This report was originally published by River Financial and its Author Sam Wouters and Reviewed by Alexandra Gaiser, Will Nemirovsky, Alexandra Gaiser, Julia Duzon, Daniel Batten, Shaun Connell, on 8th December 2022. It is only retained for research and informational purposes on the European Bitcoiners website.

Introduction

River Financial is a Bitcoin financial services and technology company that helps people accumulate and use bitcoin. We offer brokerage, hosted mining services, no fees on recurring orders, Lightning Network deposits and withdrawals, and Lightning Services to businesses.

In April 2022, we launched a hosted mining product to help anyone who does not want to physically run their own mining operation enter the Bitcoin mining industry. We have brought thousands of miners online for enthusiastic clients, and are invested in the long term success of this industry. We decided to look into what Bitcoin mining may look like in the future, for us and our clients.

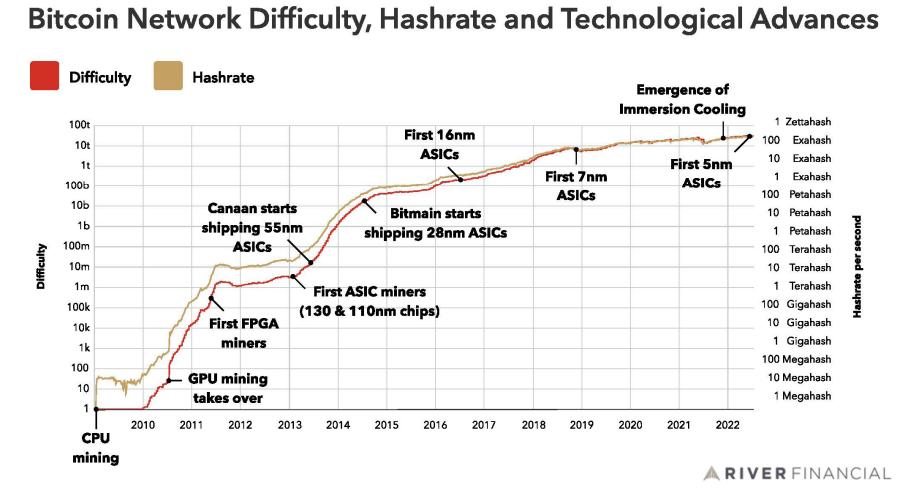

The Bitcoin mining industry has existed for nearly ten years, if we use the emergence of ASIC miners as the point where the space became serious. Ever since, we have seen tremendous efficiency improvements in ASICs of 44,857%, an explosive growth in hashrate around the world, and some governments introducing regulations due to the sheer size of the industry. We have also seen difficult times in the mining industry, given its high levels of competition and its complex, global nature.

Today, over 91% of all bitcoin that will exist (19.2 out of 21 million) has already been mined, but in some ways, the innovation in the industry is only just getting started.

As we will show you in the report, Entrepreneurs, scientists, and energy providers around the world are beginning to realize how Bitcoin mining can help balance energy grids, aid in the transition towards renewable energy, and finance a reduction of methane emissions to slow down global warming.

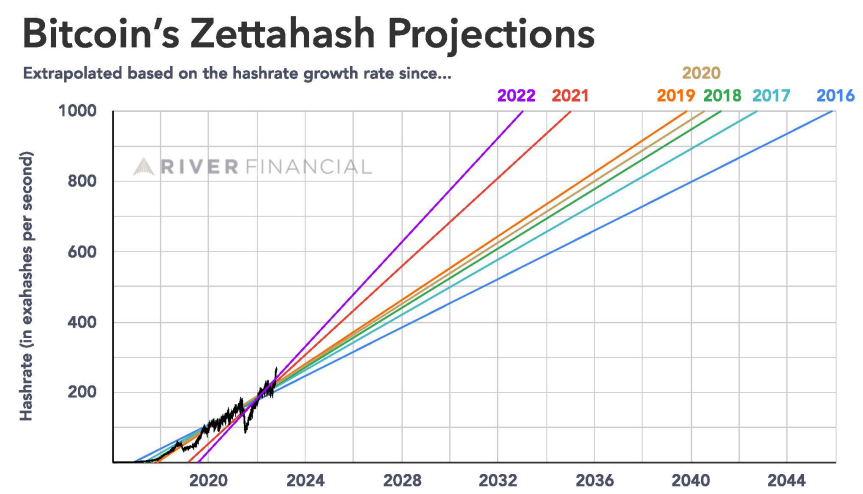

With this new wave of interest in mining, Bitcoin’s hashrate could grow tremendously. While Bitcoin’s monetary policy is predictable and fixed, its hashrate—and the rate of mining technology innovation —is far from static. We can only make projections of how Bitcoin’s hashrate could grow by looking at past trends. As a result, the goal of this report is not to try to create a highly accurate forecast of hashrate growth, but rather to examine what the mining industry may look like at a potential future point in time. We hope to inspire, start conversations, and to stimulate further research in how the mining industry may develop.

We have chosen the iconic next milestone in Bitcoin’s hashrate of one zettahash (one sextillion hashes) per second. What could Bitcoin mining look like once we get there?

The total reading time is about 75 minutes as we cover a wide range of relevant topics. Interested in an executive summary? Please see the conclusion at the end of the report.

When Zettahash?

If we assume that no dramatic, never-before-seen efficiency innovations are made in mining technology, and Bitcoin’s price continues to increase at its average growth rate since 2017, then we estimate that the latest the Bitcoin network might reach a hashrate of one Zettahash per second is around 2040-2042.

Due to Bitcoin’s unpredictable and often exponential nature, in reality this milestone could be reached much earlier. Nonetheless, we will dive into how we arrived at this upper bound, what is required to make it happen, which factors could speed up, slow down, or reverse growth, and what implications this may have for Bitcoin.

First, a quick recap of why Bitcoin uses hashing, and a look at how we got to the current hashrate to provide context.

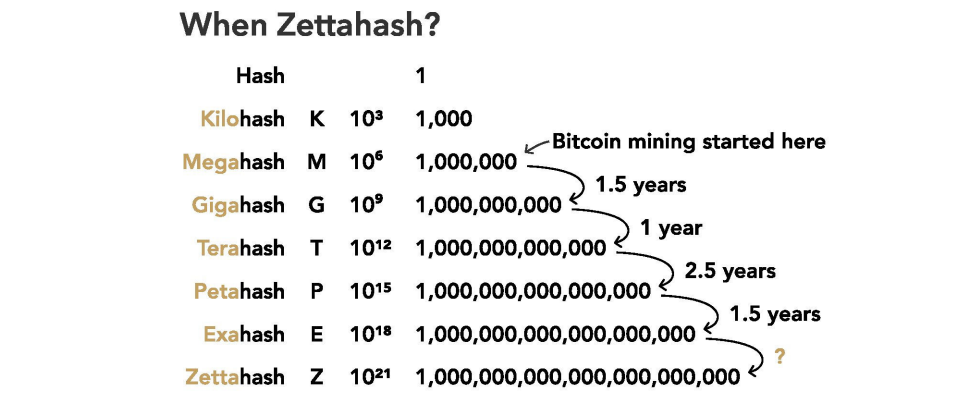

What is a Zettahash?

Many basic explanations of Bitcoin mining mention how miners perform complex calculations. This is an oversimplification that helps non-technical people get an idea of what is happening in just a few words. However, given 10 minutes, any non-technical person can understand the basics of cryptography, encryption, and hashing, which are widely used across the world today.

Hashing Is a Form of Cryptography

Rather than performing “complex calculations,” mining rigs use a form of cryptography called hashing. Cryptography is a field of study that focuses on communication methods that prevent third parties from reading private information. Encryption is the best-known form of cryptography, where the sender uses a specific method to obfuscate a message, and only the recipient knows how to decrypt the message.

A lesser known form of cryptography is hashing, which is a one-way transformation of data into a seemingly random string of letters and numbers with a fixed length. However, the same hashing algorithm used on the same data will always result in the exact same hash.

Using the popular hashing algorithm SHA256, the word ‘hello’ always transforms into the hash: 2cf24dba5fb0a30e26e83b2ac5b9e29e1b161e5c1 fa7425e7 3043362938b9824.

Any change in the data input, for example a capitalized ‘Hello’, completely changes the hash: 185f8db3227 1fe25f561a6fc938b2e264306ec304eda518007d1764826381969.

Any amount of information can be hashed: contents of Wikipedia pages, entire books, any data imaginable. A hash can also be used to prove that you know information before revealing it. When given a hash, it is not possible to reverse the process to reveal the input. The only way to guess the input is by hashing many different inputs until the hash matches. Depending on the hashing algorithm and the data input, it could take an incomprehensible amount of guesses.

Passwords Use Hashing

TIME IT TAKES A HACKER TO BRUTE FORCE YOUR PASSWORD IN The most widely used application of hashing is passwords. Instead of a service storing a password in plain text, it is considered best practice to store the hash of a password instead.

When a password is entered, the device hashes the data, and the service checks if this hash matches the one that was provided upon signing up or the most recent password change.

The use of hashing ensures that the service does not know the actual password of the user and cannot reverse-engineer it, which would have major security implications when passwords are reused.

Basic knowledge of hashing helps to understand why longer passwords with capitalization and symbols are more secure, as they exponentially increase the total possible passwords.

Bitcoin Flips Hashing Around

Instead of starting from the data input, the Bitcoin software asks miners to produce a hash that, when converted to a number, is below a specific target. Modern ASICs are in the range of 100-250 terahashes per second, so 100-250 trillion attempts per second to find a hash below the target.

This target is automatically adjusted by the Bitcoin software every 2016 blocks, based on how long it took on average to find those blocks. Through this difficulty adjustment, the software ensures that on average, it takes roughly 10 minutes for the collective network to find a new block. This remains true even if many miners have joined or left the network. The time interval ensures all the nodes around the world can stay up to date with the latest version of the blockchain, even if they use a Virtual Private Network (VPN) or have a slow internet connection.

Mining rigs are essentially making an astounding number of guesses to get the winning ticket to a lottery. The winner gets to add a block of transactions to the blockchain, and earns the block reward and the fees paid by the transactions in it. At a bitcoin price of $16,500 and a block reward of 6.25 bitcoin, this adds up to at least $103,125 per block, excluding transaction fees.

This leads us back to the arbitrary goal of a zettahash per second. A zettahash is a billion terahashes, or a sextillion hashes per second: a number far beyond human comprehension.

If more mining rigs or hashes per second do not help to speed up the block creation process, then what is the point? Hashing keeps Bitcoin secure from bad actors who try to double spend a transaction. The more hashrate the Bitcoin network collectively has, the more difficult it becomes for any attacker to undermine it, for instance if that attacker is a nation state that does not want the equivalent of free speech in money: a freedom to transact.

Through hashing, Bitcoin is secured by one of the most consistent and predictable phenomena in the universe: mathematics.

Hashrate History

Historically, the hashrate of the Bitcoin network was over a megahash (a million hashes) per second from the start. A single computer could already reach close to a megahash. It took 1.5 years, until mid 2010, to cross one gigahash (a billion hashes) per second, thanks to the advent of GPU miners. One year later, in mid 2011, the network reached a terahash (a trillion hashes) per second. Each of these jumps were three orders of magnitude improvements (x1000), but due to innovations in mining technology they did not require an equal addition in computers.

After mid 2011, it became harder for the hashrate to continue its hypergrowth. It took until late 2014 for the hashrate to exceed a petahash (a quadrillion hashes) per second, which was made possible by the invention of ASIC miners. These are highly specialized mining chips, engineered to perform one specific task. Think of them as athletes devoting their career to one sport.

Years of chip improvements followed. As ASIC manufacturers ramped up production and large amounts of capital got into mining, the network reached one exahash (a quintillion hashes) per second in early 2016.

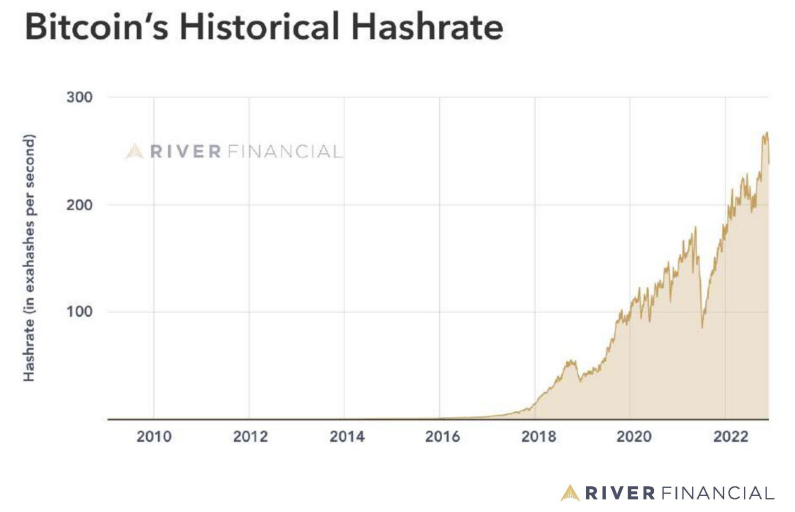

As impressive as all of this growth has been, it is not even visible when switching from a logarithmic graph to a linear graph.

Over the past seven years, Bitcoin’s hashrate has grown ~250 fold, largely through mining rig efficiency improvements, the industry professionalizing, and big institutions getting involved.

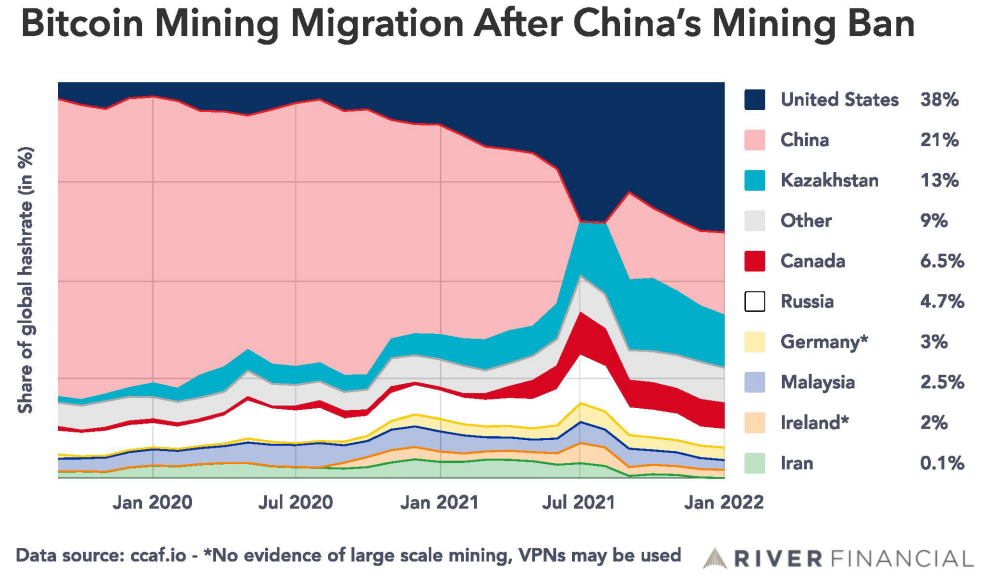

Beyond the growth trajectory, the major drop in hashrate in 2021 immediately jumps out. This was the result of the Chinese government banning all mining activity and large numbers of miners relocating internationally, primarily to the United States. More on this in a later section.

Besides China’s anomaly mining ban, Bitcoin’s hashrate has been growing at a relatively linear rate since 2018. If we extrapolate this trajectory from 2018 into the future, the network would reach one zettahash per second around the year 2041. At a more conservative estimate using the growth rate since 2017, it would take until 2042, and starting from 2016 when the network first reached one exahash, it would take until 2045. Using 2019 or 2020 as a starting point puts it ahead around 2040.

We included 2021 despite it being an outlier compared to other years. On the one hand, China’s mining ban caused a heavy decline in hashrate; on the other hand, the massive price increase skewed the growth rate upwards. This growth trajectory continues to be evident in 2022 thanks to delayed go-live of mining operations that received investments in 2021. At the 2021 rate, a zettahash could be reached as early as 2035, and at the 2022 rate, as early as 2033.

Whichever scenario you may believe to be most realistic, which is perhaps none of the above, it is important to remember that hashrate growth does not live in a vacuum. There are a range of conditions that must be met in order to sustain this kind of growth. It is important to reiterate that the need for Bitcoin’s hashrate to grow to such levels is not clear today. A zettahash is very much an arbitrary milestone that we are using to explore the future of the mining industry.

Requirements to Support a Zettahash

We believe there are three categories of requirements to support a zettahash in hashrate, or any future growth in hashrate at all:

1. Security budget (Bitcoin’s price, transaction fees, and developer funding)

2. Mining equipment (Mining rigs, efficiency improvements, and manufacturing)

3. Energy (Energy supply and grid infrastructure)

All of these categories are dynamic, which complicates any future projections.

It could be argued that favorable legislation and enough geopolitical stability could form a category, but we see these as hurdles to slow down growth, rather than absolute requirements to reach a zettahash. We will dive into these issues after the three categories.

Category 1: Security Budget

For Bitcoin to operate securely, it must be impossible for anyone to spend the same bitcoin twice, known as a double spend attack. Successfully executing such an attack with a large portion of the network's hashrate would undermine the collective belief in Bitcoin as an immutable global ledger.

Obtaining this much hashrate externally would not just be a matter of capital. An attacker would need to obtain mining rigs at an unprecedented scale, source the power, and bring them online, all without any observer or participant making this public. In the second category we look into the amount of active mining rigs, and in the third category into how much energy Bitcoin mining takes. Understanding these numbers gives a sense of how unlikely such an attack would be.

If such an attacker were observed, the industry could look into various countermeasures to protect itself. The actual costs of such an attack are very difficult to quantify, but would massively exceed the few billion dollar budget that overly simplistic calculations could arrive at based on Bitcoin’s current security budget. We look into this further below.

Internal attacks are the more likely possibility of the two, and yet still highly unlikely and never before seen in Bitcoin.

An internal attacker could be an existing group of mining pools that fully controls their hash power adding up to over 50%. This would not apply to mining pools that consist of thousands of individual miners who could switch or leave the pool at any time. The attack would need to be far more profitable than what the attackers could earn with their mining equipment through honest behavior. All major mining pools are operated by known companies and individuals. The odds of several of them wanting to take the risks associated with initiating such an attack on Bitcoin do not make rational sense, but the option should always be considered.

Protection Against Internal and External Attacks

To protect itself against internal or external attacks by malicious miners, Bitcoin depends on honest miners who are incentivized through rewards to create valid blocks.

The amount of capital that honest miners can collectively invest without losing money makes up Bitcoin’s security budget. The maximum amount they can reasonably invest today is largely defined by the revenue they can generate from mining valid blocks. This revenue consists of two components: the value of the block rewards that miners receive for successfully adding blocks to the blockchain, and the transaction fees within those blocks.

As we will address later on in the energy category, Bitcoin miners are creatively seeking out additional revenue streams by repurposing the heat they generate, boosting the security budget.

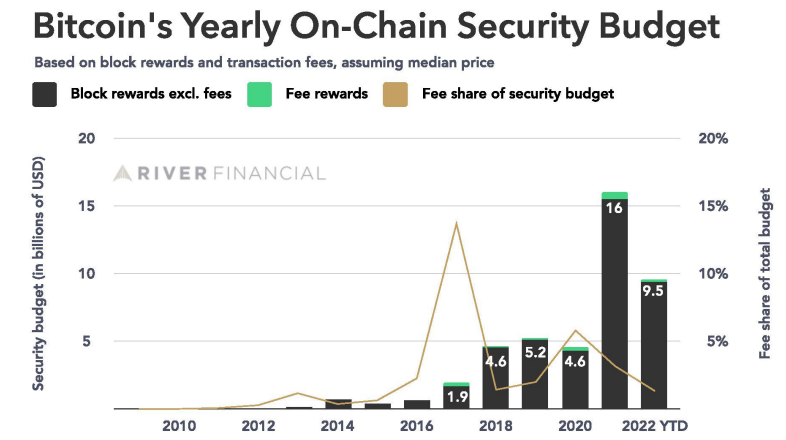

In 2022 YTD, Bitcoin’s base security budget is roughly $9.5 billion if we use the median bitcoin price, of which ~$39.4 billion comes from block rewards, and roughly $123 million from transaction fees. The $9.5 billion budget works out to around 1.7% of Bitcoin's average market cap in 2022.

Is this security budget too little? Just right? Or too much? Is the security budget relative to the market cap a good ratio for a global, digital, and decentralized financial network?

We could look at similar statistics for other assets such as gold, but gold does not run on a globally shared ledger that can be attacked at scale. At the same time, gold does not have many of the properties that Bitcoin has that could make well-funded actors such as nation states want to attack it. These new attack vectors may require different security needs, and as a result, there are no good answers or comparisons today that would help to define an adequate security budget for Bitcoin.

Bitcoin’s Extended Security Budget

In addition to the base security budget, there is an extended budget in the hands of industry participants that earned substantially from Bitcoin’s price rise, including large businesses such as exchanges and brokerages. Some of these earn significant profits from trading fees or spreads without settling each transaction on the blockchain.

These parties have an incentive to invest part of their profits into, for example, funding open-source development to continue to evolve the robustness of Bitcoin’s network. Today, there is a wide range of businesses engaging in funding development. While this only represents a fraction of the total security budget, it is possible these actors would be willing and able to invest more, in the event that their wealth or revenue streams were under threat from attacks on the Bitcoin network.

Even without any signs of direct attacks, funding open source development is critical for Bitcoin’s long term success as the protocol itself can not automatically pay those who keep working on its security. One way to attack the network could be by introducing a catastrophic bug into Bitcoin’s core software and trying to get it widely adopted by the network. While such an attack may cost less in dollar terms than other attacks, it would require corruption of an incredibly gifted mind, able to engineer such a bug in a way that would pass all peer review over a long period of time. The best defense against such an attack is to ensure that many talented developers are funded to identify such attacks and bring them to light.

The Balance of the Security Budget Will Shift

As the block reward decreases, the balance between security from block rewards and from transaction fees will shift. To estimate what changes would be needed to balance out this shift, we look at some hypothetical scenarios with very rough numbers for the year 2042, when we would expect to reach a hashrate of one zettahash per second at the latest.

Three important notes about these scenarios:

1. There is no fixed ratio between transaction fees, the Bitcoin price, and Bitcoin’s hashrate. We are using these numbers as example inputs to give an idea of which inputs result in what security budget.

2. The number of on-chain transactions remains the same as without increasing the blocksize limit, there is no room for a significant amount of growth there.

3. None of these scenarios account for inflation, as unlike Bitcoin, the monetary policy of the US Dollar is unknown.

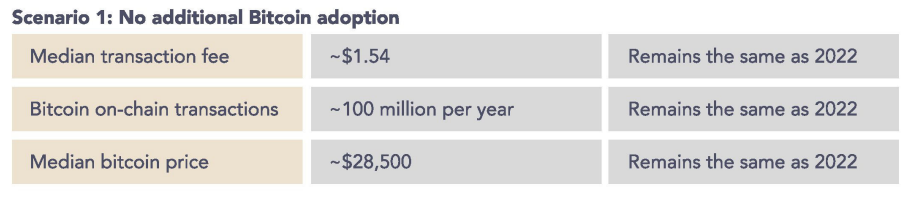

This stable scenario would reduce Bitcoin’s security budget to ~$446 million per year by 2042, or a reduction of 95.3% compared to 2022 due to smaller block rewards.

In this scenario, the most likely way for Bitcoin’s hashrate to get to a zettahash per second would be through efficiency improvements.

This scenario also assumes that a lack of additional adoption would not make more people leave the project than those who would join. In other words, there would always be a similar sized market for Bitcoin.

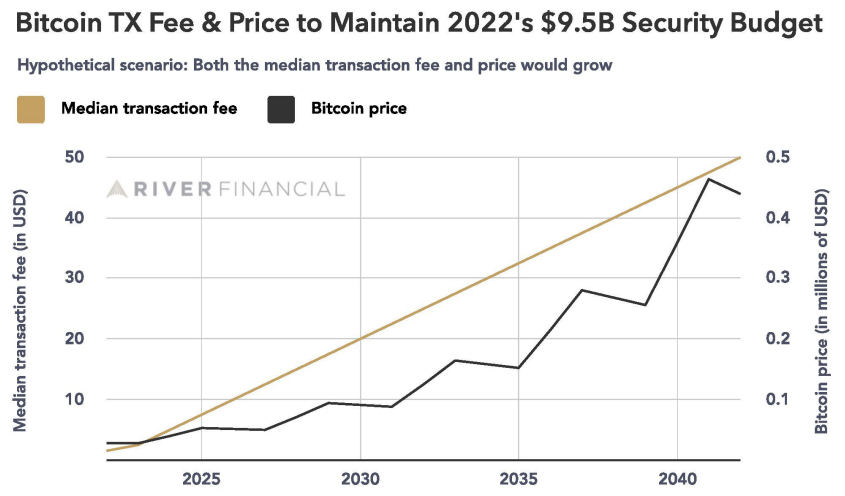

Due to the decreasing block reward, this linear growth scenario would result in Bitcoin’s security budget shrinking to ~$1.23 billion in 2042, or a reduction of 87% compared to 2022.

This price growth scenario would result in the same arbitrary security budget of 2022. It would only be realistic if bitcoin is hoarded by a group of wealthy individuals that collectively don’t exceed 100 million transactions per year. In any other scenario, the median transaction fee would increase significantly as well.

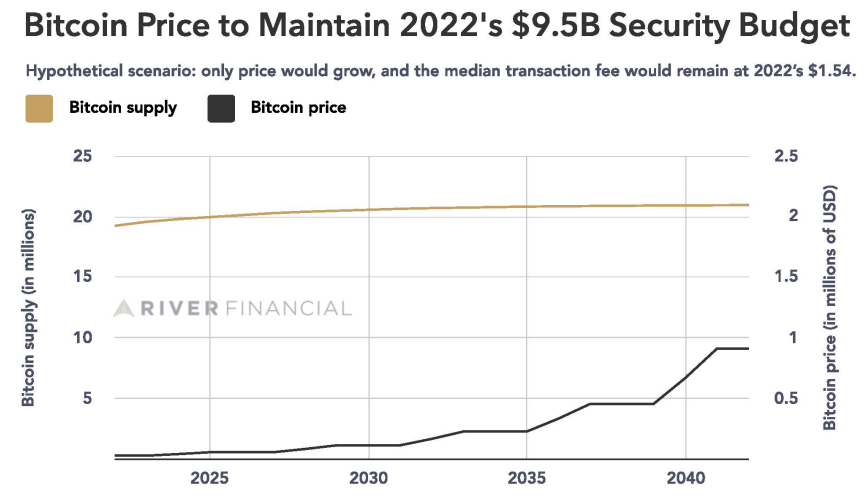

The graph below shows an example of how bitcoin’s price would need to increase after each block reward halving to maintain a similar security budget, given that the bitcoin supply would not increase significantly.

In this significant adoption increase scenario, settlement on the base layer would become expensive and most users would use additional layers for their bitcoin transactions. On-chain transactions would in many cases be settling batches of thousands or millions of transactions made on additional layers, which would ensure the cost for individual users remains low.

In just one version of this hypothetical scenario as presented in the graph below, the yearly security budget would remain around $9.5 billion, but the market cap would grow to $9.2 trillion. This is likely unrealistic as only about 0.1% of the market cap would be allocated to security. The real security budget number may be significantly higher.

Are Fees the Future?

According to the above hypothetical scenarios, the biggest contributing factor to maintain a similar security budget is a significant increase in the average bitcoin transaction fee. Is such an increase realistic? To understand the technical part of this question, we need to look into Bitcoin’s architecture.

Bitcoin has a limited transaction throughput on the base layer (the blockchain). This design ensures Bitcoin can remain decentralized, by keeping the size of blocks and thus the blockchain relatively small, and bandwidth requirements low enough so that running a node in the Bitcoin network remains accessible to people without high performing computers and internet speeds. The transaction throughput on the base layer is unlikely to increase significantly in the foreseeable future. The wider community supports a model of scaling through additional layers, as determined by the so-called “blocksize wars”.

If Bitcoin would get more adoption, more users would compete for the limited block space and transaction fees would rise. However, there is a limit to how much an individual is willing to pay for a transaction, before switching to a different solution that is cheaper but still fulfills their needs. This limit does not mean that Bitcoin would turn into a solution for the wealthy. Instead, technological developments have made it possible to turn the base layer into a settlement layer, rather than a transaction layer.

Satoshi Nakamoto envisioned this possibility during Bitcoin’s early years by introducing a solution: an additional layer built on top of Bitcoin on which payments happen and then occasionally get settled on the blockchain.

An implementation of this technology has been live for years and is called the Lightning Network. It is still under development to get it to a desired state for widespread adoption, and to truly enable the base layer to transition to a settlement layer. River is a significant participant in the Lightning Network. See our previous report to read more about what we have learned from running Lightning.

In this section on examining fees in the future, we also want to reiterate that the current security budget is by no means the standard. There is no clarity on what size security budget Bitcoin actually needs to fend off any attacker, so an inability to reach the price and transaction fee levels in some of the scenarios we listed above is by no means proof that Bitcoin would fail to operate securely. This challenge is similar to budgeting other types of physical or digital security.

lf Bitcoin were almost exclusively used as a store of value in the future with limited transaction activity, then users may want to come to a consensus on what constitutes an adequate security budget, and how to finance it. In order to better understand this challenge, further studies are needed.

Such studies could also begin to answer important questions for Bitcoin’s future: What would the security budget have to be if Bitcoin is used by billions of people with a market capitalization of tens of trillions of dollars? How much would the average user need to contribute to keep the system secure? Answering these questions goes beyond the scope of this report.

To take this section back to the future in which we envision a higher hashrate: this future is still possible even with a shrinking security budget. Efficiency innovations in mining technology go a long way towards increasing the hashrate of the network. We look into how this might progress in the next category.

Summary:

In this category we examined if Bitcoin’s future security budget can finance a 300% growth in hashrate to a zettahash per second. It is clear that Bitcoin’s usage and price will need to grow significantly to support this growth. The cost of hashrate dropping over time due to technological improvements will alleviate some pressure, but it remains an open question.

Category 2: Mining Equipment

The security budget mentioned in the previous category is largely used to pay for mining equipment and energy. Whatever remains is profit for the miners. In this category, we take a look at how much mining equipment is out there, how many mining rigs may be needed to reach a zettahash, and how much energy they may use in the future.

How Many Mining Rigs Are Active Today?

To estimate this number, we need to understand the hashrate of the average active mining rig. However, the Bitcoin network is supported by a vast range of different mining models with various hashrates. Mining is highly decentralized which makes obtaining this data difficult.

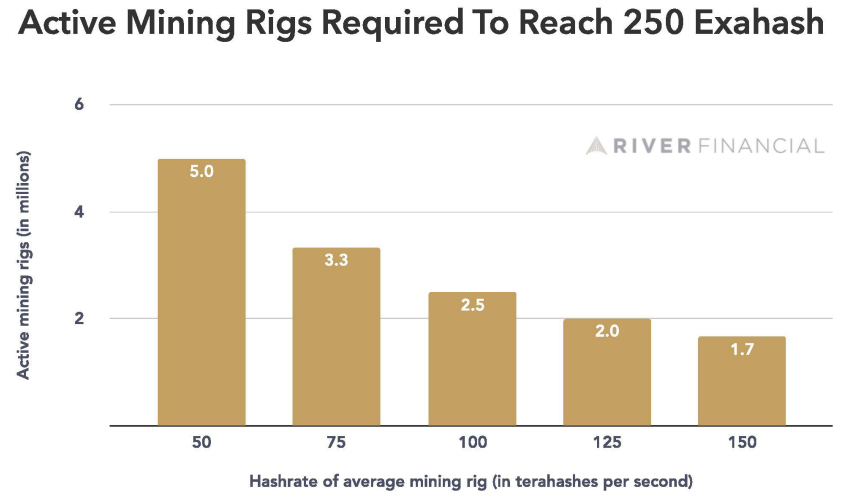

One approach is to run some rough calculations and then refine them. If the average mining rig had a hashrate of 100 terahashes per second, it would take around 2.5 million mining rigs deployed globally to make up a collective hashrate of roughly 250 exahash per second. This estimation could be off significantly, as there are ASICs with a lower hashrate that can still operate just around breakeven, depending on the energy price that is paid. At half the hashrate (50 TH/s), there would be 5 million active mining rigs today.

To refine our estimate from a broad range of 2.5 - 5 million rigs, we examine Bitcoin’s global energy consumption.

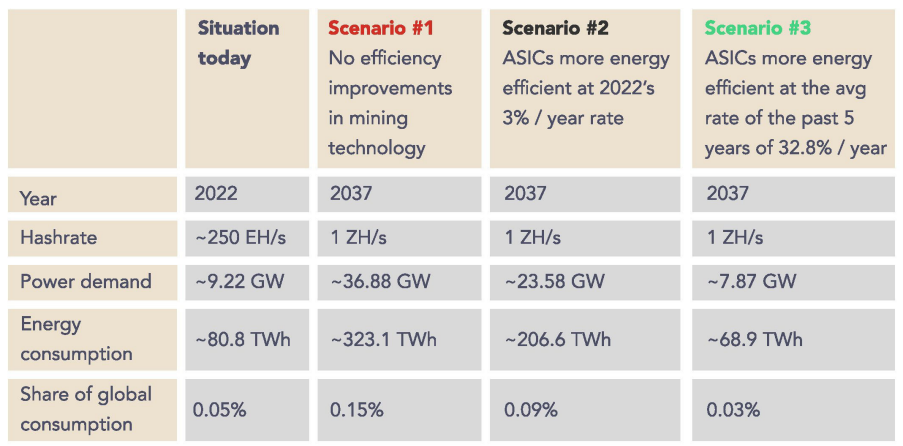

The Cambridge Centre for Alternative Finance estimates Bitcoin’s energy consumption at roughly 9.22 gigawatts as of 23 November 2022, or around 80.79 terawatt per hour.

lf we take the middle of the estimate of 2.5 - 5 million mining rigs and the total power demand of 10.34, this would mean the average Watts per rig is around 9.22 GW / 3.75 million = 2459 watts. This would mean the average mining rig is a model from around 2019, which are the only models that match this number. Given that the hashrate has increased by roughly 70% compared to the average of 2021, this estimation seems unlikely.

If we take the power consumption of a 2021 mining rig of around 3250 watts, we arrive at around 2.8 million mining rigs. This would mean the average active mining rig has a hashrate of around 89 TH/s, which seems a reasonable number.

How Many Mining Rigs For One Zettahash?

Without any efficiency improvements, the number of active mining rigs would need to grow by 300% to an estimated 11.2 million to support one zettahash per second. At an example price of $4k per mining rig, the hardware cost would add up to at least $44.8 billion.

Given that major efficiency improvements have historically happened almost yearly, it is a highly unlikely scenario that this many mining rigs would be required.

Accounting For Efficiency Improvements

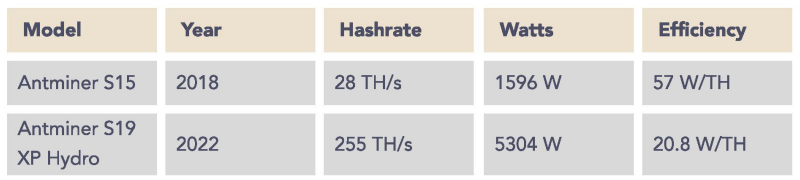

Mining rig efficiency has improved by ~44,857% since the emergence of the first ASICs. Looking more recently since 2018, it has improved by 121% in 4 years, from 57 Watts per terahash to 20.8 W/TH. It now takes the best mining rig only a third of the energy to hash at the same speed.

We have not only seen better efficiency, but also a higher hashrate per ASIC. If these trends continue, Bitcoin’s hashrate would increase significantly, even if the number of active mining rigs does not grow. New generations of ASICs would replace older models, increasing the overall hashrate, while energy consumption would grow at a slower rate.

Mapping out this growth is difficult, as both the average hashrate per ASIC as well as the growth rate of the number of active mining rigs are unknown.

We provide an example scenario below, to create an understanding of how quickly these efficiency improvements compound.

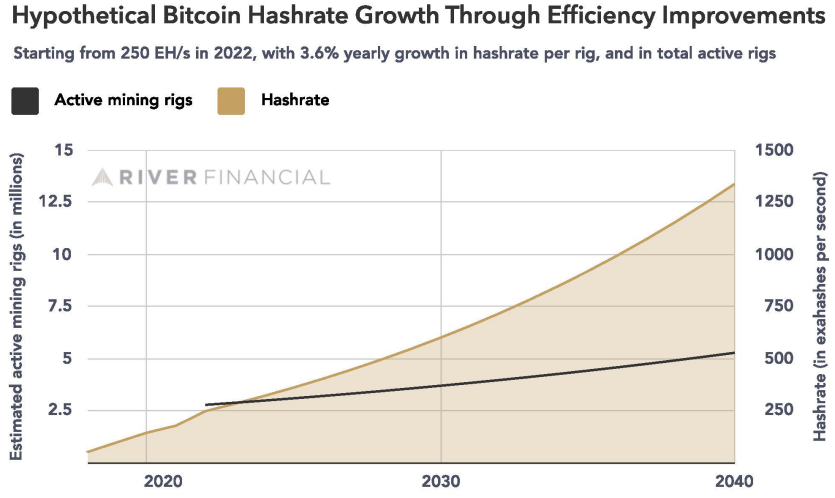

For this example, we take the average increase in hashrate of the most efficient mining rig each year since 2018, which is 45.4 terahashes per second each year. The hashrate of the average mining rig would not increase by the same amount, as production and adoption of new models takes time, and is influenced by potential future profits, as well as the ability for older models to continue running at a profit in the current market.

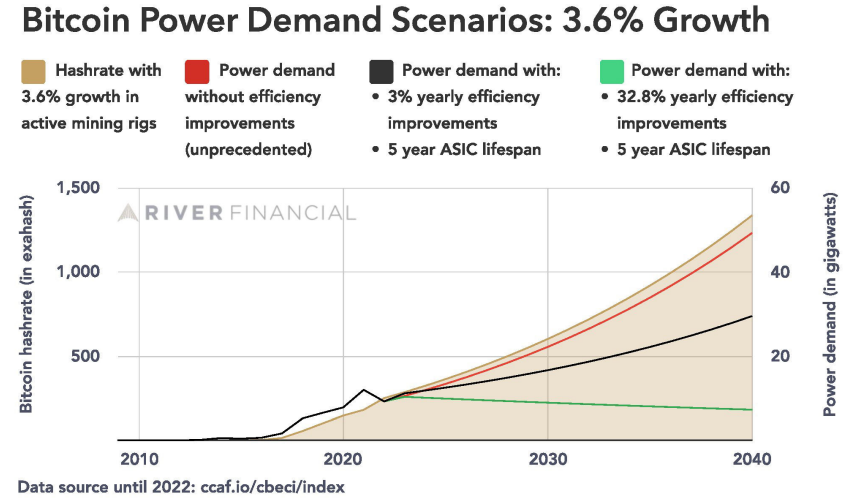

If we assume a mining rig has a life cycle of 5 years, and we thus take 20% of this growth per year, then the hashrate of the average ASIC would be increasing by 9.08 TH/s per year, without dropping in energy efficiency. We also make the assumption that the number of active mining rigs grows by the same ~3.6% per year (to highlight the discrepancy between hashrate and number of active mining rigs).

At a 3.6% growth rate, the total hashrate would reach one zettahash per second by the year 2036 after increasing by 300%, while the number of active mining rigs would grow by 167% from 2.8 million to 4.7 million.

The 3.6% yearly growth number is very conservative, given that roughly a quarter of all mining rigs (700k) went live in the past ~1.5 years. To confirm that technology is not a bottleneck to reach a zettahash, we look into public data from mining manufacturers in the next section.

ASIC Production Rate

Due to a lack of public data from ASIC manufacturers, the only option is to reverse engineer their production rate. This process is difficult and has significant room for error.

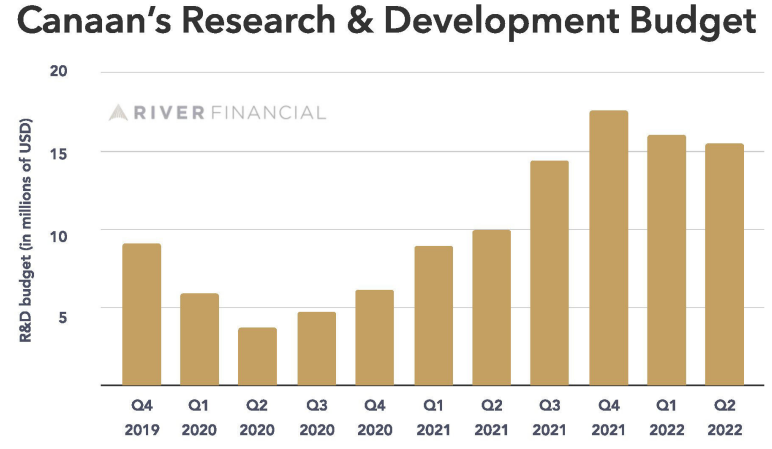

A possible approach is to use the little public data that is available to get an approximation of how many rigs are sold each year. Of the ASIC manufacturers, Canaan is the only public company and thus must disclose its financials.

There are two major uncertainties surrounding its revenue data:

1. There is no clarity around how much of this revenue is attributed to Artificial Intelligence products, and how much to ASICs.

2. Their ASIC prices are heavily discounted and have fluctuated significantly over the past years. If we assume all of Canaan's revenue is from ASICs, and we assume a price range of $2-4k per ASIC, this would create an upper bound of 50-100k mining rigs sold per quarter, adding up to around 200-400k ASICs in a year.

If ~300k ASICs would be somewhat accurate, this would mean Canaan alone added almost 10% of all mining rigs in 2022. Even at ~200k ASICs produced it would still be 7% of all active mining rigs. This may not seem like a high number, but if we look at the hashrate growth since 2021 of roughly 70%, this would mean that around one million ASICs were brought online over the past two years, of which up to 20% would be attributed to Canaan. This number appears too high, as Canaan is likely the third largest ASIC manufacturer with 6 new models since 2020, compared to MicroBT and Bitmain with 10 new models each and higher efficiency ASICs.

Due to such a massive increase in the number of active mining rigs over the past two years, it does not seem constructive at this time to attempt an extrapolation of this growth into the future.

With 2021 and 2022 being such outliers in terms of active ASICs, it also does not seem constructive to attempt estimations of how many ASICs have historically been produced.

The only relevant factor for our research here is that the manufacturing industry can certainly provide an overall production rate of a few hundred thousand ASICs per year. But can they also continue to deliver on efficiency improvements?

Examining Manufacturing R&D Budgets

In addition to technological breakthroughs, the efficiency trend also requires a security budget that is large enough to finance such growth. Mining would need to be profitable enough to incentivize miners to buy more efficient mining rigs at large scale. Without this demand, mining manufacturers would stop investing in research and development budgets to innovate.

Canaan’s R&D budget was $21.5M in 2020, and $52.2M in 2021, based on its yearly reporting.

Notably, Canaan historically has not produced the most energy efficient mining rigs. Doing so potentially requires a higher R&D budget. The only other point of reference we have is Bitmain’s IPO filing in 2018, during which it reported an $87M R&D budget for the first six months of 2018, a total of $72.5M in 2017, $16.6M in 2016, and $5.7M in 2015.

Adding up several large manufacturers likely puts the yearly industry-wide R&D budget in the hundreds of millions of dollars.

It is clear that there has been a trend of rising R&D budgets, but we can also conclude that if Bitcoin’s security budget would decrease significantly, current budgets would not be sustainable and efficiency improvements could slow down significantly.

Summary:

In this category we examined if mining resources could be a bottleneck to reaching a hashrate of a zettahash per second. We can conclude that: e An overall production rate of a few hundred thousand ASICs per year is not an issue, unless major geopolitical tensions arise. * Consistent efficiency improvements are historically proven, but this is no guarantee that they will continue in the future. Supply chains and frequent technological breakthroughs are all unpredictable factors. We examine these risks in the ‘hurdles’ section later on.

Category 3: Energy

Beyond the funding (category 1) and the physical resources (category 2) needed to reach a zettahash, energy plays a critical role.

In this category, we establish a baseline of how much energy the world might consume over the next decades. Next, we look at how much of this energy Bitcoin mining might need. Finally, we look at whether, and where, this energy might be available at affordable prices, and what is involved in tapping into these resources.

How Much Energy the World Uses

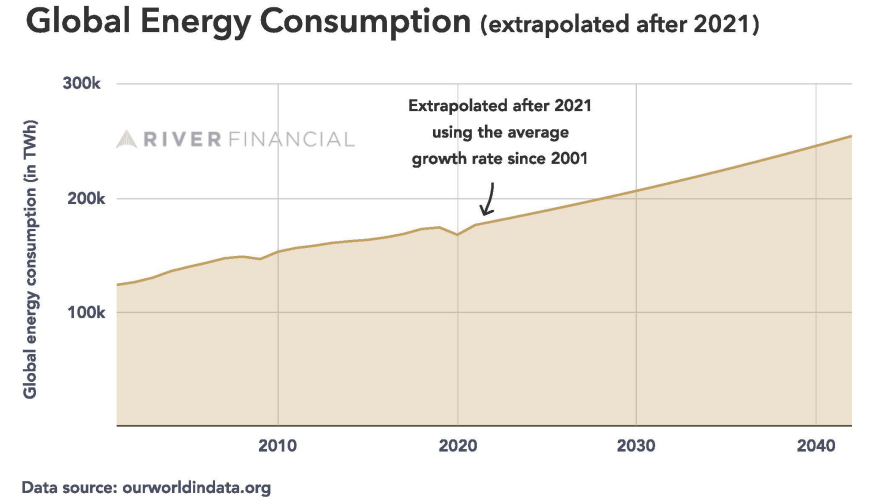

Over the past 20 years, global energy consumption has increased by an average of 1.76% per year. If we extrapolate this growth twenty years into the future to 2042, we arrive at a consumption of 254,547 TWh, a 41.77% increase compared to 2022.

True global energy demand is far greater than this figure, but the average human being who lives on a few dollars per day cannot afford to consume as much energy. If breakthroughs continue to be made in lowering the costs of renewable energy, and energy continues to become cheaper, we would expect global energy consumption to increase exponentially.

How Much Energy Would Bitcoin Mining Need at a Zettahash?

As mentioned in the mining rig estimation section, The Cambridge Centre for Alternative Finance estimates that Bitcoin’s global power demand is around 9.22 GW as of 28 November 2022, or roughly 80.8 TWh. This puts Bitcoin’s share of total global energy consumption at 0.05% today.

How might Bitcoin’s energy consumption evolve?

It largely depends on three factors:

- How many ASICs can run at least at break-even, influenced by price.

- The lifecycle of a mining rig.

- The rate at which ASICs become more energy efficient.

By playing with these factors, many different scenarios can be generated. Below we provide some examples to give an idea of potential outcomes.

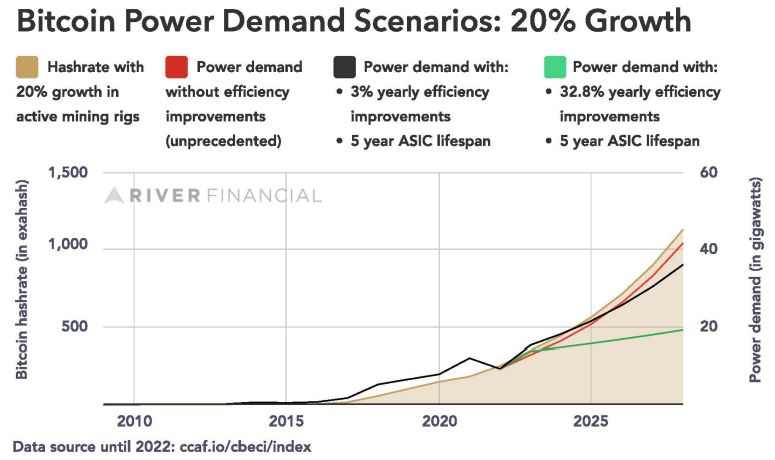

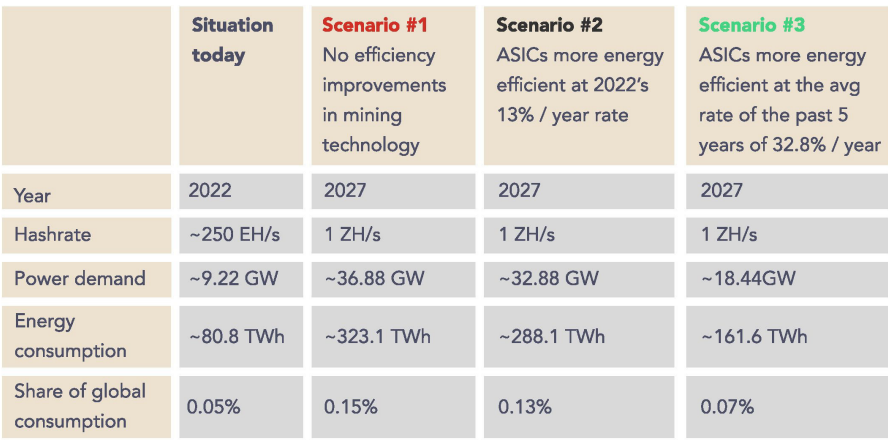

Example #1: Impact of 3.6% Yearly Growth on Energy Consumption

In the first example, we assume the previously used 3.6% yearly growth in the number of active mining rigs. We plot out three scenarios with this growth number.

*It is unprecedented that there are no efficiency breakthroughs, so why include this scenario? Because this is often how the media incorrectly portray Bitcoin’s future energy consumption. They extrapolate the current energy consumption into the future, and often do the same with the number of transactions, ignoring all efficiency improvements and scalability efforts in Bitcoin.

Example #2: Impact of 20% Yearly Growth on Energy Consumption

In the second example, we assume a more aggressive 20% yearly growth in the number of active mining rigs. We plot out the same three scenarios with this growth number.

We could continue to generate more aggressive growth scenarios, but there is a financial limitation to how many ASICs can run at break-even relative to the bitcoin price. This evolution is shown in downtrend of the value of an Exahash.

As the block reward is set to decrease—and with it Bitcoin’s security budget—such continuous, aggressive hashrate growth of 20% per year becomes less likely over time. The only counter to this factor would be major global Bitcoin adoption, which would likely introduce massive global efficiency improvements by enabling people to conduct faster trade with near instant final settlement. Capital would be available a far higher percentage of the time, leading to an increase in global productivity.

As the block reward is set to decrease—and with it Bitcoin’s security budget—such continuous, aggressive hashrate growth of 20% per year becomes less likely over time. The only counter to this factor would be major global Bitcoin adoption, which would likely introduce massive global efficiency improvements by enabling people to conduct faster trade with near instant final settlement. Capital would be available a far higher percentage of the time, leading to an increase in global productivity.

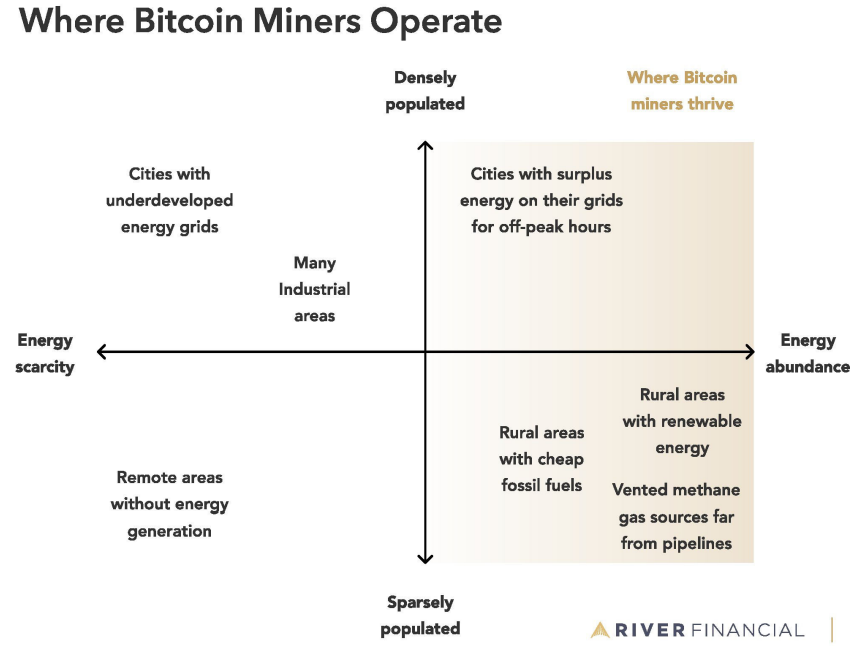

Abundant Cheap Energy

A significant increase in the availability of abundant cheap energy is a large potential growth driver for the Bitcoin mining industry. If we look at the next few decades, is such an increase a realistic scenario?

While media typically report on energy shortages, energy availability is location dependent and varies worldwide. Once generated, electricity often cannot be efficiently transported more than a few hundred kilometers. In many places there is a lack of available transmission lines that connect areas with high amounts of renewables to areas with large populations. The cost of building a mile of transmission can go up to $2M+ per mile for lines over 10 miles in length.

As a result, densely populated or industrialized areas with high energy demand are more likely to have energy shortages, while remote areas with high energy supply are more likely to have energy abundance.

By design, Bitcoin miners avoid operating in places with energy scarcity. Mining is a highly competitive industry, and only the miners with the lowest costs can survive in the long run.

As a result, there is a strong incentive for mining operators to source the cheapest possible energy to stay in business. Thus, the average energy price that Bitcoin miners pay will trend towards zero in the long term. We are already seeing miners get more creative today to increase their revenue by repurposing the heat generated by ASICS to warm greenhouses, produce whiskey, or dry wood and seaweed.

There may be intermediary periods when the bitcoin price rises significantly and mining temporarily becomes profitable for more people or in more locations, but eventually this gap is closed and those who pay higher energy prices are competed out of the market. Success in the mining business is largely defined by the ability to consistently source cheap energy.

The Cheapest Energy on the Planet

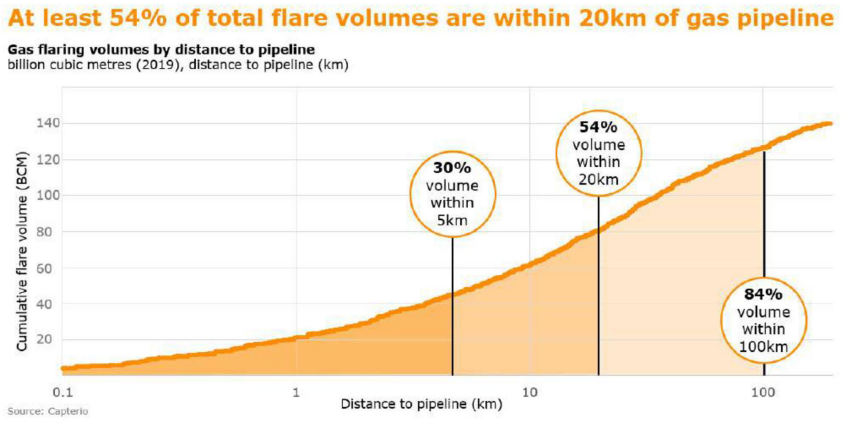

While the cost of renewable energy (such as solar) has dropped significantly over the past decades, the cheapest energy on the planet is vented methane gas that cannot economically be captured. Some Bitcoin miners report paying as little as $0.005-0.01 per kWh for such energy, which is an order of magnitude cheaper than a typical price paid by the Bitcoin mining industry.

Why is methane such a cheap energy source?

Because it is largely a byproduct of human activity. Based on IEA data from 2020, 36% of all human caused methane emissions are from agriculture, 33% from energy production (coal, gas, oil extraction), and 17% from human-made landfills. There are 2,633 landfills in the United States alone.

Methane has 84 times more effect on global warming than CO2 when it is not captured. It is widely recognized as one of the biggest contributors to climate change, responsible for at least 25% of today’s global warming. Regardless of personal opinions on climate change, Bitcoin mining is becoming a bigger part of this conversation in a constructive way as we explore below.

Keeping methane gas out of the atmosphere is critical, but often difficult and costly. Financial incentives could stimulate the capture or combustion of methane at mass scale, reducing the impact methane has on the climate.

The exact economic feasibility of capturing vented methane gas from landfills is complex. Its proximity to an existing gas pipeline to transport the gas plays a big role. Research by Capterio suggests the feasibility maxes out somewhere around 5-20 kilometers from an existing pipeline. This varies per location and topography, as these factors influence the cost to construct additional pipelines (which are typically several million dollars per kilometer). There would also need to be clear additional steps on what to do with the captured gas.

When economically feasible, capturing methane is the preferred option, as it is better for the atmosphere than combusting it. In practice, it is frequently not a viable option.

Based on analysis by Daniel Batten, 55.7% of all vented methane should be used for Bitcoin mining, as determined by a range of criteria. The electricity produced by combusting the methane can be used to generate revenue that pays for the equipment and operational costs. If this combustion can be done successfully at scale, it would reduce all methane emissions by 22.9%, which equals a reduction of 0.15 degrees celsius of global warming by the year 2045, or 10% of the 1.5 degrees celsius goal set by the Paris Agreement. By combusting methane, CO2 is still produced, but the overall impact would still drop by an estimated 5.32% in terms of CO2.

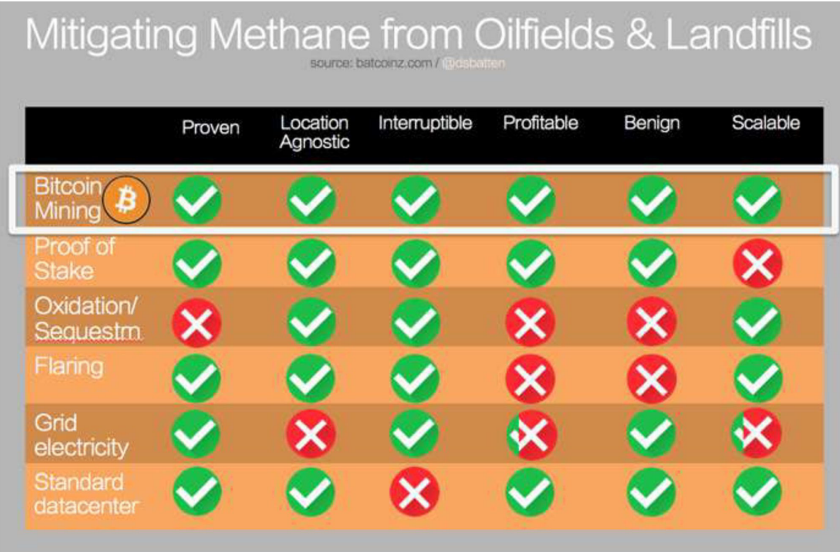

In order to finance the combustion of all this methane, an energy consumer is needed that is consistent, location agnostic, scalable, interruptible at any time, and profitable.

Bitcoin Mining With Vented Methane Gas

The best suited energy consumer for combusting vented methane gas is Bitcoin mining, as it is:

- Proven: Bitcoin mining has a track record of working consistently for over a decade.

- Location agnostic: Bitcoin mining can be done anywhere on the planet where it is legal.

- Scalable: More mining rigs can be added or removed at any time; containerized mining solutions can easily be transported and set up anywhere.

- Interruptible: ASICs can be turned off at any moment without impacting business critical processes or harming any equipment or resources. Some miners already do this today.

- Profitable: With extremely low energy costs, Bitcoin miners are more likely to make a profit. Miners have a financial incentive to leverage methane sources that cannot economically be captured.

No other energy consumer besides Bitcoin mining meets all of these criteria. This does not mean only Bitcoin mining should be used to mitigate methane, but it is one of the more appealing ways to combat methane emissions.

Depending on how popular using vented methane gas becomes for mining, we could even see the average energy price that Bitcoin miners pay drop below zero. It is possible that miners would be subsidized to seek out vented methane and combust it to mitigate global warming, as they are the energy consumer best suited to do so.

Vented methane gas that cannot be economically captured turns Bitcoin mining from a frequently criticized industry into an economic tool to combat climate change.

The two largest obstacles to make this shift happen are regulation and education. After almost a decade of negative media coverage, significant educational efforts are required to change the minds of regulators and legislators around the world. Fortunately, the data is proving that the methane approach works, as collectively these operations are already removing a combined total of 4.27% of all Bitcoin’s CO2 output.

In order to finance the combustion of all this methane gas, Bitcoin’s hashrate would have to grow by an estimated 1.5 Zettahash, according to Batten’s analysis, with 80% of all new mining operations using vented methane gas as an energy source.

This also highlights the drawback to this approach: Bitcoin mining is not yet at a large enough scale to make a significant global impact before 2030.

What if this approach struggles to gain widespread adoption? Could Bitcoin mining still become a carbon neutral or carbon negative force in the world?

How Much Renewable Energy Could Bitcoin Mining Use in 2042?

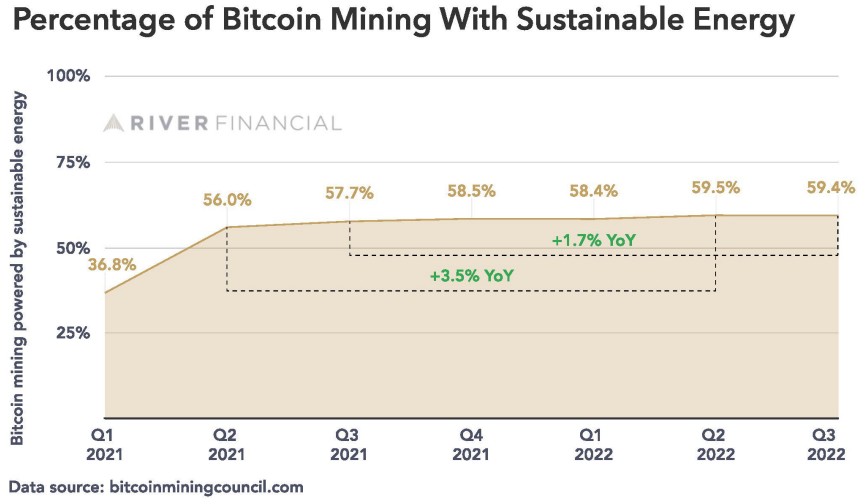

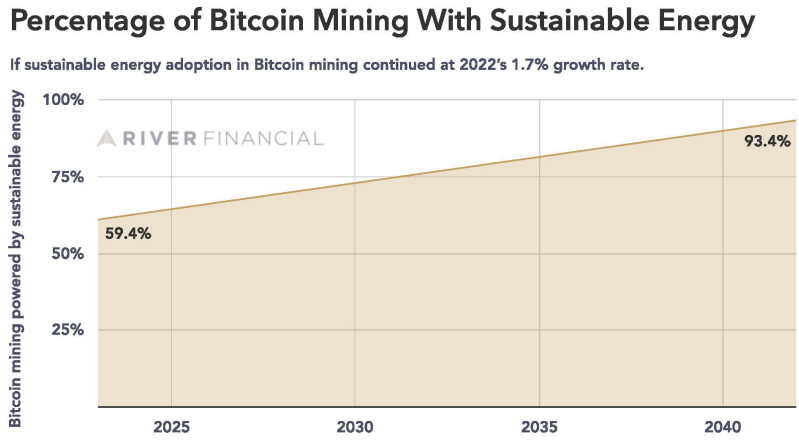

According to the Bitcoin Mining council, as of Q3 2022, 59.4% of all electricity used for Bitcoin mining is sourced sustainably. This number was reviewed by Daniel Batten and adjusted to a minimum of 52.2%, with some uncertainties to be figured out that could raise the final number.

Both numbers are significantly higher than the energy mix used by highly developed countries. The United States only has 31.4% renewable energy in its energy mix for example.

If we extrapolate the minimal growth in renewable energy usage over the next 20 years, the energy mix used to power Bitcoin mining could be 93.4% sustainably sourced by 2042. This number is no surprise, given the general trend in hydro, wind, and solar energy becoming cheaper over the past decades, in many cases already cheaper than fossil fuels.

Bitcoin mining does not only increasingly use renewable energy, it can also be used to increase the overall adoption of renewable energy.

Bitcoin Mining as a Tool for the Transition To Renewable Energy

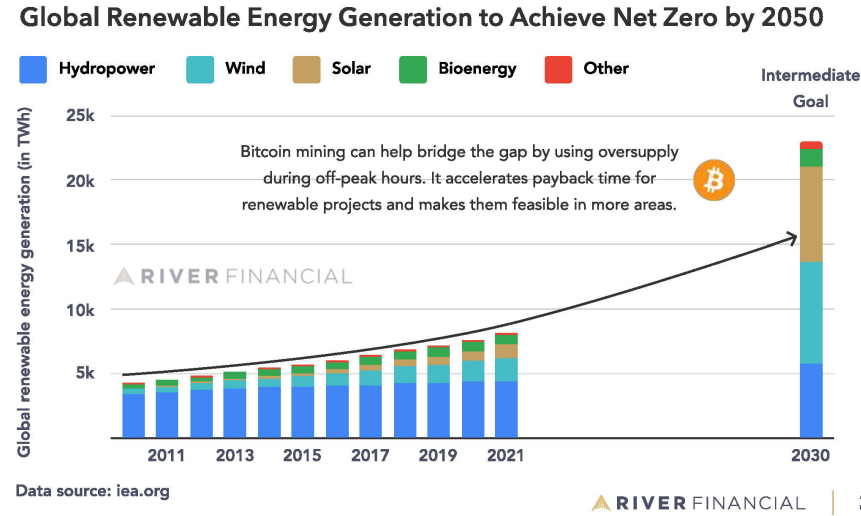

According to the International Energy Agency, there is a massive gap for the world to be on track to achieve net zero emissions by 2050.

To achieve this net zero goal by 2050, annual investments worldwide would need to more than triple by 2030 to around $4 trillion (not accounting for inflation). 88% of all electricity generation would have to come from renewable energy sources, up from 29% in 2020.

The knee jerk reaction would be to ban Bitcoin mining to ‘free up renewable energy for the transition’, but based on extensive research, this would have the opposite effect.

In order for all energy grids to be almost fully powered by renewable energy, there must be a massive increase in renewable generation and long term storage. The reason is that both wind and solar power are unreliable sources, causing wild fluctuations in supply. The biggest problems with these energy sources are that they don’t occur where and when most customers want to use energy. This leads to a wide range of complex problems for grid operators to manage supply and demand while keeping the frequency of the grid perfectly stable at all times at 50 or 60 Hertz.

These supply fluctuations are made more complex by peak demand times during hot summers and cold winters.

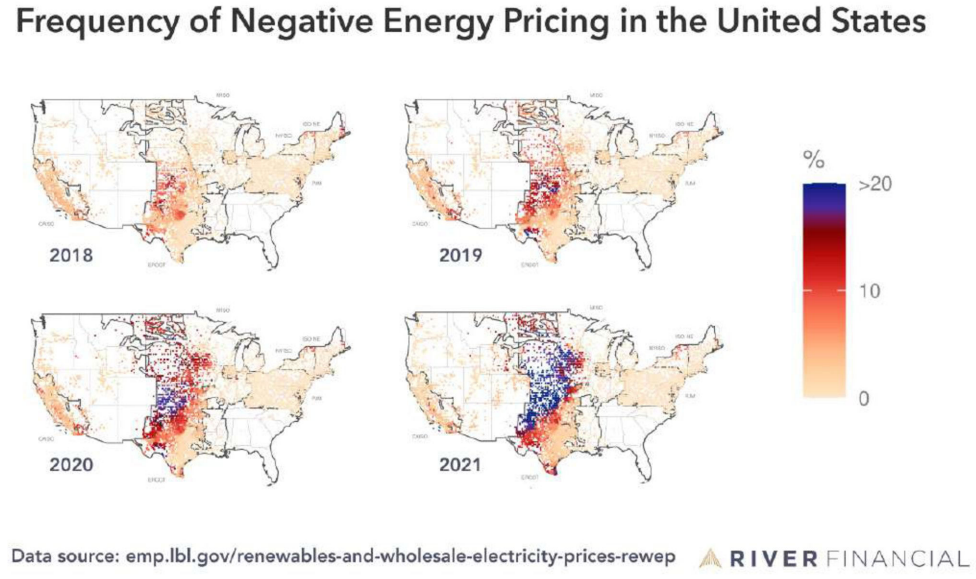

As a result, there are many locations where energy has a negative price at times. The market is paid to take energy to help grid operators maintain balance. As a result of over-building grids to enable an increase in renewable energy adoption, vast amounts of energy are and may increasingly be wasted during off-peak hours.

Bitcoin mining can help solve these balancing problems and create an affordable transition to renewable energy, as miners are the most flexible client and can switch off at a moment's notice when instructed by a grid operator.

The challenges to widespread adoption are somewhat similar to what we described in the methane section. The scale of mining is not yet large enough to make a noticeable difference, and much education is needed to explain the usefulness of Bitcoin mining for the environment.

This does not mean nothing is happening to help the renewable energy transition, on the contrary. Here are two fascinating examples:

- ERCOT, operator of the Texas power grid is a pioneer here, collaborating with industry partners in demand response programs. ERCOT recently published a report on how it is preparing for peak winter demand, which includes notes on how Bitcoin mining is part of this picture. Shaun Connell also published a wide range of data to provide more context.

- Gridless just raised a $2 million seed investment from Stillmark and Block. Gridless creates bitcoin mining sites alongside small-scale renewable energy producers in rural Africa where excess energy is not utilized. It helps these projects to be financed more rapidly and increase energy reliability for local communities.

Summary:

In this category we examined if energy could be a bottleneck to reaching a hashrate of a zettahash per second. We can conclude that:

- There is an abundance of cheap energy in the world in places with low demand. Unlocking access to this energy is a bottleneck.

- Bitcoin mining can help reduce global warming by being the ideal customer to combust vented methane gas when it cannot be economically captured.

- Bitcoin mining can act as one of many tools to help stabilize energy grids as they ramp up their reliance on renewable energy.

Hurdles to Reaching a Zettahash

In a previous section, we discussed hypothetical scenarios in which Bitcoin’s price and average transaction fees would be stable or increase. If these factors were to decrease instead in the long term, it would be difficult for the hashrate to grow. Efficiency improvements for mining rigs would need to significantly outpace the rate at which the security budget would be declining.

Beyond these factors, there are additional potential hurdles that could significantly slow down or halt hashrate growth. Below, we address what we believe are significant hurdles; we would be interested to receive feedback on additional potential hurdles from readers.

U.S. Legislative Changes to Bitcoin Mining

As mentioned in the hashrate history section, a large amount of all mining activity migrated from China to the rest of the world in 2021. As a result, the U.S. became the most popular country for Bitcoin mining, and it took six months for the hashrate to recover to previous levels.

An outright ban on mining in the U.S. would seem rather unlikely in the current political climate, given the diversity in approaches taken by the 50 states. New York has passed a partial mining moratorium, but Fort Worth in Texas mines Bitcoin itself.

Although the September 2022 White House report on Climate and Energy implications of Cryptoassets acknowledged the usefulness of Bitcoin mining to stabilize the grid and reduce overall emissions by financing the conversion of methane to CO2, overregulation is still a possibility. If it occurred at a federal level, many mining operators would again need to look for other countries where they could mine. Such a move could slow down hashrate growth by delaying new investments in the industry, especially if other countries follow suit and copy these regulations. If overregulation happens at a state level, miners could migrate between states.

Geopolitical Tensions Between the U.S. and China

We established that the largest demand for mining rigs currently comes from the U.S., which accounts for 38% of all hashrate at present. Supply, on the other hand, is primarily created in China. Both Bitmain (known for its Antminers) and MicroBT (known for its Whatsminers) are Chinese companies and together manufacture the majority of mining rigs.

These manufacturers are highly dependent on semiconductor manufacturers for their chips, such as South Korea-based Samsung for MicroBT and Canaan, and Taiwan-based TSMC for Bitmain, MicroBT, and Canaan. The latter also uses SMIC, a China-based chip foundry.

The other mining rig manufacturer listed, Intel, has only recently entered the market and is not at the production scale yet of its competitors when it comes to mining products.

Tensions between the U.S. and Chinese governments related to semiconductors have recently increased. The U.S. government is undertaking large scale action to decouple itself from China for all chip manufacturing. These actions include prohibiting exports of chips to China, and pulling out all American workers from China’s semiconductor industry. If the Chinese government were to match such actions, it could slow down the inflow of new mining rigs into the U.S. and potentially increase their cost by complicating the supply chain with new middlemen.

Energy Crises

Europe's ongoing energy crisis, and similar energy crises in the future, could also slow down hashrate growth by increasing energy prices in areas where a meaningful number of miners run their operations. If such a crisis would be sustained over a longer period of time, it could force operators to relocate. For the most part, Bitcoin mining operations would remain unaffected, as they typically operate in remote areas with a lack of buyers, using stranded energy. Barring a mass migration to such areas as a result of war, natural disasters, or climate change, we do not see energy crises as a major factor to slow down hashrate growth, but they would certainly have some effect.

Conclusion

The rapid increase in hashrate over the past year makes a zettahash seem relatively close. And yet, it could still take a decade or two before the Bitcoin network gets to this point.

A short term boost in Bitcoin’s security budget through major price increases could quickly grow the hashrate by the required 300% to reach a zettahash. If such rapid growth does not happen before 2028 when Bitcoin’s block rewards are set to halve again after the 2024 halving, then in the medium term it is likely that only significant Bitcoin adoption can help finance a sustained hashrate of one zettahash.

In the long term if Bitcoin survives, it is inevitable that it will reach a zettahash in hashrate through efficiency improvements and abundant cheap energy.

Due to the minimum costs of renewable energy dropping year after year, it is at most a matter of decades before the Bitcoin network is almost entirely sustainably powered. This transition will happen long before significant nation states will be mostly powered by renewable energy.

Humanity is only beginning to scratch the surface of using Bitcoin mining as a tool to help combat, rather than to reportedly cause, climate change. To accomplish this change at significant scale, Bitcoin’s hashrate must not only grow to a zettahash, but far beyond it. Regardless of your climate change policy preferences, Bitcoin mining is going to become a bigger part of this conversation in a constructive way. Education is critical to help people understand how mining can play a role, so that this industry can continue to grow over the next decades with less friction.

At River, we are enabling people who may not have the time or technical expertise to get into Bitcoin mining and contribute to the hashrate growth, and in turn the security of the Bitcoin network. We look forward to not only helping our clients understand the possibilities, but also entrepreneurs, energy companies, investors, climate activists, policymakers, and people around the world.

If you found this report informative to help the industry move forward, spread the word and let's change the world.

Credits

Report created by: Sam Wouters

Review by: Alexandra Gaiser, Will Nemirovsky, Julia Duzon, Daniel Batten, Shaun Connell

Cover design by: Jason Benjamin

A special thank you to Daniel Batten (@DSBatten), Adam Wright (@Digital_ Ore), and Shaun Connell (@ShaunEnergy) for their extensive online resources on energy-related topics.

Disclaimer

This report was prepared for informational purposes only and does not represent investment advice of any kind.

River Financial, Inc. does not provide tax, legal, investment, or accounting advice, and this report should not be relied on or construed as such. We recommend performing your own analysis and seeking professional advice before making any financial decisions.

Information contained in the report is based on either our own data or external sources we considered to be reliable. We cannot guarantee the accuracy or completeness of all data.

River Financial, Inc. shall have no liability whatsoever for any actions taken or decisions made as a consequence of the information in this report, including any expenses, losses, or damages, whether direct or indirect.

The contents of this report are the property of River Financial, Inc. and may not be duplicated or distributed without the prior written consent of River Financial, Inc.

Sovereign Monk

Bitcoin, Privacy & Individual Sovereignty Maximalist | Founder of European Bitcoiners - for Free and Open Bitcoin Education.

follow me :

Related Posts

La Reforma Del Bitcoin

Feb 22, 2023

La Majorité De L'exploitation Minière Du Bitcoin Est Alimentée Par Des Énergies Durables

Feb 21, 2023

Ein Überblick über Fedimint

Jan 03, 2023