Introduction: Ethics, Capital, and Responsibility

In a world where capital not only determines quality of life but also functions as a steering mechanism for society, culture, and progress, the question of the moral use of money is not secondary—it is fundamental. If every euro, dollar, or yen is a vote in the global system, the unavoidable questions are: Where do I cast my vote? Whom do I empower? And: Is it morally acceptable to actively support a corrupt system through my capital allocation?

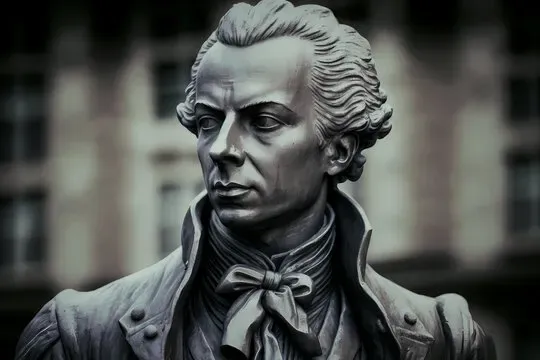

Into this ethical void left behind by fiat money steps Bitcoin—not merely as a monetary innovation, but as an ethical revolution. Going “All In Bitcoin” is, in this light, not a speculative folly, but a radical moral act. It is the realization of a modern categorical imperative: Act with your capital in such a way that your usage of it enables the emergence of a better world—a world where freedom, honesty, and responsibility are not enforced, but inherent.

I. The Categorical Imperative in the Monetary Sphere

Kant taught that moral action must be universalizable. An action is only ethical if it would still be good were everyone to do it. But what does this mean for capital usage?

- Is it desirable for everyone to put their money into a system that creates money arbitrarily out of nothing?

- Is it desirable for everyone to invest in a finite resource based on mathematical scarcity, transparency, and decentralization?

The answer is clear: Only the latter meets the condition of universal ethics. Bitcoin treats all people equally—regardless of nationality, gender, status, or bank account. It does not enforce participation but invites cooperation through its open protocol. It would remain fair even if everyone used it. Fiat, by contrast, is only “stable” so long as the majority are being exploited.

Those who place capital into a system that cements inequality, centralizes power, and legalizes expropriation are not acting morally—they are supporting a broken system. Bitcoin is the only universally defensible money.

II. The Ethics of Property and Time Preference

Capital is stored life-time. Every Satoshi earned is the result of time, energy, and skill. If we store this in a system that devalues, manipulates, and expropriates it, we not only dishonor our own lives—but the lives of others.

“All In Bitcoin” is an act of property protection. But more than that: It is the refusal to support a system that impoverishes millions through inflation—especially those who cannot hedge against it.

Those who save in Bitcoin do so within a zero-sum game—no one is expropriated, no one profits at another’s cost. And: Those who use Bitcoin lower their time preference—thinking long-term, intergenerationally, sustainably.

“All In Bitcoin” is the decision to no longer be part of a system of unjust redistribution—and instead to make a stand for integrity, personal responsibility, and respect for the property of others.

III. The Silence of the Majority and the Moral Radicalism of the Bitcoiner

Moral action is rarely convenient. It demands attitude, courage, and often personal sacrifice. The Bitcoiner who goes “All In” does so not only out of economic conviction—but also from a place of conscience.

He knows:

- Banks bail themselves out at the taxpayers’ expense.

- Central banks manipulate markets and destroy saving incentives.

- Politicians buy votes with freshly printed money.

- And the little man and his family loses—again and again.

To morally legitimize this silent catastrophe just because “everyone does it” is cynical. The Bitcoiner rejects it—publicly, persistently, fundamentally. He accepts volatility to do what is right. He risks social alienation to support a just system.

“All In Bitcoin” is lived civil courage. It is resistance by peaceful means—a revolution that begins in your balance sheet.

IV. The Universalizable Maxim: “Act So That Your Capital Strengthens Freedom”

Let us reformulate Kant’s imperative into a bitcoinesque maxim:

“Invest only in a monetary system whose universal adoption strengthens the freedom of all people.”

Bitcoin fulfills this condition. No other money system does. Gold is hard to transfer and confiscatable. Fiat is centralized. Stablecoins are controllable. Only Bitcoin is:

- Borderless – a tool against capital controls.

- Censorship-resistant – a tool against political oppression.

- Deflationary – a tool against the expropriation of the poor.

- Open Source – a tool for innovation and trust.

Those who entrust their capital to Bitcoin do not only strengthen themselves—but also a system that tends to help everyone. And: They weaken a system that is built on lies, control, and dependency.

Final Word: The Bitcoinian Imperative

“All In Bitcoin” is not a financial trick. It is not a trend. It is a moral commitment.

A commitment to truth instead of deception.

To freedom instead of control.

To responsibility instead of comfort.

It is the radical implementation of a modern, monetary categorical imperative. Nothing more, nothing less.

“Act in such a way that through your capital you foster a world in which you would want to live.”

That world is called: Bitcoin.

Sinautoshi

#Bitcoin only - #GetOnZero - united we fix the money (supply to 21M BTC)

Related Posts

Dlaczego Wybitni Fizycy Wybraliby Bitcoina

Oct 14, 2025

Czas Jest Naszym Sprzymierzeńcem: Dlaczego Bitcoinerzy Starzeją Się Wolniej

Sep 22, 2025

Time is Our Ally: Why Bitcoiners Age Slower

Sep 22, 2025