The recent drop in bitcoin's price is due to several factors affecting markets and economic conditions. Below, we'll describe those we believe had the most significant impact.

Interest Rate Hike in Japan: The Bank of Japan unexpectedly raised interest rates from 0% to 0.25%, causing a significant appreciation (increase in value) of the yen. This disrupted carry trades—transactions using borrowed funds, where investors borrowed yen and invested in higher-yielding assets like bitcoin, stocks, real estate, precious metals, etc. As investors started facing losses, they were forced to close their positions, leading to selling pressure in the market.

Liquidation of Leveraged Positions: The sharp drop in bitcoin's price triggered massive liquidations of leveraged trading positions. When Bitcoin's price drops significantly, leveraged positions based on loans are quickly liquidated, increasing selling pressure. Over $1 billion in leveraged crypto positions were liquidated within 24 hours, further exacerbating the drop.

Global Market Sell-Off: Broader financial markets experienced turmoil due to fears of a potential recession in the US. Poor economic data, such as low employment figures and weak manufacturing data, increased investor concerns, leading to a sell-off of risky assets, including Bitcoin and overinflated tech stocks.

Low Volatility and High Asset Values: Before the drop, there was an unusual period of low volatility in asset values, including bitcoin. When volatility returned, it pressured leveraged trades and their prices.

All these reasons, along with possibly others, significantly impacted the prices not only of bitcoin but also of other investments. Other patterns, such as panic, are also emerging as potential reasons for the drop. While the entire global market is collapsing, the stock of military giant Lockheed Martin is soaring, indicating a possible new military conflict in the Middle East. Coincidence?

The FED has also announced an emergency meeting where a future interest rate cut of about 50 basis points (0.5%) is speculated. This would mean a new wave of liquidity in the US financial system to combat the stock market crisis and simultaneously a wave of price inflation for rare and desirable assets as well as everything else. If prices fell sharply after the interest rate hike in Japan, we can predict the consequence of a rate cut in the US.

Future of Bitcoin: Despite the current situation, some experts remain optimistic about bitcoin's future. Historical patterns have shown that after sharp price drops, a period of recovery can occur. Historical data indicates that such crises can lead to long-term growth opportunities, especially if central banks introduce measures to increase liquidity and lower interest rates.

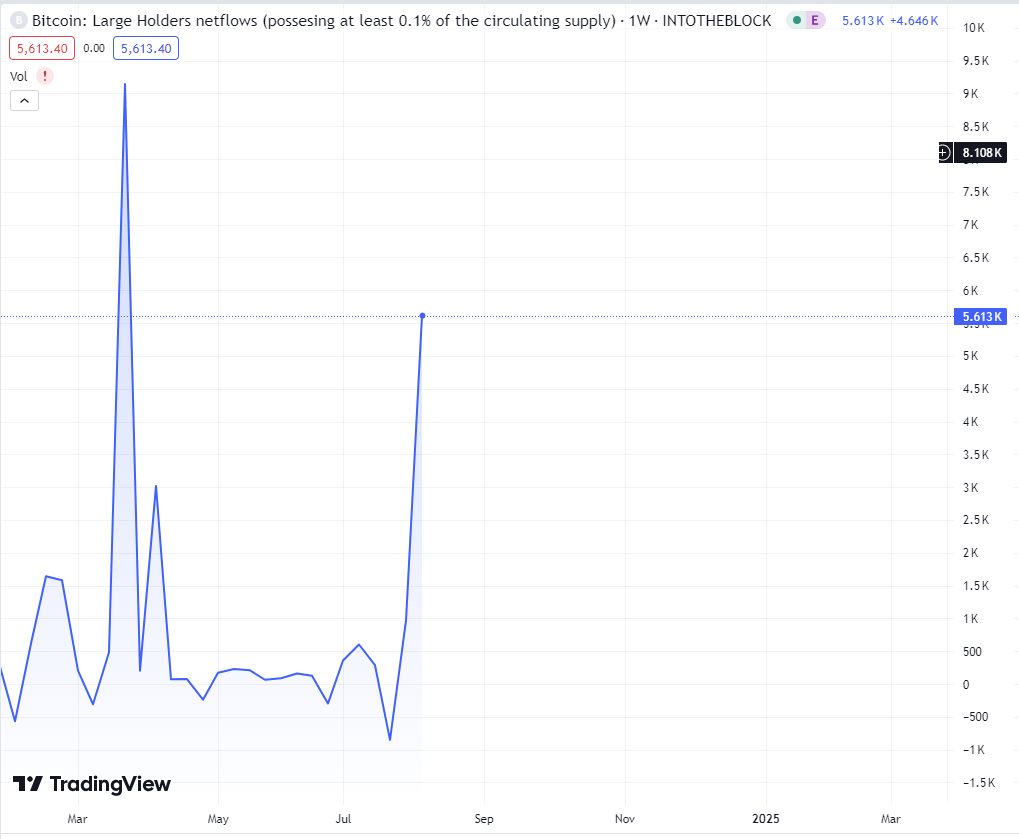

It is likely that the resilience of bitcoin is also indicated by the fact that large "holders" of Bitcoin are not selling at this moment but are accumulating it. In recent days, they have purchased larger quantities of bitcoin, seemingly recognizing that such upheavals are excellent buying opportunities rather than reasons for panic.

Articles and translations for the blog on the website are written by various members, supporters, and groups of individuals in the Bitcoin Slovenia group. These do not constitute any financial advice. Everyone has their own view on the technology, Bitcoin, and existing systems. The society provides a platform to share these views with a wider audience. You can join our society at bitcoin.si, on our Telegram group, or in the "Kriptovalute — Slovenska Blockchain Skupnost — Bitcoin.si" group on Facebook.

- Bitcoin

- bitcoin drustvo slovenije

- finance

- news

- lang:en

- level:advanced

- read:short

- author:bitcoin-si

- topic:economics

- topic:basics

- topic:opinion

Bitcoin SLO

Bitcoin društvo Slovenije je ustanovljeno z namenom, da povežemo slovensko kripto skupnost, organiziramo dogodke, odgovarjamo na vprašanja ter pomagamo posameznikom. Več info: https://bitcoin.si

follow me :

Related Posts

The philosophy of digital sovereignty

Feb 22, 2026

Die Philosophie der digitalen Souveränität

Feb 22, 2026

Inflacija: Skriti davek, ki požira vašo kupno moč – kako jo premagati s trdnim denarjem - Burek zgodba

Feb 15, 2026