I. Vacuum fluctuations of trust

I'm not a famous economist. Not a developer of a new Lightning protocol. Not an influencer preaching the gospel of digital gold on stage. I'm a pleb. A small point of mass in a large field. But I'm awake. And I'm observing.

I observe a world drifting apart—not through wars, not through pandemics, or technological singularities, but through something more subtle: a vacuum collapse of fiat faith . A kind of quantum instability in the monetary vacuum that suddenly—emanating from a single event—causes the space-time structure of the economy to collapse.

The event? For me, it was the moment I first realized: Bitcoin isn't just money. It's a time machine.

II. Mass points in the monetary field

In general relativity, every object with mass has the ability to bend spacetime. Mass tells spacetime how to behave—and spacetime tells mass how to move. This interplay, this deep symmetry, has always been one of the most beautiful discoveries in physics for me.

But today – in this era of hyperbitcoinization – I discover a new equivalent: Bitcoin holders as mass points in the economic gravitational field.

A Bitcoiner who holds for a long time, who educates himself, who helps others understand—curves economic spacetime. Not through material mass, but through information density, through energy, through conviction. This curvature generates forces of adoption. Other "particles"—in other words, people—move along the resulting geodesics into this new field.

And I wonder: If these forces become stronger, if they reinforce each other, what happens then? Is there an event horizon of adoption , a point of no return?

III. Understanding the Singularity

In the cosmos, a singularity is a place where our known physical laws fail. Where space and time cease to exist separately. Where cause and effect blur. In economic reality, hyperbitcoinization could be just such a singularity.

Imagine: A world in which trust is no longer conveyed by institutions, but by mathematical certainty. A world in which energy, labor, capital, and information are aligned on a new axis—no longer toward short-term returns, but toward long-term preservation. A world in which people learn to be patient again.

For me, this is the singularity. Not a bang, not an explosion. But a silent upheaval. A semantic mass migration from one system to another. A "flippening" of values.

IV. Time dilation in the semantic field

What I'm increasingly noticing is that the longer I spend time with Bitcoin, the more my sense of time changes. I experience fiat money as a world in which time is compressed. Everything is now. Consumption, debt, growth. It's a constant race through a flat field. No pause, no scale.

Bitcoin, on the other hand, stretches time. Suddenly, I'm thinking in terms of block size. In halvings. In terms of generations. My own lifetime is no longer measured as a short-term career path, but as a cycle within a monetary cosmos .

This time dilation is real—at least subjectively. Perhaps it's even the true transformation: Bitcoin is changing not only what we think we know, but how quickly we're even willing to think.

V. Entropy and order in monetary architecture

In thermodynamics, systems naturally strive toward a state of maximum entropy—that is, greatest disorder. Fiat monetary systems, driven by inflation, follow this law almost perfectly: They disintegrate, they lose information, they become chaotic. Those living in such a system must expend ever more energy to create stability—be it through bureaucracy, laws, or violence.

Bitcoin, on the other hand, acts like a negative entropy field. Through its finiteness, transparency, and regularity, it creates order from information . Each block is like a layer of time in the geological memory of the economy. Immutable. Traceable. Full of meaning.

I no longer see Bitcoin as a mere protocol—I see it as a low-entropy information structure that enables stability through clarity. A "low-entropy attractor" in the social space-time fabric.

VI. The Gravity of Knowledge

In the early days of Bitcoin, adoption was almost always a technical or ideological act. Today, however, as states, corporations, and billionaires buy in, the gravitational balance is changing.

When someone like Michael Saylor makes another billion-dollar purchase, a new curvature appears in this field. People who have never had anything to do with monetary policy begin to ask: Why? Why is he doing this? And then, like tiny droplets, they slowly fall into the orbit of Bitcoin's attraction.

What's fascinating is that these gravitational fields aren't directly financial. They're semantic . It's about shifts in meaning. About narratives. About truths that suddenly carry more weight than the old ones. Bitcoin is a semantic mass of truth in the post-truth fiat endgame.

VII. Feedback and Fractality

As a physicist, I know that a system with positive feedback can become unstable as a result of a bank run, or it can be stable – depending on its structure.

Bitcoin is fractal. Each new user begins to engage with the topic in their own way, encountering the same fundamental questions, passing through self-similar stages of understanding—and in doing so, creating their own little source of gravity.

These sources are not isolated. They overlap, interfere, and form patterns. One could say that hyperbitcoinization is a standing wave pattern of adoption, skepticism, euphoria, and recognition . And this pattern intensifies with each subsequent iteration and the passage of time.

VIII. The Light of Last Instance

I believe that Bitcoin represents not only an economic revolution, but an epistemological one.

In a world where truth became negotiable, Bitcoin brought back the non-negotiable. A hash is a hash. A signature is either valid or not. 21 million is not an opinion. The truth is mathematically encoded.

For someone who has been surrounded by relativity and probabilities all his life, this is almost a metaphysical shock. Suddenly, there is an authority that stands outside the debate. A kind of light that outshines all perspectives—not through power, but through logic.

IX. The Hyperbolic Limit

When I try to understand the dynamics of adoption, I always come back to the same point: We're moving toward a hyperbolic curve . Not a linear progression. Not smooth growth.

Rather, it's a system that's accelerated by feedback effects: network effects, educational effects, distribution effects. And at some point: exhaustion of supply, resulting in a price shock.

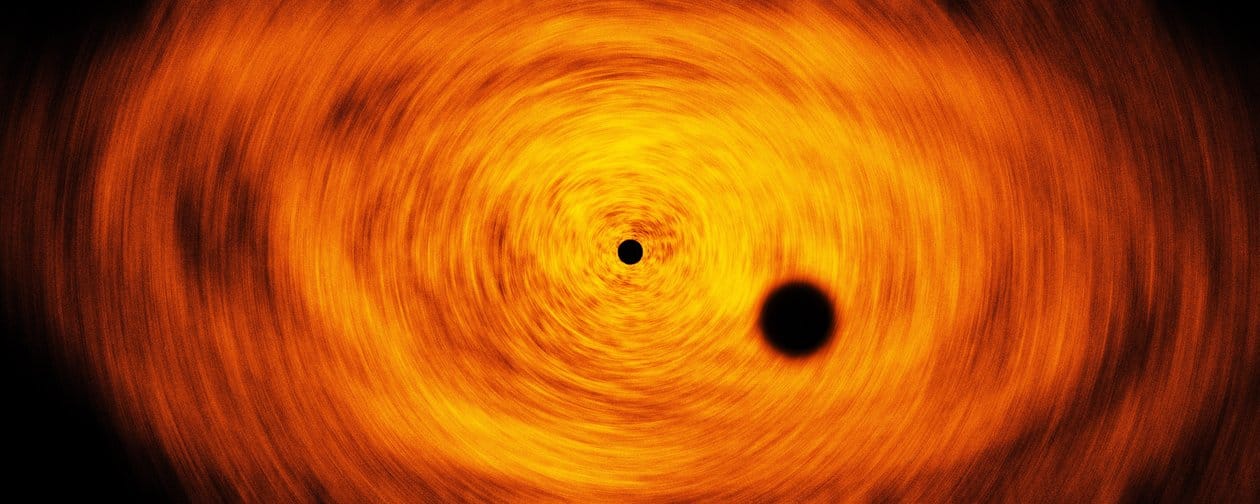

It's like a star that accumulates too much mass. At a certain point, it no longer collapses slowly—it collapses in on itself. Not through destruction, but through density.

I think we're close to that threshold. Maybe it's 2030. Maybe 2040. But the field is taut. Spacetime is curved. The mass points are set.

X. The Pleb as Chronicler

Why am I writing this down? Because I believe that later we will look back on this time and not understand how slow and yet fast everything happened. We live in a space-time field that is curving—but we don't feel it because we are part of it.

The plebeians – the small points of mass and source of gravity in the Bitcoin universe, who ask questions, learn, and act – are in truth the gravitational core of hyperbitcoinization. Not the exchanges, not the ETF, not the states.

XI. The new coordinate system

Perhaps there won't be a Bitcoin world in the traditional sense. Perhaps Bitcoin isn't a goal at all, but rather a coordinate system within which everything else is re-measured.

- Work is no longer measured in euros, but in energy conservation.

- Freedom is no longer measured in rights, but in private keys.

- Knowledge is no longer measured in degrees, but in understanding.

And perhaps truth is no longer measured by who says it – but by whether it can be hashed.

XII. Bitcoinium and the asymptotic time machine

"What is a time machine but a system that influences the passage of time? And what if that system isn't made of gears—but of hashes, blocks, and an asymptotic metric?"

For some time now, I've been thinking about an entity that can be described with a made-up word: Bitcoinium . It's not a chemical element, not a substance in the classical sense. It's a memetic-semantic molecule—consisting of Satoshis bound by the cryptographic strength of SHA-256. And yet it behaves like a physical entity, like a kind of new isotope in the periodic table of thought .

The fascinating thing is that Bitcoinium has a half-life that tends towards infinity.

In a natural decay process, an element is halved with each half-life – the substance evaporates, loses structure, and disintegrates into disorder. Bitcoin is similar: The "creation" of new units – the block reward – is halved every four years. In a precise, deterministic manner. Monetary issuance declines asymptotically.

At the limit – as a mathematical idea – new creation ceases. The time itself, in which new Bitcoinium is created, slows down exponentially until it freezes asymptotically. And what remains is the finite supply. The 21 million – only almost reached. Eternally preserved in the thermodynamic vacuum of the digital world.

What does this mean?

It means: Bitcoin is a time machine.

Not because it lets us travel through epochs—but because it transforms the meaning of time itself. It preserves labor, will, and information for decades—perhaps centuries. In a world where the ravages of time gnaw at everything, where everything weathers, everything rotates, everything decays—Bitcoin offers something tremendous: a fixed constant in spacetime.

Bitcoinium is like an element with a negative half-life. The older it gets, the more stable it becomes relative to its entirety. The longer it exists, the more it attracts time to itself—like a black hole that doesn't consume matter but neutralizes transience .

And for us living today, that means: If we hold a fraction of that today, we hold a time anchor . A semantic anchor in the form of a seed phrase that will withstand the coming storm of systems. And the more people realize this, the more the space-time axis of our civilization shifts toward hyperbitcoinization.

Sinautoshi

#Bitcoin only - #GetOnZero - united we fix the money (supply to 21M BTC)

Related Posts

Inflacija: Skriti davek, ki požira vašo kupno moč – kako jo premagati s trdnim denarjem - Burek zgodba

Feb 15, 2026

Mediji lažejo o Bitcoinu — resnica o pranju denarja, ki jo skriva finančni sistem

Feb 08, 2026

Kako kripto kartice in bitcoin plačila v EU in Sloveniji ne delujejo - Regulacije in davki kot glavni krivci

Feb 06, 2026