This is PART 7 of my series, where I examine Bitcoin through the lens of Austrian economics. This part will examine the properties of bitcoin that give it its salability.

According to the Austrian theory, what determines the success of a medium of exchange in becoming money is its relative salability. Salability (liquidity) determines bitcoin’s popularity as a medium of exchange because liquidity minimizes exchange costs. Bitcoin is already a medium of exchange and will compete on the money market strictly based on its salability alone, not based on its origin. To speculate on the use of bitcoin in the future, it is not helpful to find direct use value for bitcoin since that is not what will determine the success of bitcoins transition from medium to exchange to a commonly used medium of exchange, i.e., money.

This part will examine the salability of bitcoin by looking at the framework from PART 3. Since the Austrian monetary theory is based on the theory of salability, it is logically consistent with examining bitcoin through the same theoretical framework. Also, some new ways of looking at salability are introduced. This is done because the time when most monetary theories discussed in this series were invented differs greatly from the modern-day world.

The key function of money is to facilitate indirect exchange with the least amount of economic sacrifice. The property that minimizes the costs of exchange is salability. The concept of salability is explained in PART 2, and now the salability of bitcoin will be examined. This part can be viewed as an answer to one question: how does bitcoin minimize the costs of indirect exchange?

Salability through time

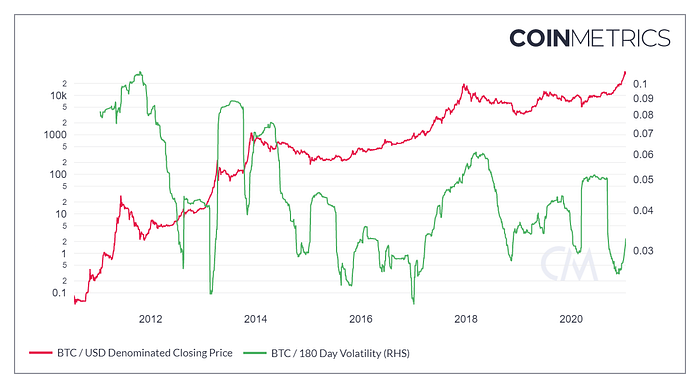

The foundational characteristic of salability through time is scarcity and resistance to stock dilution. Per the bitcoin protocol rules, no more than 21,000,000 bitcoin will ever be issued on the network. The block reward, the amount of new bitcoin created, gets cut in half every 210,000 blocks, approximately four years. This block reward halving is continued until the new bitcoin production is 0 (approximately year 2140). The consensus rules enforce these rules. While theoretically possible to change the 21 million hard cap, it is implausible due to the consensus around this rule. Even if the demand for bitcoin increases, the total supply cannot be adjusted as with any other good. On the negative side, this reality causes high volatility. While still volatile, figure 1 shows volatility decreasing as the price/market size increases.

Stock dilution refers to how much of the existing stock (supply) is diluted with a new supply. The supply schedule is pre-determined, making it highly predictable, which could make it a reliable store of value and a unit of account. Figure 2 below shows a diminishing annual inflation rate with block halvings creating clear supply shocks (see November 2012, July 2016, and May 2020).

Stock dilution can be quantified with a stock/ flow ratio. In his book, The Bitcoin Standard, Saifedean Ammous describes the stock/flow ratio as a measure of monetary “hardness.” The measure is a ratio of new supply and existing stock of units. It indicates how hard it is to produce new units relative to the existing stock. Figure 2 shows a divergence between the bitcoin inflation rate (new supply) and the existing bitcoin that has been produced already (existing stock). With every halving occurring for approximately four years, the new supply production (inflation) gets cut in half, and existing supply growth decreases. This illustrates the long-term predictability of Bitcoin’s hardness, one aspect of scarcity. The second side is demand, which cannot be predicted. The hardness of money can be viewed as its resistance to new production.

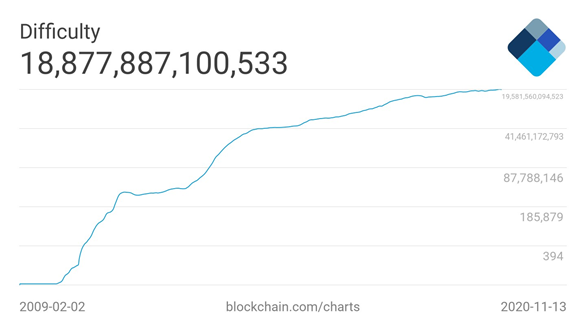

The critical component of bitcoin’s hardness is a process called difficulty adjustment. This process happens every 2016 block or approximately every two weeks. It adjusts the difficulty of producing new blocks based on how much energy on the network is expended for block production. If there is a lot of energy and blocks are found too quickly, the difficulty of producing blocks adjusts upward. The process reverses when too little energy and blocks are produced too slowly. This process returns the block production time to its 10-minute average. Figure 3 shows historical difficulty levels, meaning more energy is spent on producing bitcoin. The unit in figure 3 representing difficulty is the number of tries needed on average to yield success (produce a new block). Bitcoin production can be expedited only to a very limited degree. This makes unexpected or additional stock dilution impossible. On the contrary, it makes stock dilution pre-determined.

Hard-capped supply does not equate to scarcity; the relationship between supply and aggregate market demand for bitcoin makes it scarce. The capped supply simply keeps the bitcoin supply resistant to ad hoc stock dilution.

Bitcoin also introduces the concept of digital scarcity. Traditionally, digital goods such as files and images have been non-scarce since they can be copied easily. Attempts to make them non-copiable have manifested in intellectual property laws, copyrights, and digital rights management. These have proven to be ineffective. Bitcoin is a breakthrough because it introduced digital scarcity without needing an intermediary to verify the integrity of the payment, which was previously impossible with digital payments. Technically, everything in bitcoin can be copied since it is code, but the bitcoin copy would be out of consensus with the network, i.e., not part of the same network anymore.

The supply of bitcoin can be audited at very low costs. Auditing the monetary supply of Bitcoin can be done independently with a simple command (bitcoincli-gettxoutsetinfo) in the Bitcoin software client, which makes verifying supply cheap and fast.

As per the Austrian theory, another important quality for salability through time is the durability of a good. Bitcoin is code, and code is numbers and letters, non-tangible concepts that do not decay with time. Another point to consider that does not relate to bitcoin’s durability per se is how durable is how people store their private keys; some might prefer to stamp them on a piece of steel, while others have chosen to store them in their memory. This issue, however, is not intrinsic to the issue of bitcoins’ durability. Being intangible, bitcoin is durable and has low storage costs.

The market values Bitcoin by its resistance to consensus rule changes, i.e., for its immutability. Ammous mentions in the Bitcoin Standard book that immutability is derived from the incentive structure where different network participants are incentivized to uphold the current consensus rules. Even not-so-controversial changes are hard to create because of the distributed nature of the Bitcoin network; many different and adversarial parties need to agree on changes that might not be well understood and create bugs in the software. This results in an aversion to changes in the code. To change something in the primary Bitcoin software implementation known as “Bitcoin Core” would require large enough consensus and support which is hard to reach.

Salability through space

The most visible characteristic that affects salability across space is the good’s portability. Bitcoin, by nature, is portable. Regarding bitcoin, thinking about portability in the traditional sense is not useful. This is because bitcoin cannot be carried around like tangible goods; bitcoin are not stored in data storage devices or software. Bitcoin the units are entries on the decentralized database that is called bitcoin’s blockchain. These units are controlled via private keys that are used to provide digital signatures to prove control over the units. Carrying these signatures, which are essentially strings of numbers has minimal costs. Portability in terms of sending bitcoin on its native network depends on the preferred settlement time. Currently, a transaction of $100,000,000 can be sent on the bitcoin network for less than 40 cents and have a final settlement in 10 minutes which makes bitcoin quite portable. However, if one were to buy a cup of coffee for $1 and spend 40 cents on network fees, in that case, bitcoin cannot be considered very portable. It has been observed that the bitcoin network’s settlement layer is not suitable for small payments in the long term, meaning that bitcoin, generally speaking, is portable for big transfers.

Censorship resistance can be seen as a defense mechanism against political influence over money. Bitcoin, as a system, was built to be trust-minimized; cheap verification enables one to delegate more trust in math and software instead of institutions. This design creates less trust in third parties, as Szabo calls them, “security holes.” Bitcoin can be verified with small costs by running the bitcoin software. The storage requirement for running a full validating bitcoin client is 350 gigabytes, which can be achieved on most computers or by using external hard drives, which are not costly to acquire. This low cost of verifiability makes it hard to send counterfeited bitcoin to a bitcoin client that is validating the ruleset. This characteristic enabled it to circumvent trusted third parties to 35 to whom this verification was outsourced.

Bitcoin is fungible at the network level: the units are indistinguishable from each other in the eyes of the network. Being a public blockchain observable by anyone, bitcoin can be “tainted” after being used in nefarious activity. This taint, however, is attached to bitcoin by humans, not the network itself. Nevertheless, this can become a problem. There might become a widespread practice of separating “clean” and “dirty” bitcoin, which might cause them to be traded at a discount or a premium, depending on their history and proximity to illegal usage. There are, however, attempts to increase the fungibility of bitcoin with various privacy techniques (Samourai, Wasabi, Joinmarket) that are meant to improve anonymity by obfuscating the heuristics some companies use to analyze the blockchain and giving this information to law enforcement.

Salability through scales

In theory, bitcoin can be divided into a hundred million units. These units are called satoshis. Although theoretically possible to divide bitcoin infinitely, sending minimal amounts is not possible in some cases due to network fees that would make the transaction either uneconomical or technically unspendable. Another point to consider is that when the valuation of the smallest unit of bitcoin becomes too valuable for low-value transactions, the currently smallest unit can be technically divided into even smaller units. This, combined with future potential programmability, makes bitcoin highly salable through scales.

Acceptability

Bitcoin acceptance by various businesses and individuals has been growing steadily. In 2015 there were 7406 venues accepting bitcoin, and in 2020 the number is 18634 venues, an increase of 151,6%. Image 1 shows the development of bitcoin as a means of payment at various venues. The images' maps were taken on the 4th of November 2020, 5 years apart.

This fast growth can be partly explained by the world getting more digitalized. Another explanation is the increased knowledge about what characteristics can make a monetary medium good. When ancient proto-money was adopted, people were drawn to these objects without having empirical data on which characteristics constitute good money. As a new invention, bitcoin was created and used by individuals more or less aware of monetary economics, which could have been a factor in expediting bitcoin’s fast adoption.

While image 2 only shows the venues officially announcing that they accept bitcoin, other companies and individuals might accept bitcoin for their products and services. Other metrics to examine this topic are the total value transferred and the transaction count on the bitcoin network. While not an indicator of bitcoin’s acceptability per se, this metric can give an idea of how much activity there is on the Bitcoin network.

To conclude, salability is fundamental for monetary media because it decreases transaction costs. Friction, in figure 5, can be summarized as all the costs of indirect exchange, from acquisition and preservation to disposal of a good. These costs to send the monetary unit from point A to point B and other less visible costs. Figure 5 shows different costs related to using a medium of exchange in immediate time or in deferred exchange (store of value).

The characteristic contributing to the exchange costs is salability, which is derived from specific characteristics (see this article). In essence, media of exchange that lower exchange costs tend to become even more salable.

Related Posts

Czy dystrybucja Bitcoina jest sprawiedliwa?

May 02, 2024

Che cos'è l'Economia Austriaca?

Nov 24, 2023

Cos'è l'economia austriaca?

Nov 21, 2023