based exemptions collapses. If reporting is not simpler—and is in fact more complex—then the rationale for unequal treatment no longer holds. The law, therefore, promises a simple system in its justification, but imposes obligations typical of complex systems in its normative part, placing taxpayers in an uncertain and burdensome position.

The record-keeping requirements in Article 13 of the ZDDOKS proposal are not a logical consequence of the selected net cash flow model but are in apparent contradiction with it. The justification for excluding a holding-period exemption—citing simplified reporting—does not withstand serious legal scrutiny in light of these requirements.

The Law Still Requires Self-Reporting of Crypto Assets with Detailed Information

The revised draft of ZDDOKS still includes provisions that infringe on the privacy of crypto asset holders and expose them to unnecessary risks. It is an indisputable fact that authorities can tax individuals without requiring a complete inventory of their crypto assets, as currently envisaged by the law.

What’s alarming is that physical attacks on crypto holders are becoming more frequent, as transferring assets from a digital wallet is easier than transferring funds from a traditional bank account, because there are no intermediaries (like banks). Therefore, respecting the privacy of crypto holders is essential, since there are no protective mechanisms, and executed transactions cannot be reversed.

The protection of crypto asset holders largely (or exclusively) depends on their personal responsibility, knowledge, understanding, and correct technical use of the tools for accessing their crypto assets. No technical measure can protect against the forced disclosure of access credentials in the event of threats to the life or safety of the holder or their loved ones.

According to data from GitHub, by 2025, the media have already recorded 34 physical attacks on crypto asset holders. These attacks are frequent in Asia and increasingly common in Europe, particularly in France, Spain, and Italy. For comparison, there were 31 such attacks in all of 2024, while by the end of May 2025, the exact number had nearly been reached. This clearly shows a growing trend and increased exposure for crypto holders.

Conclusion: The Need for Serious Reflection

The opinion of both initiatives—Bitcoin Slovenia and Blockchain Alliance Europe—is that a thoughtful reconsideration of the taxation method and the full consequences of ZDDOKS is necessary. The law should be adapted to prevent it from endangering tax residents of the Republic of Slovenia through excessive data collection on private assets. Consideration should also be given to a holding-period exemption or a progressive taxation model.

The Ministry intends to submit the law for public discussion before the parliamentary recess, meaning there will be no further opportunity for dialogue. We continue to advocate for an open discussion and hope that future steps will include better alignment with European standards and the genuine needs of users and businesses in the crypto space.

Articles and translations for the blog on the website are written by various members, supporters, and groups of individuals in the Bitcoin Slovenia group. These do not constitute any financial advice. Everyone has their own view on the technology, Bitcoin, and existing systems. The society provides a platform to share these views with a wider audience. You can join our society at bitcoin.si, on our Telegram group, or in the "Kriptovalute — Slovenska Blockchain Skupnost — Bitcoin.si" group on Facebook.

Bitcoin SLO

Bitcoin društvo Slovenije je ustanovljeno z namenom, da povežemo slovensko kripto skupnost, organiziramo dogodke, odgovarjamo na vprašanja ter pomagamo posameznikom. Več info: https://bitcoin.si

follow me :

Related Posts

Mapping Stats on Bitcoin Professional Frontier

Jan 27, 2026

New Year's greeting 2026: 12k-Basti and the last Fiat illusion

Jan 02, 2026

The plebs who make Bitcoin shine

Dec 28, 2025