Bitcoin mining remains a hot topic as global adoption continues to grow. If you're a bitcoiner, you probably thought about mining at some point.

The hype around nerdminers and bitaxes is hard to ignore, especially the regular solo wins.

While mining can seem intimidating to newcomers, there are multiple entry points depending on your goals, budget, and technical expertise. In this article we'll explore seven distinct approaches to getting involved in Bitcoin mining, from educational experiments to serious investments.

First things first, should you start mining?

The short answer is, yes!

Bitcoin mining secures the network and every miner contributes to the decentralization of hashpower. This is important to avoid mining centralization.

More importantly, bitcoiners who want to be active contributors rather than just passive holders, will enjoy experimenting with mining for their own educational benefit. Every holder can easily become a noderunner. Every noderunner can easily become a miner. Learning never stops in Bitcoin.

Should you start mining to make money?

No. Don't mine bitcoin if you if your goal is to turn a profit.

Profitable mining is difficult and beginners will most certainly burn themselves, unless they have a deep understanding of bitcoin mining economics.

And yet, ideologically, idealistically and for the sake of decentralization, there is no doubt about it: Bitcoiners must mine.

The trifecta of sovereignty is self-custody, node-running, and mining. Own the hardware that can find blocks. Validate the network with your node. Own bitcoin private keys. All parts are essential to keep bitcoin secure and immune to attacks.

Level 1: Manual Mining - Understanding the Fundamentals

Before investing any money, it's worth understanding what mining actually does. Think about a random number. That's it. That's essentially bitcoin mining. Manual mining involves "writing or using simple code, to find a valid cryptographic nonce (a number used once) that produces a hash meeting Bitcoin's difficulty requirements."

To understand this, we need help.

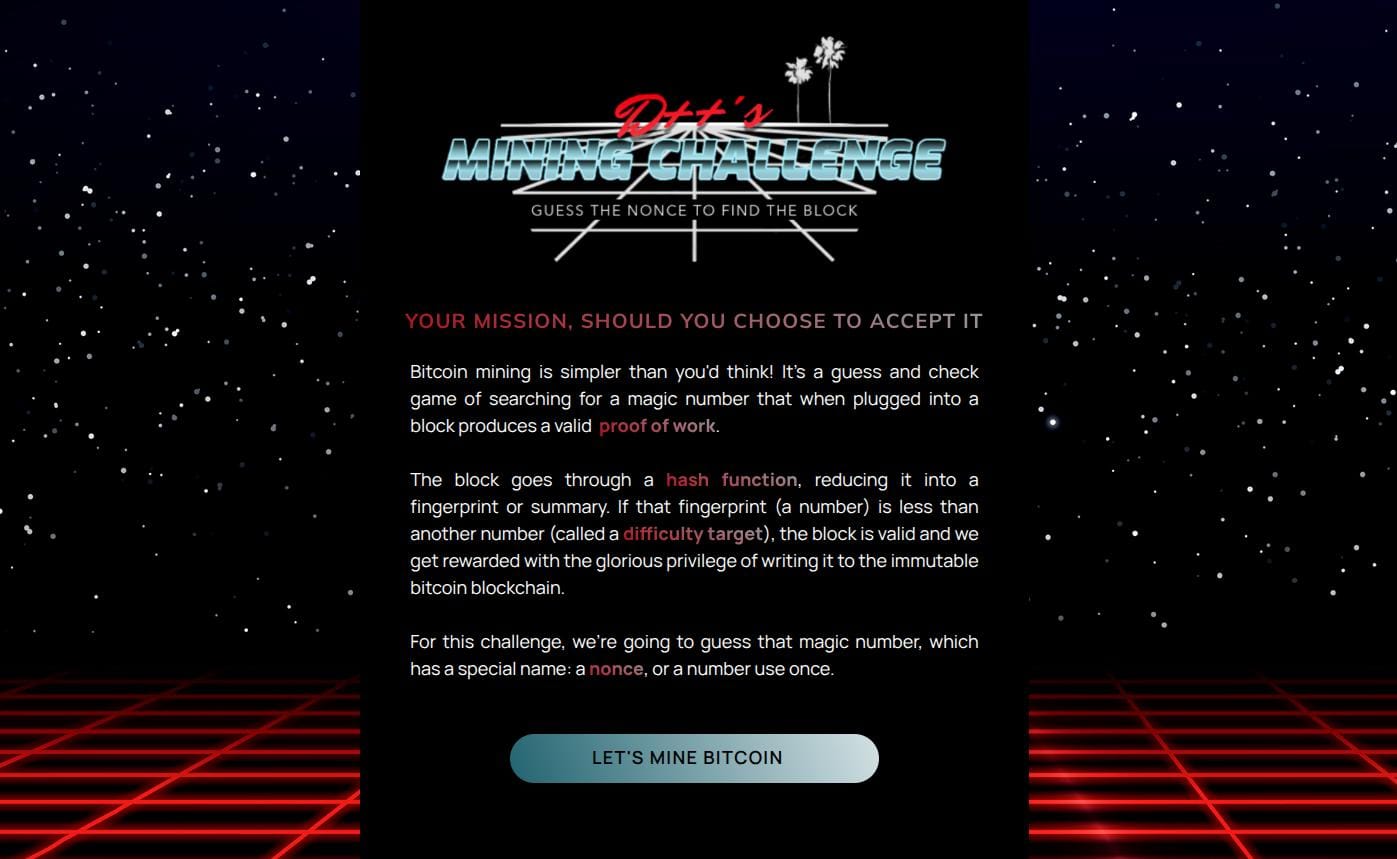

And there is no better human to ask than D++, a prominent bitcoin educator and software engineer who describes herself as a "#Bitcoin Professor," and "Revolutionary Cypherpunk.

Sidenote, she is also recognized as a key figure in launching and promoting Plebnet, a community focused on Bitcoin's Lightning Network and bitcoin adoption through node-running, education and support.

But back to mining bitcoin, on her website, we can find a Bitcoin Mining Simulator that makes the mining process interactive and fun;

"Bitcoin mining is simpler than you'd think! It's a guess and check game of searching for a magic number that when plugged into a block produces a valid proof of work"

Of course, manual bitcoin mining is not profitable and you'll never actually mine a block.

Even if you're a math genius, you're simply to slow to compete against computers doing the math.

Remember, back in the days anyone could mine bitcoin with laptops at home. Then it was GPUs, and finally ASICs, specialized chips for optimal efficiency. Manual mining is a bit like mining archaeology, understanding the process Satoshi Nakamoto originally designed before it became an industrial operation.

For those who spend hours on YouTube, or who want an introduction to mining while being well entertained, this presentation by D++ is not to be missed.

Cost: Free (just your time)

Level 2: Lottery Home Mining - Playing the Odds

Devices like the NerdMiner and Bitaxe represent a new category of ultra-low-power miners that open the portal to become a miner for as little as 20-30 bucks. These devices typically produce between 75 kH/s to 1 TH/s, which is microscopically small compared to industrial operations.

The idea here is to mine for fun and to play the mining lottery, all while learning fundamentals. You're solo mining with such low hashrate that finding a block is astronomically unlikely, but technically possible. If lightning strikes and you find a block, you'd receive the full block reward (currently 3.125 BTC plus fees, worth over €300,000 at current rates).

The good thing? The odds of winning (finding) a block with a solo miner like a bitaxe, are sometimes better than national lottery and you play every ten minutes as opposed to just daily.

For those who want to go ballistic, over-specced and water-cooled home miners like the NerdQaxe++ Hydro are the latest trend. They can hustle over 5TH using just 70 W.

Lightning NewsRoadToNeverhill

Lightning NewsRoadToNeverhill

In Germany, the "mini-mining-movement" has become a sizeable community of bitcoin-nerds who grow fleets of small miners and connect to community pools. German Bitcoin Youtuber Sunnydecree launched a community pool which gained over 1 PH of combined hashrate. German engineering, huh?!

Cost: €50-€200 for the device, plus around €2-5/month in electricity Availability: These devices can be ordered from resellers and European distributors. For lower prices check ebay and secondary markets.

Level 3: Pool Home Mining - Consistent Small Returns

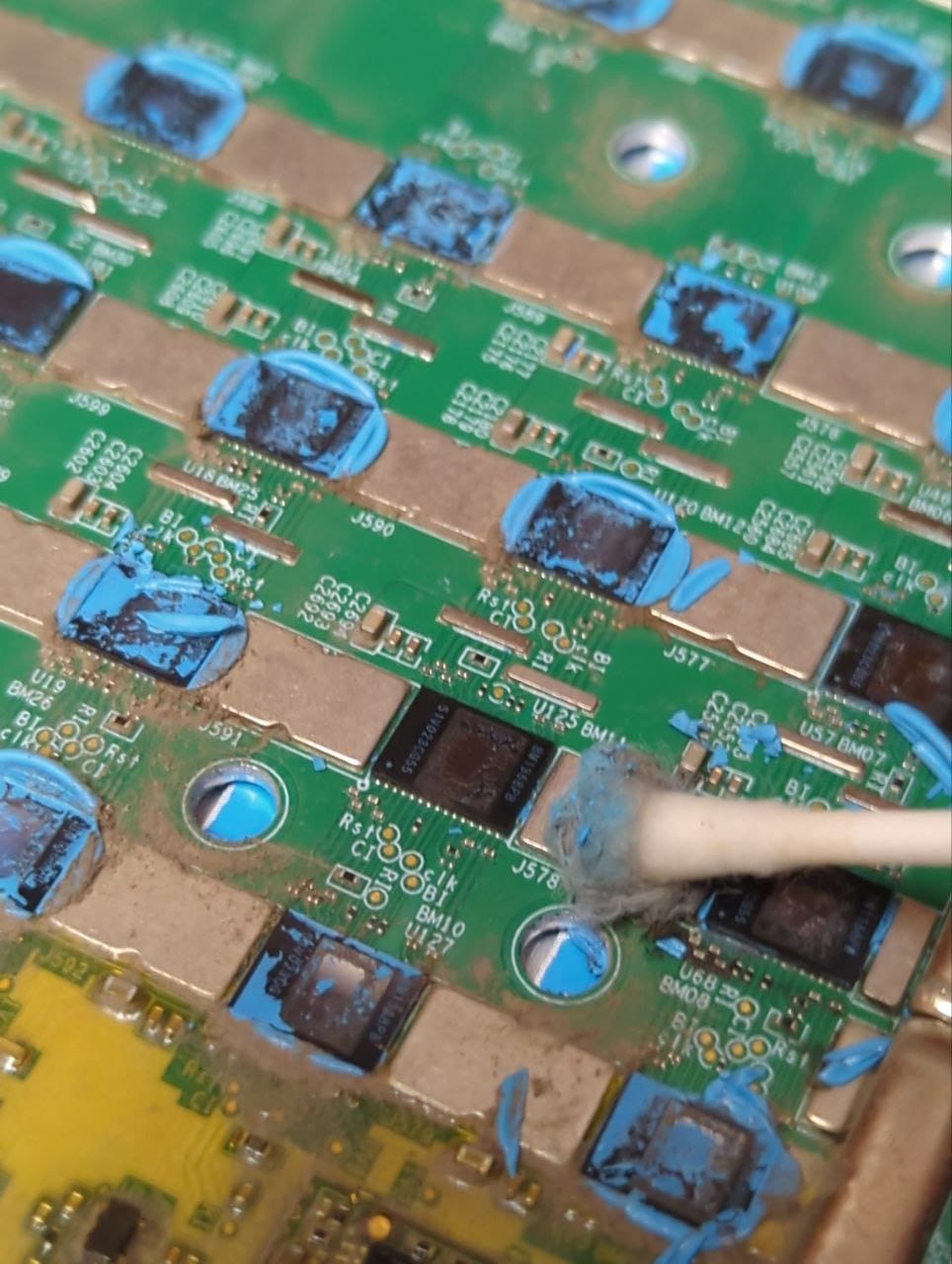

If you had your fun with the micro-miners, you might want to step up to more serious hardware like the Avalon Q1 or used Antminer S9s. That's when you enter the realm of pool mining. Mining pools combine the hashrate of thousands of individual miners and distribute rewards proportionally (based on contributed hashpower) when blocks are found.

Most pools have minimum hashrate requirements or payout thresholds. An S9 produces around 13-14 TH/s, while newer models like the S19 series can exceed 100 TH/s. In a pool, you'll receive regular small payouts rather than waiting years (or decades) for a solo mining win.

Pools like ViaBTC and Luxor offer low payout treshholds while OCEAN has new features to allow more flexibility on block template creation.

Calculate how long you would need to run your miner to meet the payout treshhold and also factor in difficulty increases and hardware competition. If you can (and want to) afford the electricity expenses–or if the payouts pay at least the electricity consumed–then pool mining is a good option to rev up hashpower at home.

Considerations: With electricity costs ranging from €0.20-€0.40 per kWh across most of Europe (higher in Germany, Denmark, and Belgium; lower in Norway and France), running an S9 that consumes 1,300W will cost €75-€150 per month. At current Bitcoin prices and difficulty, you'll likely mine €40-€80 worth of Bitcoin monthly, resulting in a net loss in most European countries.

Cost: €100-€300 for used S9, €1,500-€3,000 for newer efficient models Noise level: 70-80 decibels (comparable to a vacuum cleaner)

This level really only makes economic sense in countries with electricity below €0.15/kWh or if you have other considerations like learning or ideological support.

Level 4: Heating Mining - Dual Purpose Hardware

Now it gets interesting! Why not turn mining's biggest drawback (heat generation) into a feature? Companies like 21energy, RY3T, Futurebit, Heatbit, and Canaan have designed mining solutions that function as space heaters, water heaters, or even radiator accessories.

@21energy_com 👀

— Bitcoin verstehen (@BTCVerstehenPod) October 30, 2025

Wer möchte ein Video zur neuen #Bitcoin-Heizung Ofen 2? pic.twitter.com/HMQPg3gWrx

These devices typically produce 200W to 1,500W of heat while mining at modest hashrates. The economics work differently here because you're offsetting heating costs you'd pay anyway. During European winters (roughly October through April), a Heatbit could replace a 1,500W electric heater while earning €10-€20 in Bitcoin monthly.

European advantage: With heating seasons lasting 6-8 months in most of Europe, heating miners can offset €150-€300 annually in heating costs while accumulating Bitcoin. This is one of the few scenarios where home mining makes economic sense in high-electricity European markets.

Cost: €500-€1,500 for heating-focused miners Best for: Northern Europe, Alpine regions, and anyone with electric heating

Bitcoin mining as a source of heat is reality. It is comfortable and easy to install. This is a @foghashing Bitcoin boiler for 6 machines running on Braiins OS rated for 24kW or 81,000 BTU/hr, which will generate approximately $33 to $66 per day worth of Bitcoin depending on the… pic.twitter.com/8O4E8CxSLK

— Softwarm LLC (@SoftwarmLLC) August 4, 2025

Another consideration is using the heat from your miners for something else than just warming up a place. Examples are drying laundry, dehydrating foods and warming greenhouses.

I'm mining Bitcoin off-grid (when it's sunny) and making beef jerky with it pic.twitter.com/3LccCWvjjd

— tulkooo (@tulkooo2) December 23, 2024

Level 5: Solar Mining & Off-Grid Mining

Solar mining can solve the biggest problem in residential mining: electricity costs. By pairing mining hardware with solar panels and battery storage, you can mine during daylight hours using free energy. However, be honest in your profitability calculation and consider worst-case scenarios as well. If installation costs are too high, mining won't be profitable either.

Reality check: Solar is less favorable in Europe than in sunnier regions. Countries like Spain, Portugal, southern France, and Italy get decent solar hours (4-6 peak hours daily), while northern Europe sees far less, especially in winter.

A meaningful solar setup requires €5,000-€15,000 for 5-8kW of panels plus battery storage, then another €1,500-€3,000 for mining hardware. The payback period can extend to 5-10 years depending on your location and Bitcoin price movements.

Best locations: Spain, Portugal, southern Italy, Greece, Cyprus Regulatory note: Check local regulations on solar installations and grid feed-in tariffs, which vary significantly by country.

If you already have solar panels on your roof and want to use your excess energy to mine bitcoin instead of feeding it back into the grid, there are a number of great guides online. Also consider to join a forum like Home Mining Wizards and ask questions there.

If you decide to buy a more efficient, modern miner, compare different models and do extensive research. There are many models from manufacturers like Bitmain or Whatsminer. You can buy used miners for faster ROI or purchase new miners that last longer.

For small-scale lottery mining, off-grid solar setups are a great solution and will definitely get the conversation about "full-sovereignty" started if you're at the beach.

Yes!!

— DePIN Nomad (@depinnomad) April 21, 2025

It took less than 10 minutes to hook this Bitaxe up to solar.

We are officially mining Bitcoin on the beach pic.twitter.com/SlvX74kQ2X

SolarBit update. Building in public is fun until things go wrong. Now that I've digested what happened, you should know what the fuck took me so long. So, below is a list of setbacks and hurdles I couldn't have possibly imagined, but, they all happened and most are fixed by now. pic.twitter.com/rN1ex4pdLJ

— Printer ⚡ (@Printer_Gobrrr) July 24, 2025

Before investing any significant sums of money into your mining hobby, speak with experts with experience who can answer your questions impartial.

Level 6: Mining as a Service - Hosted Solutions

Not everyone can host loud, hot mining equipment at home. Mining as a service providers like Sazmining, HashLabs, Munich International and a few others allow you to purchase mining hardware that's hosted in professional facilities with cheap electricity.

Munich International specifically targets European customers, offering hosting in locations with industrial electricity rates (€0.04-€0.08 per kWh). You own the actual ASIC miners, but they're housed in data centers where economies of scale and location make mining viable.

Cost breakdown:

- ASIC purchase: €2,000-€5,000 per miner

- Hosting fees: €150-€250 per month per miner

- Contract terms: Typically 12-24 months minimum

Advantages: No noise, no heat, professional maintenance, viable electricity rates Risks: Counterparty risk, shipping costs if you want to retrieve equipment, dependency on the hosting company's operations.

This level combines real hardware ownership with professional hosting infrastructure. You avoid cloud mining scams because you own identifiable, specific machines with serial numbers and verifiable hashrate.

Providers like Sazmining specifically promote green mining with hydroelectric power. If you have a weak side for massive hyrdo dams, then Sazmining can be a good option.

💥 5 giga projects, 77,593 MW annually. The output of the world's 5 largest dams = 77 EPR-type nuclear reactors running.

— Kent Halliburton (@khalliburton) November 26, 2025

Here are the five largest hydro-electric power projects in the world that provide the planet with clean energy 👇🧵 pic.twitter.com/0LwOiilLPs

Level 7: Mining Stocks - Indirect Exposure

Surely, this is a controversial take for those who strictly want to see liquidity flows into bitcoin. But for anyone who wants Bitcoin mining exposure without getting active by himself, publicly traded mining companies can be an option. While most large miners are US-based, European investors can access them through European exchanges or brokers offering US stock access.

Major mining companies like Wulf, Iren, Hive, Marathon Digital, Riot Platforms, and CleanSpark operate large-scale mining facilities. Some European-listed alternatives exist, though the sector is smaller in Europe.

Some mining stocks have performed well while others struggle. Specializing only on bitcoin mining has been a challenge for these large-scale pubco miners and many have pivoted to a AI data-center model. With pubco miners, you become an investor in the largest mining farms on the planet, some of which exceed 1GW of power generating multiple Exahash in hashpower. These stocks can also provide leveraged exposure to Bitcoin's price plus potential operational improvements. However, you're now investing (stock picking) in a business with all the associated risks: management decisions, debt loads, and operational efficiency.

European investment approach:

- Trade through European brokers with US market access (DEGIRO, Interactive Brokers, Trade Republic)

- Consider European ETFs with mining exposure

- Watch for currency exchange risk (EUR/USD fluctuations)

Cost: Depends on your investment size, plus brokerage fees (typically €1-€10 per trade)

What to Avoid: Common Pitfalls

Low Quality Gear: While USB-miners for a few bucks from Asian online shops sound like a great deal, they could turn into a nightmare. When you opt for cheap or untested alternatives, you also get exposed to a number of risks. Fire hazard, toxic fumes or viruses are no joke. Don't take shortcuts on your equipment and always have safety-fist approach.

Cloud Mining (Usually Scams): Services claiming you can rent hashrate without owning hardware are almost always Ponzi schemes. They pay early investors with later investors' money until they collapse. If you can't identify specific hardware you own or visit the facility, it's probably fraudulent.

Mining with High Electricity Costs: If you're paying standard European residential rates (€0.20-€0.40/kWh) without any offsetting factors, you're mining at a significant loss. A single Antminer S19 consuming 3,250W costs €450-€900 monthly to run in most European countries, while producing only €200-€400 worth of Bitcoin.

Ignoring VAT and taxes: Most European countries charge 19-25% VAT on mining equipment. Additionally, mined Bitcoin is typically taxable as income at the time of receipt, and you'll owe capital gains tax when selling.

European-Specific Considerations

Electricity costs: Europe has some of the world's highest residential electricity rates. Only Norway, Sweden, and parts of France have rates low enough (under €0.15/kWh) for traditional home mining to approach profitability.

Climate advantage: Cold climates reduce cooling needs and increase heating mining value. Nordic countries and Alpine regions see the best economics for dual-purpose mining.

Regulatory environment: Most EU countries treat mined Bitcoin as taxable income. Keep detailed records for tax purposes. Some countries (like Germany) offer tax advantages for long-term holding.

Space constraints: European homes are typically smaller than North American ones. Noise and space become limiting factors faster, making hosted mining more attractive.

Choosing Your Path

Your ideal mining level depends on your goals and location within Europe:

- Learning about Bitcoin? Start with Level 1-2 (manual or lottery mining)

- Cold climate with electric heating? Level 4 (heating mining) makes the most sense

- Southern Europe with solar potential? Consider Level 5 (solar mining)

- High electricity costs but want to mine? Level 6 (hosted mining) is your best option

- Want exposure without technical complexity? Level 7 (mining stocks) fits

The reality is that profitable home mining in Europe is extremely challenging given electricity costs. Most European hobbyist miners participate for education, ideological support of decentralization, or secondary benefits like heating rather than pure profit.

Budget-friendly starting point: Begin with a €100-€200 lottery miner (Level 2) to learn the basics and participate in the network without significant financial risk. If you want serious mining exposure, mining as a service (Level 6) offers the most realistic path to potential profitability for European residents.

Whatever level you choose, start small, research thoroughly, and never invest more than what you can actually afford. Bitcoin mining is a fascinating world of hardware, software, community and competition. It secures the network and hashpower can generate income or provide a lottery ticket. It's a great hobby for any bitcoiner who will not settle and doesn't want to give up on learning and educating himself. Serious industrial mining requires ongoing attention to profitability metrics, and remains subject to a variety of factors such as difficulty, hashprice, hardware and electricity cost.