This report was originally published by Arcane Research and its Authors, Jaran Mellerud and Anders Helseth on 1st September 2022. It is only retained for research and informational purposes on the European Bitcoiners website.

Summary

Bitcoin mining is a much-maligned industry due to its vast energy consumption. The criticism relies heavily on the assumption that bitcoin miners provide no positive externalities to energy systems and only serve as energy hogs forcing additional non-renewable energy generation.

Many of the harshest critics lack an understanding of both Bitcoin and energy systems. In this report, we highlight how bitcoin mining can alter energy systems for the better.

We acknowledge that the brunt of the current mining operations does not operate in the ways we outline in this report. However, we believe that through necessity, mining operations will increasingly move in this direction. Professional mining is a young business. The skyrocketing bitcoin price combined with limitations in machine production made mining super-profitable in 2020 and 2021. Consequently, most miners' focus during this period was to get hold of and plug in as many machines as possible, almost disregarding electricity cost.

Disregarding electricity cost is not a sustainable mode of operation for miners. Increased competition over time will, even in bull markets, reduce profit margins and force miners to lower costs. In addition, mining is a cyclical industry and is not always super profitable. During the downturns, like in the summer of 2022, the margin squeeze forces miners to be creative to lower electricity costs. For a miner, the easiest way to reduce electricity costs is to cooperate with the energy industry to solve some of our most pressing problems. We address four areas where bitcoin miners can affect energy systems in a desired way and/or improve the economics of energy production.

- Strengthening electricity grids with bitcoin mining

- Improving the economics of renewable energy with bitcoin mining

- Mitigating natural gas flaring with bitcoin mining

- Repurposing waste heat from bitcoin mining

Strengthening electricity grids with bitcoin mining

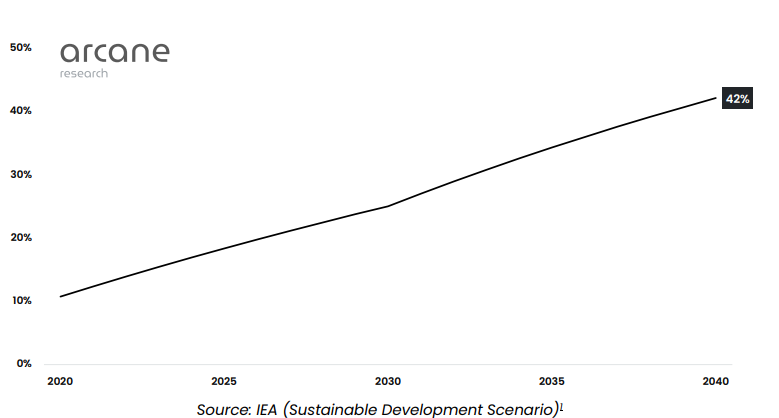

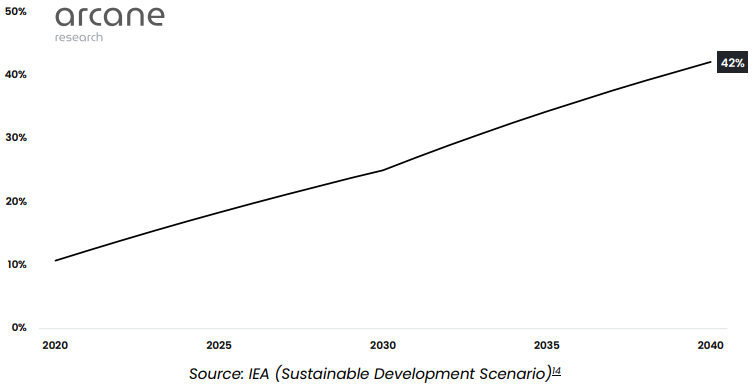

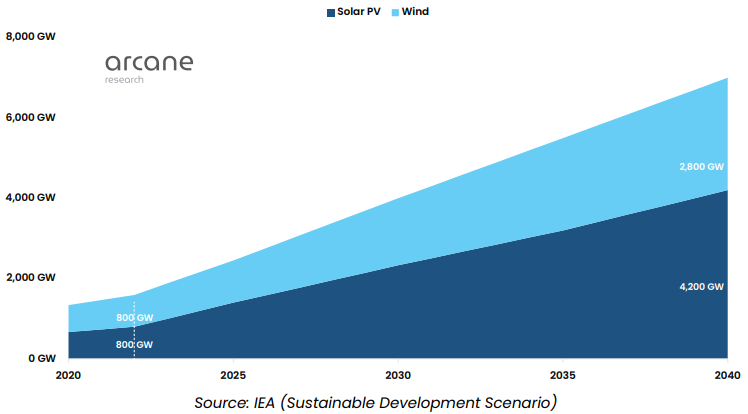

The supply and demand in electricity systems must always be balanced since even a slight mismatch can affect the system's reliability. Historically, a fossil fuelpowered supply-side has provided the bulk of the necessary flexibility by adjusting power generation after the expected demand. One of today's biggest energy challenges is replacing electricity grids' lost flexibility caused by the increasing share of non-controllable energy sources like wind and solar. In IEA's sustainable development scenario, the percentage of wind and solar in global electricity generation will increase from 11% in 2020 to 42% in 2040.

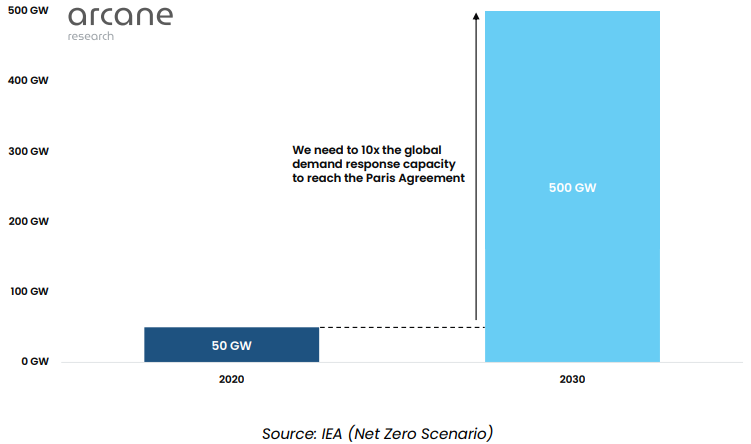

The growth of wind and solar increases the need for flexible electricity demand because the supply is unstable and non-controllable. This flexible electricity demand is called demand response, and according to the IEA, we must increase its global capacity by a factor of 10 by 2030 to reach the Paris Agreement. Bitcoin mining is the best alternative for demand response due to its low cost of reacting, the possibility of responding immediately at the needed granularity, and the constant demand for electricity.

Bitcoin mining as a demand response is not just a possibility - it's already happening. In the ERCOT system in Texas, bitcoin miners provide demand response that strengthens a vulnerable wind and solar-powered electricity grid. Other industries also serve as demand response in Texas, but to date, the grid operator has only allowed bitcoin miners to participate in the most advanced demand response programs.

Improving the economics of renewable energy with bitcoin mining

The growing share of wind and solar will lead to more wasted energy due to the variable nature of renewable energy production. Energy waste is an economic challenge that, if left unmitigated, can threaten the economics of renewable energy and thus limit its growth.

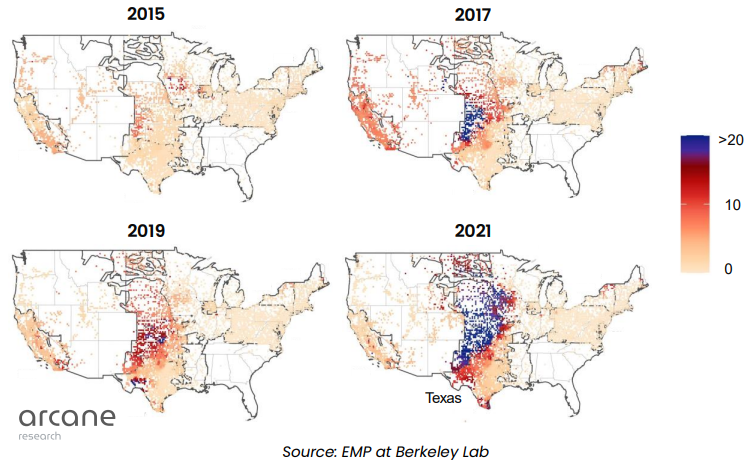

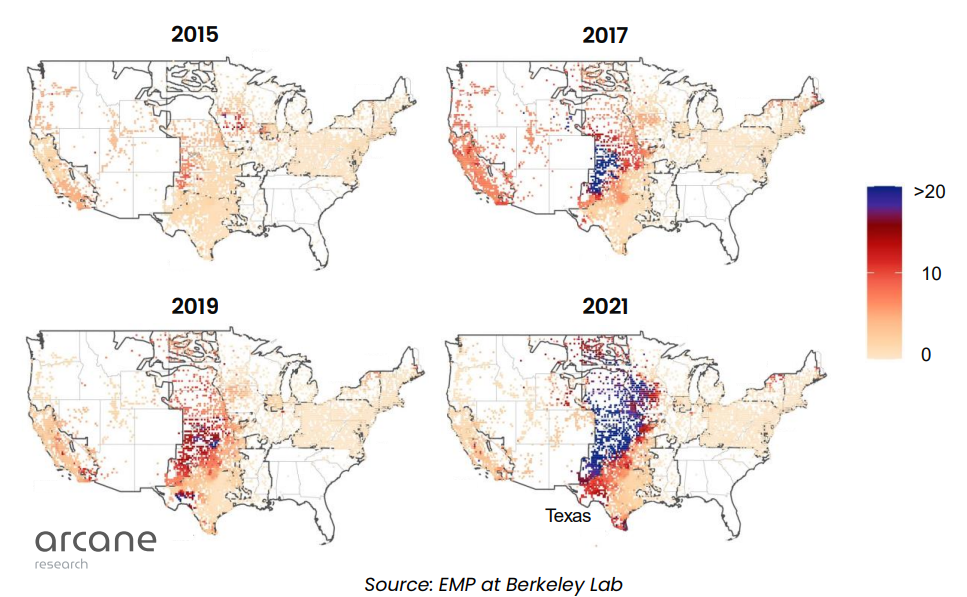

The map above shows how the frequency of negative power prices has increased in the central part of the United States from 2015 to 2021, as this windy region has seen a massive development of wind power. This effect has a devastating impact on the revenues of wind and solar projects.

Bitcoin mining's combination of location agnosticism, interruptibility, and modularity makes it the perfect purchaser of stranded renewable energy. Bitcoin miners can seek out areas with excess wind and solar and build a data center of the exact size needed to consume the surplus energy. Having a bitcoin mining load right next to remotely located wind and solar plants prevents energy waste and improves the economics of these projects.

Bitcoin mining can become more integral to the energy transition than most people realize since the future economics of wind and solar projects depend on flexible consumers like bitcoin miners who can purchase excess energy.

Mitigating natural gas flaring with bitcoin mining

Natural gas is produced as a byproduct of oil drilling. Harnessing this gas for consumption is not always economically viable for oil producers. In these cases, the oil producer ends up burning the gas on-site in a process called flaring.

Gas flaring creates emissions without deriving any utility. In addition, the flaring process releases higher amounts of the potent greenhouse gas methane than burning the gas inside the controlled environment of an electrical generator.

Bitcoin mining has emerged as the superior technology for reducing natural gas flaring. The location agnosticism, modularity, and portability of the bitcoin mining process make it possible to place a bitcoin mining operation directly at the oil well to offtake the excess natural gas and mitigate flaring.

We have seen massive growth in oil field bitcoin mining over the past few years. The growth has been concentrated in the United States and Canada, but we have also seen projects in other regions where flaring is a big problem, like Russia and the Middle East.

Both economic and environmental forces drive the growth of oil field bitcoin mining. Gas flaring wastes an economic resource that the oil producer could have sold to generate income. By mining bitcoin, either by themselves or through a third party, the oil producer can earn some money off the gas instead of letting it go to waste.

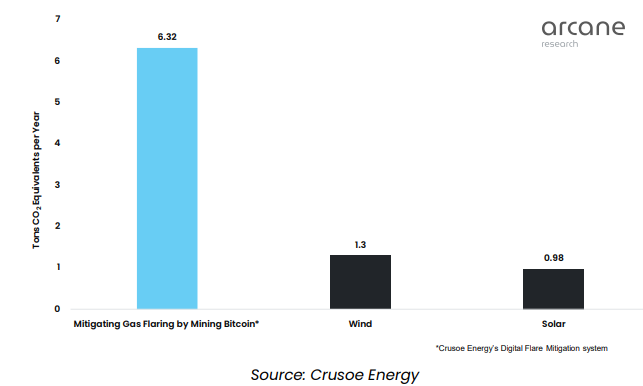

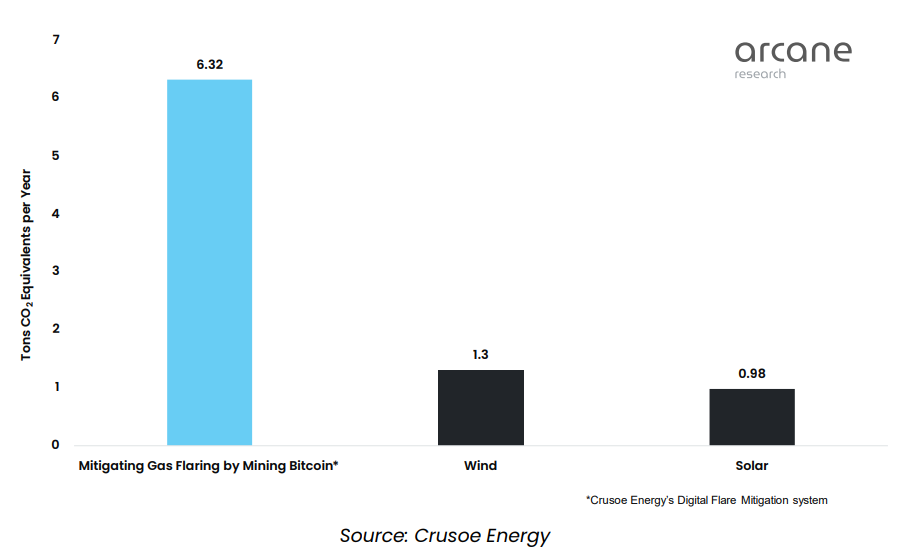

While economic incentives are important, the biggest driving force is the opportunity to reduce emissions. Numbers show that mitigating gas flaring by mining bitcoin is by far the most cost-efficient way of reducing emissions. Per $1,000 investment, a bitcoin mining system reduces emissions of 6.32 tons of CO₂ equivalents per year, compared to 1.3 for wind and 0.98 for solar.

Repurposing waste heat from bitcoin mining

Providing heating for homes, industries, and other applications is the world's largest energy end-use, accounting for almost half of global final energy consumption in 2021.

Unsurprisingly, heating is also the single largest source of greenhouse gas emissions, accounting for roughly 40% of the world's CO2 emissions and 30% of CO2 equivalent emissions.

Heat is a byproduct of bitcoin mining, and miners are starting to see the potential in heat recovery. This growing focus is primarily driven by the opportunity of lowering costs as the industry becomes increasingly competitive, but the possibility of reducing carbon emissions is also a driving force. Unsurprisingly, most innovation in bitcoin mining heat recovery happens in colder areas like Canada and Scandinavia, where heat is more valuable than in hotter bitcoin mining hubs like Texas.

Repurposing heat from bitcoin mining has three main advantages. First, the income from bitcoin mining subsidizes the cost of the electricity used to produce the heat. In addition to lowering heating costs, using bitcoin mining for district heating can reduce carbon emissions if the machines are powered by renewable electricity. Thirdly, repurposing the heat from bitcoin mining is essentially using the same energy twice. This offsets energy used by the bitcoin mining industry since it outcompetes other miners that are not repurposing their heat.

1. Why and how does Bitcoin use energy?

To understand Bitcoin mining, one must superficially understand Bitcoin. In this chapter, we explain the parts necessary to get a feel for what Bitcoin is and why mining is an essential part of Bitcoin.

1.1 Energy consumption is a fundamental and important property of Bitcoin

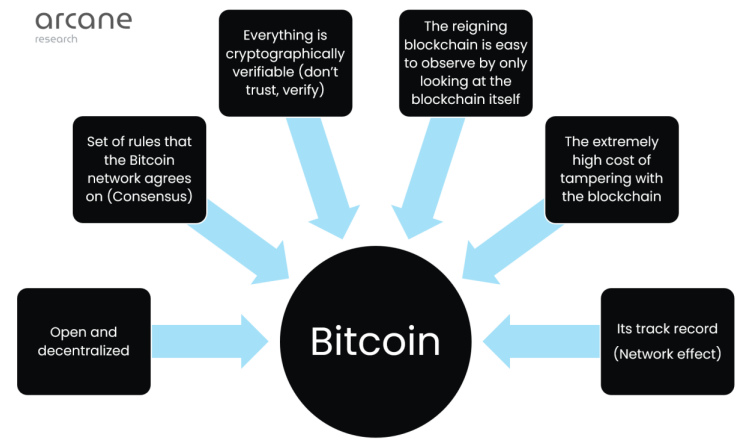

Bitcoin is a network of computers (often called nodes). The nodes communicate with each other via the internet. In principle, the nodes can communicate whatever they want. In practice, all the other nodes will simply ignore you if you deviate from the Bitcoin Network's consensus rules.

The Bitcoin Network's consensus rules are just a set of rules that people choose to follow. There are no natural laws or anything that must be this way. Incentives, in combination with the power of decentralization, make the Bitcoin Network tick, and the consensus rules stick.

The Bitcoin Network's duties can be divided into two main groups.

1. At any given point in time: Verify that all new and previous transactions are legit. This is done by cryptography in line with the consensus rules.

2. Order transactions in time: This task is vital for the Bitcoin Network to ensure nobody spends more than they have. The Bitcoin Network solves the monumental task of ordering transactions in a decentralized way by utilizing proof-of-work.

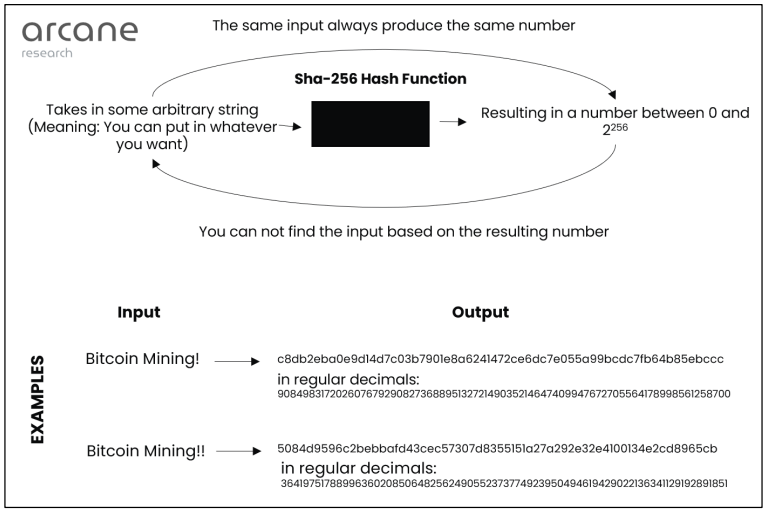

The Bitcoin Network uses hash functions in a clever way for participants to prove work and thus order transactions.

The Bitcoin Network orders transactions in batches at a time. These batches are often referenced as blocks for a visually understandable representation. To produce a new block that will be accepted by the network, a participant must broadcast a valid block header in the form of a string of the previous block's hash, a hash produced from the new transactions, a timestamp, a difficulty setting, the block version, and a nonce (A nonce might sound mysterious but is not. In this context, the nonce is simply a decimal number between 0 and 4,294,967,296). Inserting this string into the SHA256 Hash-Function must produce a number below a certain threshold, which is decided by the difficulty setting.

All the inputs in the header but the nonce can be considered as given, meaning they only need to be inserted or calculated once. But producing a valid block header requires guessing a nonce that produces a hash under the threshold limit. This is no easy task. The nonce is a number between 0 and 2³² (4,294,967,296), and finding a 'correct' nonce can only be achieved through guessing. Finding a correct nonce, therefore, proves you have exerted a significant effort through guessing an enormous amount of numbers, i.e., it serves as proof of work.

Bitcoin mining is the process of using computers to find a nonce that produces a valid block header by trial and error. The more numbers you are able to guess, the higher your chance of guessing a valid nonce.

Miners are not altruistic. They are incentivized to mine through the issuance of new bitcoin and transaction fees if they are the first to find a valid nonce. For each new block, the miner that guessed a correct nonce first is currently rewarded 6.25 bitcoin. This reward is halved every four years, and the next halving is in 2024.

The amount of work that goes into Bitcoin mining is measured in hashes per second. Put simply; it measures how many nonces the miners are able to check per second. Producing hashes comes at a cost through capital expenditure and electricity costs.

The security of the Bitcoin Network can be measured by how costly it is to obtain a majority of hashing power. The amount of work, i.e., mining activity, is, therefore, of great importance for the security of the Bitcoin Network.

A block will be accepted by the Bitcoin Network if it satisfies the following properties:

1. Check if the previous block referenced by the block exists and is valid.

2. Check that the timestamp of the block is greater than that of the previous block and less than 2 hours into the future.

3. Check that the proof of work on the block is valid (producing a hash under the threshold limit).

4. Check that every single transaction is legit, i.e. that the bitcoin sent are sent from accounts whose balance is high enough to warrant this transaction.

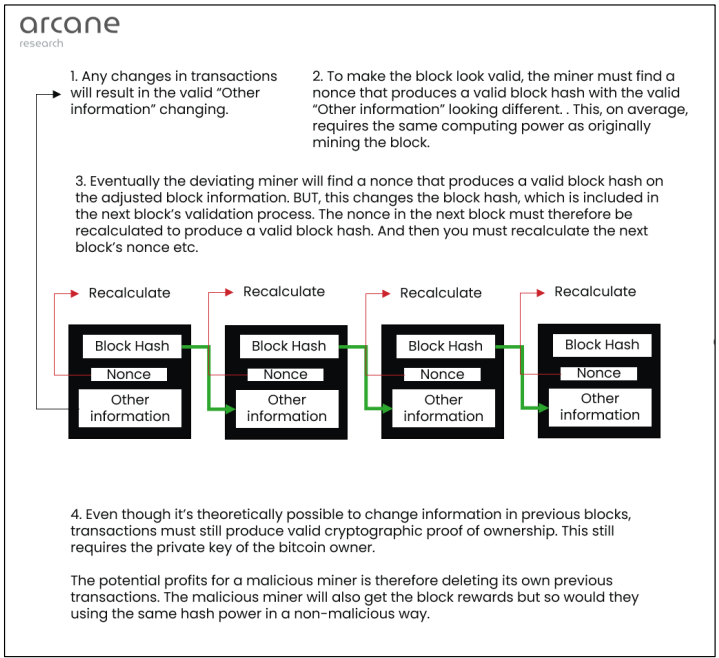

If there are competing, valid versions of the Bitcoin blockchain broadcasted, the network will pick the longest blockchain, the one containing the most proof of work. To be able to create the longest blockchain itself, an entity must have more than half of the hashrate of the Bitcoin Network (often called 51% attack).

No matter who has the majority of hash power, a valid transaction requires valid cryptographic proof. There are, therefore, clear limits to what an entity controlling the hashpower actually can do.

They can:

- Undo earlier payments where they have the private keys

- Take the mining reward (which they would have gotten if they were 'good' as well)

The gains from 'attacking' the Bitcoin Network is therefore limited to undoing your earlier transactions, creating what is called a double-spend opportunity, i.e., you can spend your bitcoin more than once.

As noted earlier, the cost of making a 51% attack is directly dependent on how much mining there is. The more mining, the more expensive to perform a 51% attack. Add in that all blocks from the tampered block onwards must find a new valid nonce; the attack becomes vastly expensive.

1.2 Bitcoin miners are unique energy consumers

Bitcoin mining has come a long way from its humble beginnings a few years ago. What started as a hobbyist endeavor with ordinary computer CPUs has now moved to industrial-scale facilities filled with specialized mining machines called ASICs.

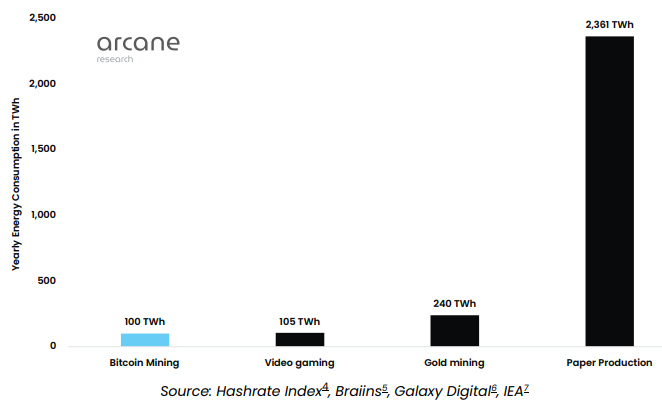

Although bitcoin mining's energy consumption has increased considerably as the industry has grown, it's still a relatively insignificant industry globally. The Bitcoin mining network consumes around 100 TWh² per year or 0.06% of the global energy consumption.³ This means that the bitcoin mining industry consumes a little less energy than video gaming. We can further compare Bitcoin mining's energy consumption with other, more traditional energy-intensive industries, like paper production, which consumes 24 times as much energy.

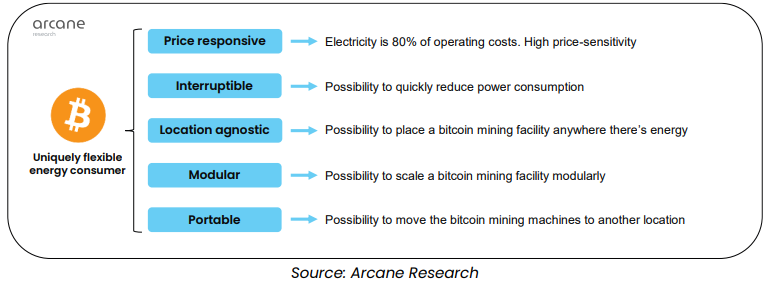

Most people disregard bitcoin mining as just yet another energy-intensive industry, but there is one big difference: bitcoin miners are uniquely flexible with regards to when and where they consume energy. We will now go through five power consumption characteristics that make bitcoin miners uniquely flexible electricity consumers.

Price-responsive

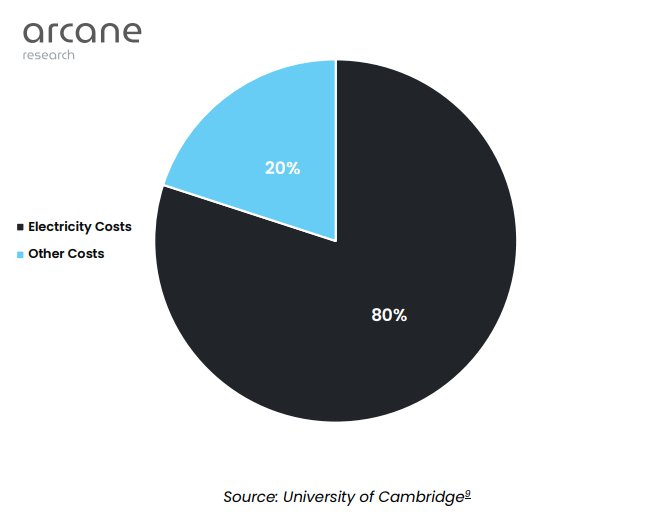

Electricity makes up around 80% of a miner's operating costs.⁸ Because of the importance of the electricity input, we consider mining an electricity refining process: The miner sends electricity into its machines, which refines the electricity into bitcoin.

The bitcoin mining industry is global with low barriers to entry, making it very competitive. The only way to stay competitive long-term is to minimize costs. Since electricity is such a significant part of the cost structure, miners are highly incentivized to respond to changes in the electricity price by adjusting power consumption or moving their operations. An example showing the priceresponsivity of bitcoin mining is Norwegian miners responding to increased electricity prices in the southern part of the country by moving their operations further north, where electricity is cheaper.¹⁰

Interruptible

A bitcoin miner "sells" hashes to the Bitcoin network. Since each hash is independent of the previous one, a bitcoin miner can interrupt its production and energy consumption at a moment's notice. It can not only interrupt its consumption but also granularly adjust it up or down in kilowatt increments. Since bitcoin mining is an interruptible and price-responsive load, the process is exceptionally suitable as a demand response tool that can help strengthen electricity systems. We write more about this in chapter 2.

Location agnostic

While most other energy-intensive industries produce physical products that need access to supply chains, bitcoin miners produce hashes, which are information goods sold through the internet. Therefore, a bitcoin mining facility can generally be built in any location with cheap energy and internet access. The location agnosticism of bitcoin mining makes it possible to take the energy consumer directly to the energy source. Bitcoin miners are the ultimate customers of previously stranded energy resources, which is why oil producers have started to use natural gas that they otherwise would flare to mine bitcoin. More on that in chapter 4.

Modular

ASICs, the machines used to mine bitcoin, consume anywhere from 1 kW to 5 kW.¹¹ It's possible to combine different amounts of these machines into different levels of load. Whether an energy asset owner wants a bitcoin mining load of 5 M.W., 20 M.W., or 100 MW doesn't matter: all load sizes are possible by changing the number of machines.

The modularity of bitcoin mining makes it possible to design a bitcoin mining load to match the available energy generation capacity. This is especially relevant when matching the bitcoin mining load with the excess production capacity of a stranded renewable energy generator to improve its economics, as we explain in chapter 3.

Portable

We can design a bitcoin mining load in specific ways to maximize portability. Filling specially designed shipping containers with mining machines has recently emerged as a way to optimize portability. These container solutions are designed after the plug-and-play principle and can quickly be shipped to other locations if needed.

An example of the portability of mining was the annual Chinese mining migration, in which Chinese miners moved their machines between regions in China due to seasonal differences in hydroelectric power availability caused by wet and dry seasons.¹²

The portability of bitcoin mining makes it easy to move a mining facility to soak up excess energy and quickly move the facility to another location if the energy stops being in excess in the first location.

These power consumption characteristics make it possible for bitcoin mining to serve as an energy tool we can use to solve some of our biggest energy challenges. Bitcoin mining can strengthen electricity grids, improve the economics of renewable energy, mitigate natural gas flaring, and lower heating costs by repurposing the heat.

2 Strengthening electricity grids with bitcoin mining

The demand must always match the supply in electricity systems since even a slight imbalance can affect the system's reliability. In addition to altering the electricity supply or demand, energy storage and transmission lines can provide system flexibility. Historically, we have relied mainly on the supply-side to adjust power generation to the expected demand.

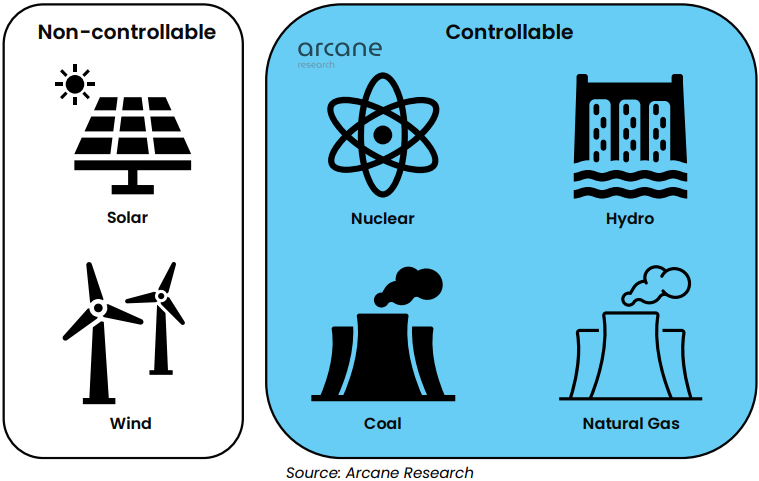

The different energy sources for electricity vary significantly in their controllability. Natural gas and hydropower are the most controllable energy sources since the energy producer can easily adjust their production up or down. Coal and nuclear are also controllable but to a lesser extent. They are very reliable, but granularly changing their production is inefficient. Coal and nuclear plants traditionally provided the baseload, letting natural gas or hydro plants fine-tune production to accommodate demand swings.

One of today's biggest energy challenges is that the supply side's ability to provide system flexibility is decreasing. We are in the middle of an energy transition, replacing fossil fuels with renewable energy sources like wind and solar. These are non-controllable energy sources since their ability to generate electricity depends on weather conditions. Non-controllable energy sources can not be relied upon for system flexibility.

The International Energy Agency (IEA) operates with several scenarios for the energy transition. The Sustainable Development Scenario represents a gateway to the outcomes of the Paris Agreement, entailing massive growth in non-controllable energy sources as a share of the generation mix from 11% to 42% in 2040.¹³

This scenario assumes a massive replacement of controllable with noncontrollable energy sources. How do we replace this lost system flexibility? Our options are increasing the demand side flexibility, energy storage capacity, or transmission lines' capacity.

We will need a combination of these options, but taking advantage of the demand side's flexibility stands out since it's cheaper and more scalable than the other alternatives.

2.1 Flexible electricity consumers can provide demand response

Demand response is a change in consumption by electricity consumers to match the electricity demand to the supply. The process typically involves payment or other financial incentives to consumers for agreeing to reduce their electricity use when supply is low.

Demand response exists in most developed electricity systems globally. ERCOT, the electricity system in Texas, is at the forefront of demand response, and bitcoin miners have become one of their most trusted sources for system stability.

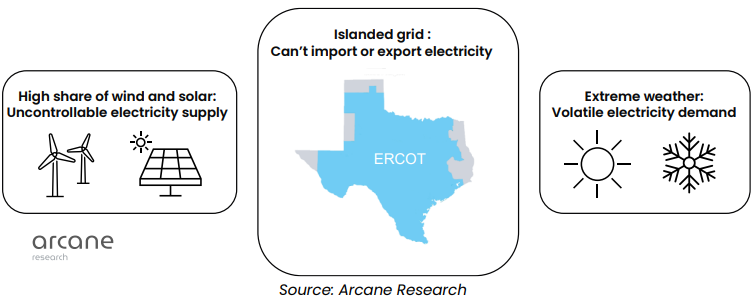

The electricity system in Texas is called ERCOT, which is also the system operator's name. ERCOT faces a unique combination of challenges, incentivizing them to look for innovative ways to keep the electricity system reliable. The ERCOT electricity system is islanded, with almost no connections to other electricity grids. Importing or exporting electricity through transmission lines to provide system flexibility is, therefore, not possible.

ERCOT has a high share of wind and a rapidly growing share of solar power, as Texas has among the best wind and solar conditions on the planet. The heavy reliance on wind and solar power means that the supply side is volatile, and they must increasingly rely on demand-side flexibility.

Not only is the Texas grid islanded and has a high and rapidly growing share of wind and solar, but the Texas weather can be extreme and unpredictable, leading to volatile demand. An example is the winter storm in February 2021, which led to skyrocketing demand and supply outages.¹⁵

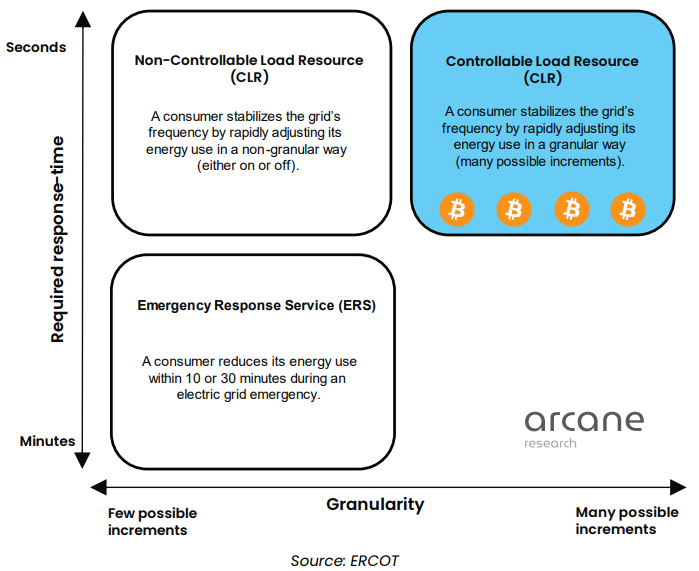

This combination of system stability challenges has incentivized ERCOT to develop one of the most advanced demand response markets globally. ERCOT has two main categories of demand response depending on how fast the demand response resource must adjust its electricity consumption. The first category is called load resource, and the other is emergency response service.

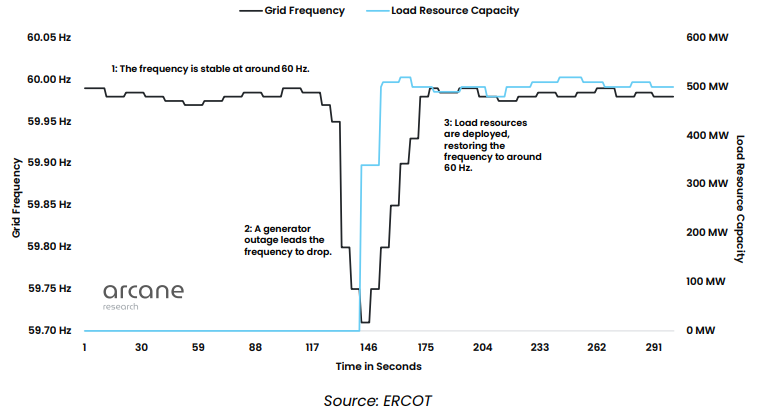

The load resource designation allows eligible demand response resources to help stabilize the grid's frequency. The frequency fluctuates around 60 Hz in North America, and keeping it as close as possible to this level is essential. A high load relative to generation decreases the frequency, while the opposite increases it. The system operator continuously monitors the frequency and employs various tools to stabilize it.

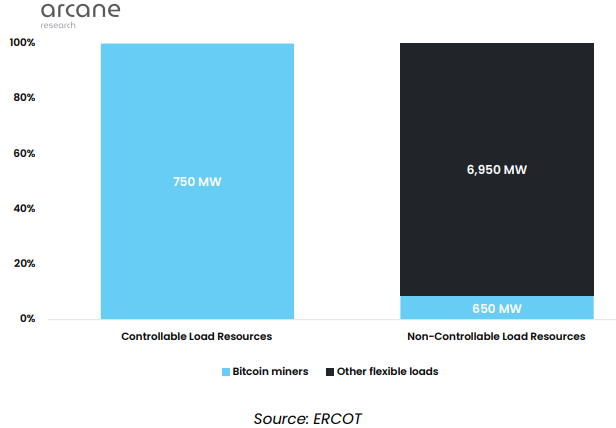

We can break the load resource designation into two types: Controllable Load Resource (CLR) and Non-Controllable Load Resource (NCLR). To earn these designations, loads must pass several tests regarding their controllability. As the names suggest, the controllable load resource designation has higher entry requirements than the non-controllable load resource.

Controllable load resources are loads that can granularly adjust their load within seconds, allowing them to take active roles in balancing the grid's frequency. Noncontrollable load resources also help stabilize the frequency, but only in a binary way by tripping the whole load offline if the frequency drops below a certain level. The higher controllability of controllable load resources means that these demand response resources are much more efficient in stabilizing the grid than noncontrollable load resources. So far, only crypto miners have earned the controllable load resource designation.

While load resources provide the first layer of protection for the grid by regulating their load to stabilize the frequency in seconds, one additional layer of protection is employed if the load resources are insufficient. This final level of grid insurance is called Emergency Response Service (ERS) and consists of loads that can reduce their electricity usage within 10 or 30 minutes, depending on agreements.

Demand response generally works by electricity consumers selling their ability to shut down operations in various day-ahead markets for ancillary services. They then reduce their electricity consumption per this agreement if the system operator orders them. We can view this arrangement as demand response resources selling insurance to the grid.

Demand response can also be provided simply by reacting to price signals. If the electricity price is high during specific periods, flexible consumers can restrain from buying during these times. By avoiding consumption during expensive hours, a consumer effectively acts as a demand response and alleviates pressure on the system.

2.2 Bitcoin mining is the best alternative for demand response

ERCOT created the controllable load designation in 2004. No electricity consumers fulfilled the requirements until 2020, when the demand response technology company Lancium and a bitcoin mining load passed the necessary tests.¹⁶ Lancium's patented Smart Response® software allows bitcoin miners to act as controllable load resources.

Bitcoin miners designated as controllable load resources are allowed to participate in all of ERCOT's ancillary services markets, where they sell their ability to regulate their power consumption following instructions from ERCOT. They can also participate in real-time power markets, allowing them to include a clause in their power purchasing agreements to power down and "sell" power back to the grid for the real-time price of electricity.

According to ERCOT, there are currently eight crypto miners with a total capacity of 750 MW designated as controllable load resources, with an additional 2600 MW awaiting approval.¹⁷ However, Rich Godwin, a Texas bitcoin miner, tracks the realtime participation of controllable load resources daily and has only seen about 130 MW. This difference might be due to not all controllable load resources participating in the market simultaneously.

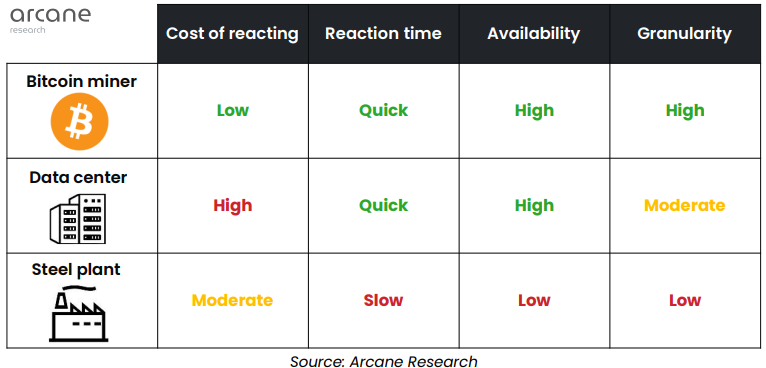

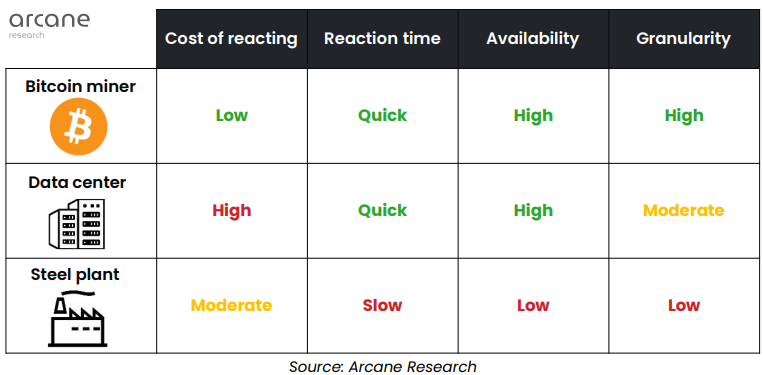

Why have only crypto miners passed ERCOT's controllable load resource requirements? It all comes down to bitcoin mining's uniqueness as an interruptible load, which we explained in chapter 1. We will now build on that analysis by dissecting four factors that make a load interruptible, comparing bitcoin mining's score on these factors with that of two other energy-intensive consumers: A conventional data center and a steel plant.

Cost of reacting

The cost of reacting refers to a demand response resource's costs of powering down its operations. This number is very high for a conventional data center since it serves clients that depend on available data, making it unsuitable for providing demand response.

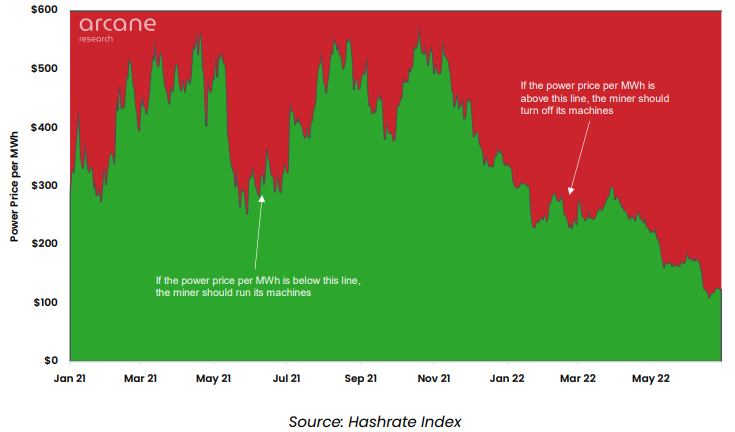

For bitcoin miners, the only cost of reacting is the alternative cost of not producing bitcoin, giving them high economic incentives to provide demand response. Suppose the price per MWh exceeds what the miner could have earned by dedicating this MWh to mining bitcoin. In that case, the miner should stop mining since it will gain more by turning off its machines than by mining bitcoin.

The chart above shows that in 2022, the alternative cost of not dedicating a MWh to bitcoin mining has fluctuated between $150 to $300. In times of grid stress, when demand response is needed, the real-time power price can reach thousands of dollars per MWh, substantially higher than this alternative cost, meaning that economically rational bitcoin miners will turn off their machines

Reaction time

The second factor, reaction time, is how fast the demand response resource can power down its operations. A steel plant has a slow reaction time since it takes a lot of coordination to power down a factory with many different processes and employees. On the other hand, a bitcoin mining facility only does one function, solving the SHA-256 hashing algorithm. This single process can rapidly be interrupted, allowing bitcoin miners to participate in demand response programs requiring the fastest reaction times.

Availability

Because of the stability of a bitcoin miner's load, a system operator can always rely on the bitcoin mining load to be available to provide demand response when needed. An example of an industrial load with low availability is a steel plant. Steel production consists of many processes; only a few are energy-intensive enough to provide demand response. Since these processes demand different amounts of energy, a steel plant's load will fluctuate daily and weekly. It can not always be relied on to provide demand response.

Granularity

Granularity refers to how many increments the demand response resource can adjust its load. A bitcoin miner can adjust its load in almost infinite increments and is therefore highly flexible in the amounts of electricity it can sell to the grid. The high granularity of a bitcoin miner stays in stark contrast to a steel plant, which either runs its electric arc furnace or not. Scoring high on reaction cost, reaction time, availability, and granularity makes bitcoin mining a highly interruptible load, which is why it is the only controllable load resource in ERCOT.

2.3 Examples of bitcoin miners stabilizing the grid

The point of demand response is to protect the grid during high-stress events when there is not sufficient generation compared to the load. Then it makes the most sense to look at what bitcoin miners did during the most high-stress event on the Texas grid in history: the winter storm Uri in 2021.

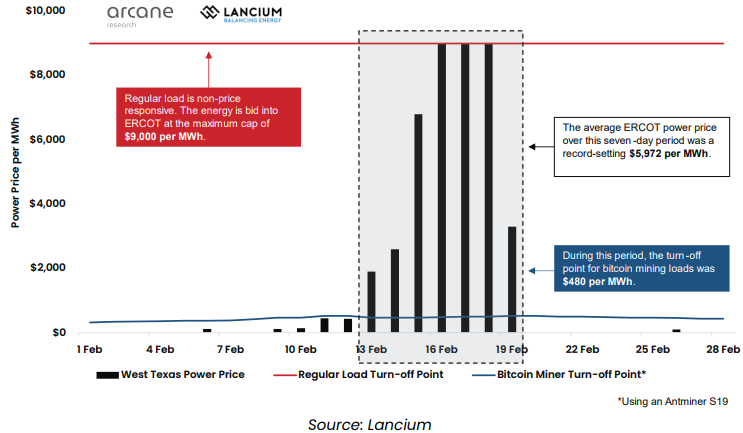

From February 13th to 19th, a severe winter storm hit Texas. ERCOT had not prepared for such a black swan event, and the winter storm led to widespread outages of generation and natural gas supply. The combination of generation outages and skyrocketing electricity demand from homes needing heating caused a severe imbalance between supply and demand. Real-time electricity prices soared to more than $9,000 per MWh.

To reduce electricity demand and mitigate the impacts of the catastrophe, ERCOT deployed all its demand response resources, of which many were bitcoin miners. These bitcoin miners voluntarily turned off their machines and sold their unused power back to the grid.¹⁸ Meanwhile, the state's conventional data centers didn't turn off to stay online.¹⁹

The chart above compares West Texas's average real-time power price for each day in February 2021 with the turn-off points for bitcoin mining and residential customers. Residential customers are non-price responsive since they need the energy for essentials like heating, meaning that they will generally not stop consuming energy even when prices soar. On the other hand, Bitcoin miners are very price responsive since they know precisely how much they earn per MWh.

During the 7-day winter storm, the average ERCOT power price was $5,972 per MWh, far above the bitcoin mining revenue per MWh of $480. The economic incentives are clear: A bitcoin miner that didn't turn off his machines during the winter storm would have spent nearly ten times more on electricity than this electricity would have earned him in revenue.

ERCOT also suffered a winter storm in 2022, which was not nearly as bad as the year before, but the system operator still had to deploy some of its demand response resources. Riot Blockchain was among the miners that powered down its operations.²⁰ Bitcoin miners have become ERCOT's most trusted demand response resources, confirmed by the interim CEO of ERCOT, Brad Jones, saying in an interview with CNBC that "crypto miners help ERCOT keep renewable energy operational."²¹

2.4 Bitcoin mining provides the demand flexibility needed to integrate renewable energy safely

Demand response will be an integral tool to secure the reliability of electricity systems as we continue integrating variable renewable energy sources like wind and solar. The IEA estimates that to reach the Paris Agreement, we must bring a total demand response capacity of 500 GW to market by 2030, corresponding to a 10x growth from 2020.²²

Bitcoin mining is an energy-intensive and stable load that can be rapidly adjusted up or down with extreme precision at no extra cost other than the alternative cost of not mining bitcoin. The combination of these traits makes bitcoin mining a uniquely interruptible load and our best alternative for demand response, providing the demand flexibility needed to integrate variable renewable energy safely.

3 Improving the economics of renewable energy with bitcoin mining

The growing share of wind and solar power will lead to more wasted energy due to the variable nature of renewable energy production. Energy waste is an economic challenge that, if left unmitigated, can threaten renewable energy economics, thus limiting its growth.

The global generation capacities of wind and solar power have seen massive growth over the past years. In its Sustainable Development Scenario, the IEA estimates that wind and solar generation capacities will need to keep growing and reach 2,800 GW and 4,200 GW by 2040 to limit global warming to well under 2॰C above pre-industrial levels.²³

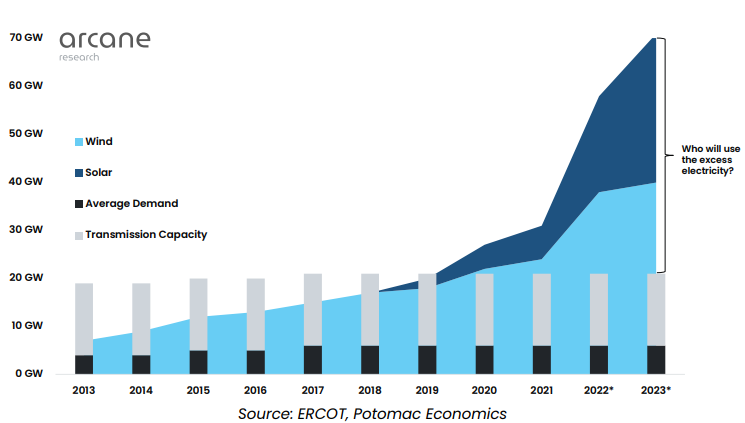

As in the previous chapter, we will use Texas as a case study. The state has some of the best wind and solar resources globally, but most of them are in West Texas, far away from the population centers in the southeast. West Texas has 24 G.W. of wind and 7 G.W. of solar generation capacity but an average load of only 6 G.W., meaning that most of this energy can't be consumed locally and must be transported southeastward to where the demand is.

The capacity of the transmission lines connecting West Texas with the rest of the state is only 12 G.W., far from enough to transport all the energy at peak wind and solar generation. This is called the West Texas Export Constraint. The low local demand combined with the West Texas Export Constraint means that a massive amount of renewable energy is stranded in West Texas, leading to energy waste and less revenue for wind and solar projects.

The stranded renewable energy problem will only worsen in West Texas as ERCOT expects the wind and solar generation capacities to grow to a combined 71 G.W. in 2023 without a corresponding increase in transmission capacity.²⁴

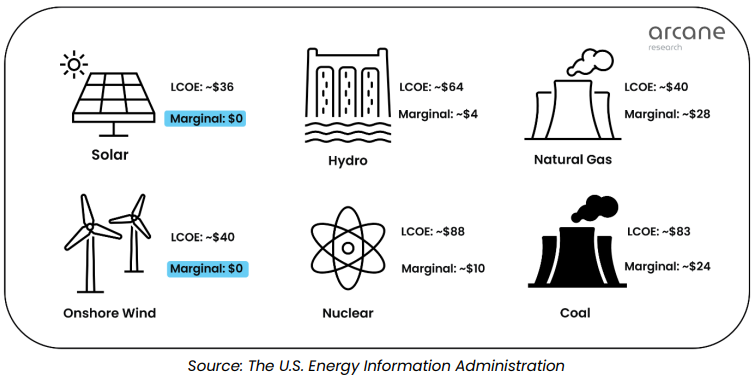

The main driving force behind the surge in wind and solar development is that these energy sources have become very cost-competitive. The Levelized Cost of Electricity (LCOE) (measures the average net present cost of electricity generation for a generator over its lifetime.) for solar and wind in the United States is currently $36 and $40, lower than all alternatives.²⁵ Also, the economics of wind and solar consists almost entirely of capital expenditures. They have no fuel costs, meaning their marginal production cost is $0.

3.1 Energy waste threatens the economics of renewable energy

Since wind and solar have marginal production costs of $0, they will always bid their energy into the market for $0 per MWh. Therefore, we often see high price volatility in electricity markets with high shares of wind and solar. The electricity price is very low or even negative at times of high wind and solar production and very high when wind and solar don't produce.

This problem is exacerbated by production tax credits that allow certain renewable energy generators to sell power at a negative price and still make a profit. In the United States, wind farms receive federal production tax credits of up to $25 per MWh produced. A wind producer receiving such tax credits is incentivized to bid the energy to the grid at -$24 per MWh. These production tax credits have increased the prevalence of negative power prices in the United States, especially in Texas. This federal subsidy has played a major role in incentivizing the buildout of stranded renewable energy in West Texas.

During the past years, the prevalence of negative electricity prices has grown dramatically in many regions where wind and solar have become significant parts of the electricity generation capacity. This is especially true for West Texas, where about 10% of real-time power prices were negative in 2021.²⁶

The map above shows how the frequency of negative prices has increased in the central part of the United States from 2015 to 2021, as this windy region has seen a massive development of wind power. The increased prevalence of negative power prices has a devastating impact on the revenues of wind and solar projects.

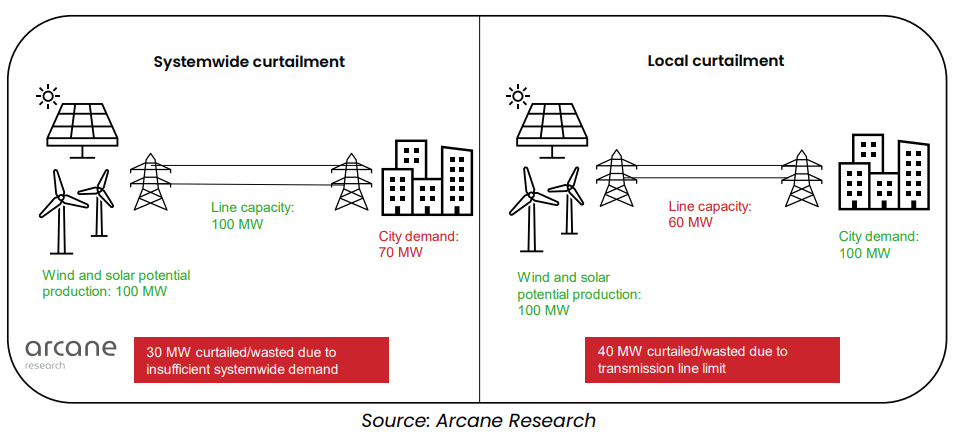

In a deregulated power market like ERCOT, the negative price is a price signal telling the generation owners to shut down production because there is too much energy supply relative to the demand. This phenomenon is called economic curtailment and means that wind and solar farms periodically must reduce their output below what they could have produced. There are two types of economic curtailment, depending on its cause: systemwide curtailment and local curtailment.

Systemwide curtailment is when weather conditions allow a renewable energy plant to produce a certain amount, but the plant must refrain from sending this electricity to the grid since there is insufficient demand. Local curtailment is caused by not enough transmission capacity to transport the electricity to where the demand is.

The problem in West Texas is local curtailment. The population centers in the southeast would like to tap into all the renewable energy produced in the west but can't due to the limited transmission capacity.

Both types of economic curtailment waste energy, hurting renewable energy economics since the plants don't get paid for curtailed energy. Since the economics of wind and solar are heavily skewed towards CAPEX with little to no OPEX, the profitability of these projects depends upon maximizing the amount of electricity the plant can sell during its lifetime. Therefore, being forced to curtail a significant part of production is terrible for wind and solar economics.

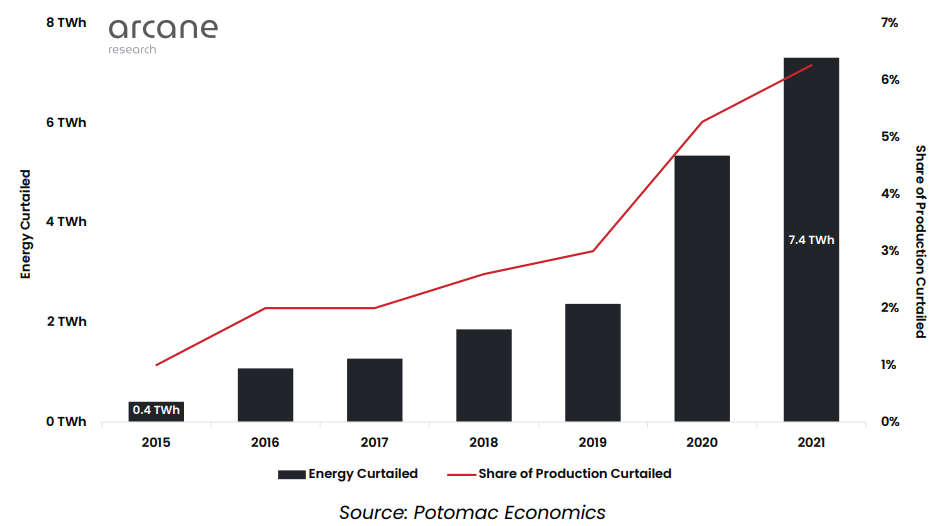

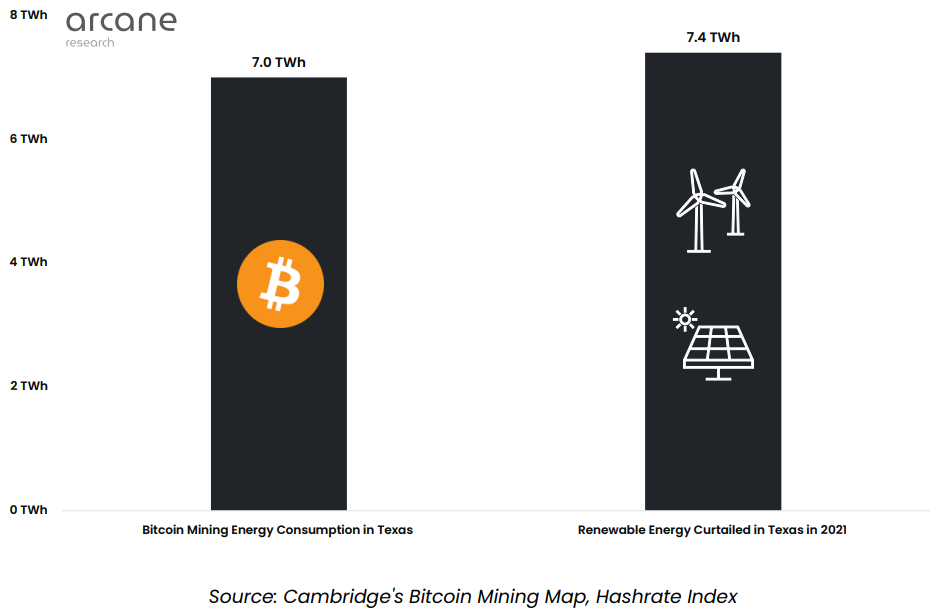

Curtailment is a growing problem globally, particularly in Texas. In 2021, 6% of wind and 8% of solar production were curtailed in ERCOT²⁷, corresponding to a total curtailment of 7.4 TWh. Industry insiders assume that Texas hosts 8% of the 10 G.W. global bitcoin mining capacity, equivalent to an annualized electricity consumption of 7 TWh. This means that more renewable energy was wasted in Texas in 2021 than the electricity consumption of all the state's bitcoin miners.

There are mainly three ways to mitigate local curtailment: transmission lines, batteries, and moving the demand closer to the supply. Transmission lines are arguably the most impactful long-term solution, but they are generally costly and time-consuming to build. ERCOT is studying the potential for increasing the transmission capacity. These lines' estimated breakeven cost is $13.8 billion, and they will be operational earliest in 2030 and 2035.²⁸

Batteries could become part of the solution, but the technology has still not reached a sufficiently low cost that they are economically viable to deploy at the scale required. In addition, batteries have limited storage capacity, so they should ideally be coupled with flexible electricity consumers that can consume excess energy when the battery is full.

3.2 Bitcoin miners can adjust their consumption after renewable energy production

Bitcoin miners can help reduce curtailment and mitigate the frequency of negative electricity prices by strategically locating themselves close to the wind and solar plants to offtake their excess energy. This is achieved by exploiting the interruptibility of bitcoin mining, so that wind and solar producers can alternate between delivering power to the grid and bitcoin miners depending on the power prices. The caveat for the bitcoin miners is that they must accept that they will not be able to run their machines 100% of the time, but that is an acceptable tradeoff if the mean electricity price is low enough.

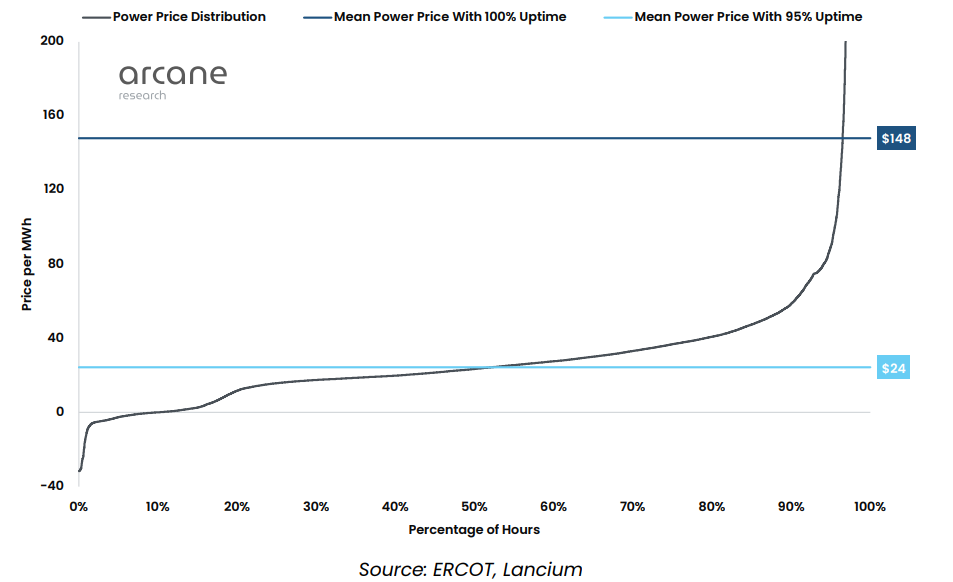

To understand how bitcoin miners operating in grids with a high share of wind and solar accept reduced uptime for lower electricity costs, we can look at the cumulative distribution of electricity prices in West Texas in 2021. In February this year, Texas suffered a devastating winter storm that led to even more volatile power prices than usual.

We see that electricity prices were mostly low, with 85% of prices being below $40 per MWh and negative prices 10% of the time. On the right side of the distribution sits a small number of extremely high prices that occurred when peak demand coincided with low wind and solar output.

If a bitcoin miner ran its machines 100% of the time in West Texas in 2021, the miner's mean power price would be $148 per MWh, which is close to the cash flow breakeven of an energy-efficient machine. Had the miner turned off its machines during the 5% highest-priced periods, the miner would have reduced its mean power price from $148 per MWh to $24 per MWh, which would have massively improved the profitability. These possibilities for lowering power prices by avoiding the price peaks show that bitcoin miners are incentivized to adjust their power consumption depending on power prices, making them the perfect loads in volatile electricity markets with a high share of renewable energy.

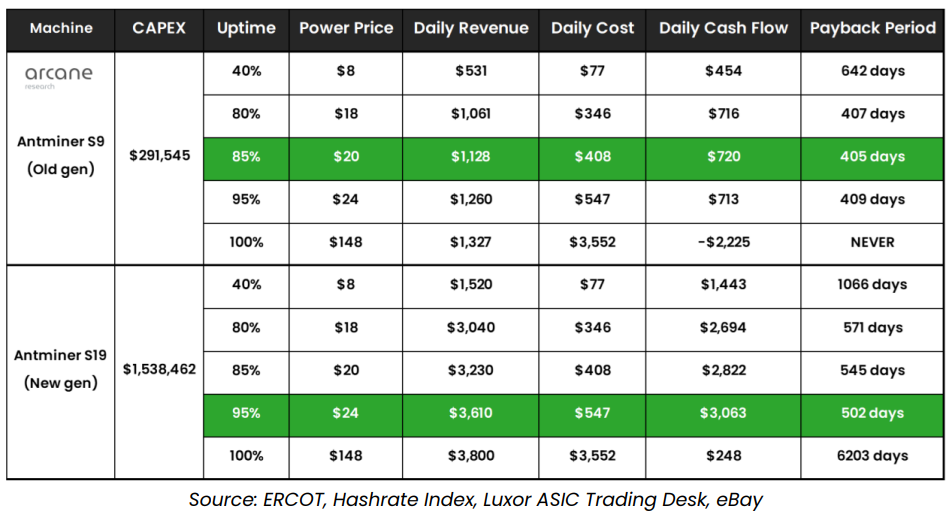

Many incorrectly assume that reducing their uptime is not in the best interests of bitcoin miners. This assumption is wrong, particularly in markets with a high share of wind and solar, which often corresponds to volatile electricity prices. This is proved by the table below, showing how various uptime reductions impacted bitcoin mining economics in West Texas in 2021.

We see that for the Antminer S19 – a new generation machine – the ideal uptime was 95%, while the Antminer S9 – an old generation machine – should ideally be up and running 85% of the time. Do you see the connection here? Older machines have less uptime because they need lower energy prices to be cash-flow positive due to being less energy efficient. Consequently, older machines are cheaper and can have a better return on investment under the right circumstances than newer machines.

3.3 Three bitcoin mining operational models in high wind and solar grids

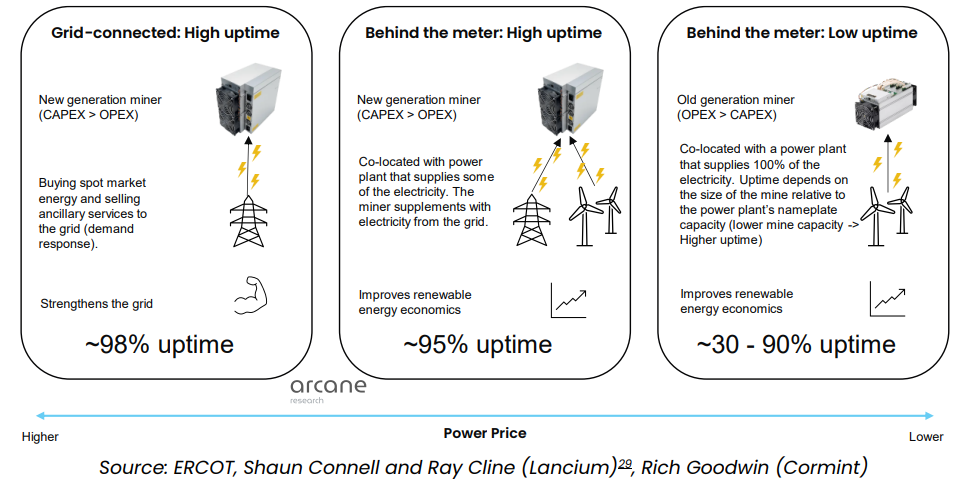

Miners can utilize three main operational models to help offtake excess energy in high wind and solar grids, where the type of hardware used is of utmost importance. The models are: Grid-connected with high uptime, behind-the-meter with high uptime, and behind-the-meter with low uptime.

Model 1: Grid-connected – high uptime

The first model is the traditional one, where the bitcoin miner is grid-connected and focuses on maximizing uptime with new generation machines. As outlined in the previous chapter, these miners can often lower their overall electricity costs by participating in demand response programs that help strengthen the electricity grid. An example of such a facility is Riot's Rockdale, Texas facility, with a developed capacity of 400 MW.³⁰

Model 2: Behind the meter – high uptime

This second model is a hybrid model where a bitcoin miner is co-located with a wind or solar plant and uses new generation machines. The miner switches between pulling electricity from the power plant and the grid to achieve the uptime required to amortize the expensive new generation machines.

This setup is advantageous for the renewable energy plant since it now has two options: selling its electricity to the grid or the bitcoin miner, depending on what is the most profitable. The additional bitcoin mining option can increase the prices renewable energy producers receive for their electricity. It also de-risks development since the power plant has a behind-the-meter customer that is always ready to buy electricity no matter what happens on the grid.

In addition, as we explained previously, many wind and solar plants struggle with curtailment. Wind and solar projects often presell a large part of their future electricity production through a power purchase agreement (PPA) as part of the project financing. Because of how PPAs are structured, curtailment means that the wind or solar plant must bid higher for a PPA, making the PPA less competitive, and the project might not get the required financing. By having a bitcoin miner behind the meter to eat up all the previously curtailed energy, the wind or solar plant can eliminate curtailment, making the plant more competitive in the power market.

Model 3: Behind the meter – low uptime

The third model is entirely off-grid, and the miner only uses power generated by the co-located renewable energy plant. Since the average capacity factors (The capacity factor of a power plant is its average power output divided by its maximum power capability) for wind and solar in the United States are only 35% and 25%³¹ , the behind-the-meter bitcoin mining load should have a lower capacity than the nameplate capacity (The nameplate capacity is the maximum rated output of a generator) of the power plant. In the case of a wind farm with a nameplate capacity of 100 MW and a 35% capacity factor, a behind-the-meter bitcoin mining load of 35 M.W. can expect close to 100% uptime. Still, operators generally aim for a lower uptime since the power plant will also sell power to the grid, so older machines with lower CAPEX should ideally be used here.

Wind and solar plants must apply for a grid connection, a process that can take many years and involves risks. In ERCOT alone, 107 GW of solar and 20 G.W. of wind are waiting in the grid interconnection queue³². Many of these waiting projects could bootstrap themselves with bitcoin mining while waiting for a grid connection. This will require the project to match its nameplate capacity with bitcoin mining capacity, which means that the off-grid bitcoin mining operation will have a less than ideal uptime due to the low-capacity factors of wind and solar. Still, as shown in the table above, an uptime of 35-40% with an old generation miner is not the end of the world and can be viewed as a development cost, as the power plant can be connected to the grid later.

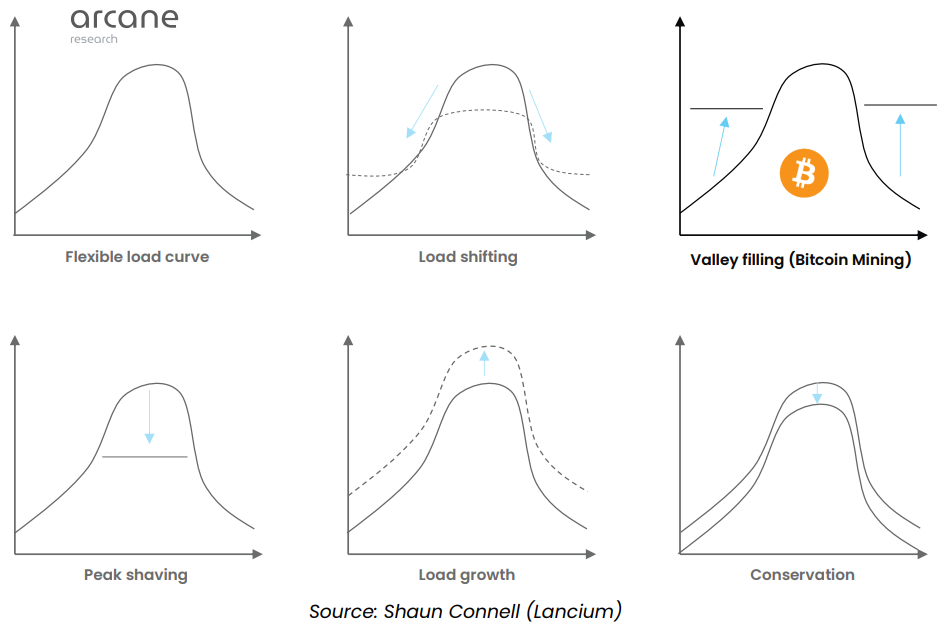

3.4 How bitcoin mining impacts the power market

Common for all three operating models is that they stabilize electricity prices. By buying electricity when renewable energy is abundant, and prices are low, bitcoin miners provide a demand pressure that can lift the lowest electricity prices, improving the economics of renewable energy plants.

The figure above illustrates the load distribution of an electricity system and six different ways we can manipulate it. Bitcoin miners impact the system through a mechanism called "valley filling," which lifts the baseload without lifting the peak load since bitcoin miners are highly incentivized to turn off their machines when electricity is scarce and prices are high. A higher baseload improves the economics of renewable energy and incentivizes the buildout of additional capacity.

3.5 Bitcoin mining compared to batteries and hydrogen

While many energy professionals acknowledge that bitcoin mining helps stabilize power prices in electricity systems with a high share of renewable energy, some raise a valid point: "Why not use batteries or hydrogen production instead?"

Let's start with comparing bitcoin mining to batteries. First, bitcoin mining has a fundamentally different role in an energy system than a battery since bitcoin mining is a load while a battery is an energy storage technology. The battery has an advantage over the bitcoin miner since it can store energy and supply it to the grid later. Still, this feature can also be a disadvantage since the battery has a limited storage capacity.

The largest battery in Texas has a nameplate capacity of 260 MW and a storage capacity of 260 MWh³³ , meaning it only takes one hour to charge and discharge. Compare that to a bitcoin mining facility, which can soak up energy for unlimited hours. Because of their differences, batteries and bitcoin mining could be complementary technologies. Block, Blockstream, and Tesla are currently developing an energy system that combines a solar plant, a bitcoin mining facility, and batteries, where the solar plant sends electricity to the grid or the battery, depending on economics³⁴.

Since bitcoin mining and batteries have two different roles in energy systems, we should compare bitcoin mining to other power-to-x technologies like hydrogen production. Still, there are some differences. Firstly, while bitcoin miners are completely location agnostic, hydrogen production requires access to a market to sell the hydrogen, which means the production process should be located close to a logistical network. In addition, hydrogen production is not a fully interruptible process since the producers have contracts to fulfill and physical products to ship.

Also, hydrogen production's supply chain considerations mean that electricity will likely be a less critical part of the cost structure for hydrogen producers than for bitcoin miners. Because of this, hydrogen producers will most likely outcompete bitcoin miners on power prices alone, forcing them to seek out the most stranded energy resources that hydrogen producers can't harness due to their limited location agnosticism. This means that both bitcoin mining and hydrogen production can play essential roles in offtaking excess renewable energy in the future, as one doesn't exclude the other.

3.6 Bitcoin mining improves the economics of renewable energy

Bitcoin mining's combination of location agnosticism, interruptibility, and modularity makes it the perfect purchaser of stranded renewable energy. Bitcoin miners can seek out areas with excess wind and solar and build a data center of the exact size needed to consume the excess energy. Having a bitcoin mining load right next to remotely located wind and solar farms prevents curtailment and negative power prices and improves the economics of these projects.

Bitcoin mining can become more integral to the energy transition than most people realize since the future economics of wind and solar projects depends on flexible consumers like bitcoin miners who can purchase excess energy.

4 Mitigating natural gas flaring with bitcoin mining

Natural gas is produced as a byproduct of oil drilling. Harnessing this gas for consumption is not always economically viable for oil producers. In these cases, the oil producer burns the gas on-site in a process called flaring.

Gas flaring creates emissions without deriving any utility. In addition, the flaring process releases higher amounts of methane into the air than using the gas to generate electricity.

4.1 Gas flaring is a significant polluter

Oil depressurizes on the surface into liquids and gas (primarily methane) in oil extraction. Gas is worth less than oil by volume and is more difficult to transport, so most oil companies consider the gas a cost center. If the oilfield is located close to population centers, it might be economically feasible to build pipelines and transport the gas for usage as electricity or heating. But in many oil drilling locations, this is not the case. The oil producer then chooses to dispatch the gas in the most cost-effective way, which is simply burning the gas in a process called gas flaring.

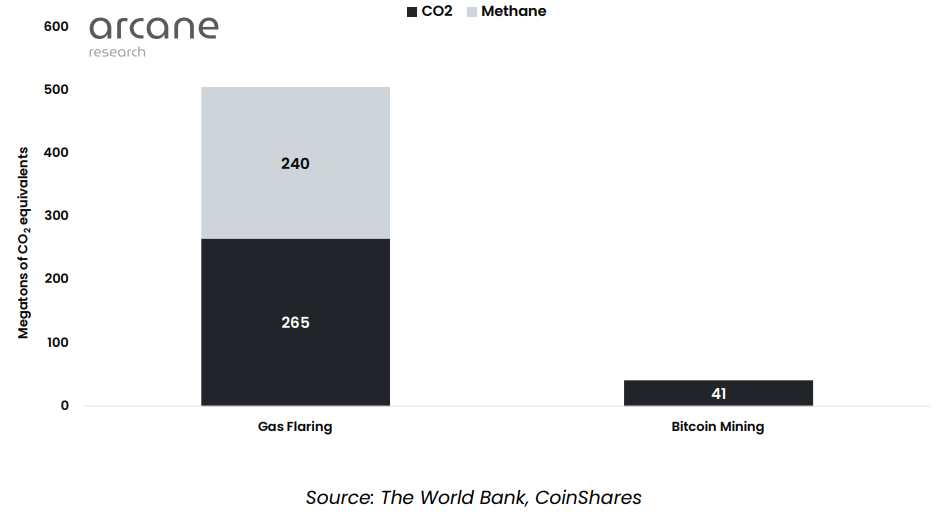

Gas flaring emitted more than 500 megatons of CO2 equivalents in 2020.³⁵ Assuming a typical car emits about 4.6 tons of carbon dioxide per year³⁶ , emissions from gas flaring equate to that of more than 100 million cars. In comparison, generating the electricity used by the Bitcoin mining industry emitted 41 megaton CO₂ in 2021 – only 8% that of gas flaring.

If instead utilized, the flared gas could produce almost 700 TWh a year, which is more than the electricity consumption of all but five countries in the world.

Gas flaring occurs on oil production sites and is hence geographically concentrated. The most flaring intense oil regions are found in the U.S., the Middle East, Russian Siberia, and Africa. By country, Russia is the biggest gas flarer, flaring about 25 billion cubic meters of gas each year.

Iraq and Iran are the second and third largest countries by flaring volume, flaring close to 30 billion cubic meters of gas combined. The United States, where many smaller oil producers are unable to coordinate the building of pipelines, flares about 12 billion cubic meters of gas each year, while Algeria rounds out the top 5 countries by flaring volumes totaling close to 10 billion cubic meters a year.

4.2 Bitcoin mining can help mitigate natural gas flaring

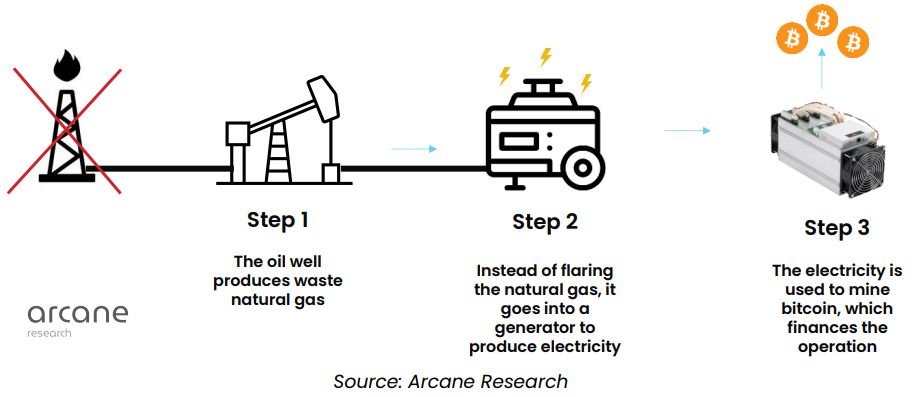

Bitcoin mining is emerging as the superior technology for reducing natural gas flaring. Flaring exists due to difficulties in taking natural gas to the market, but bitcoin mining solves this problem by taking the market to the natural gas. How does it work?

The previously flared natural gas is pumped into a generator, where it is burned inside a controlled environment to produce electricity. This electricity is then used to power machines that produce bitcoin. The income from the bitcoin mining operation is used to finance the infrastructure.

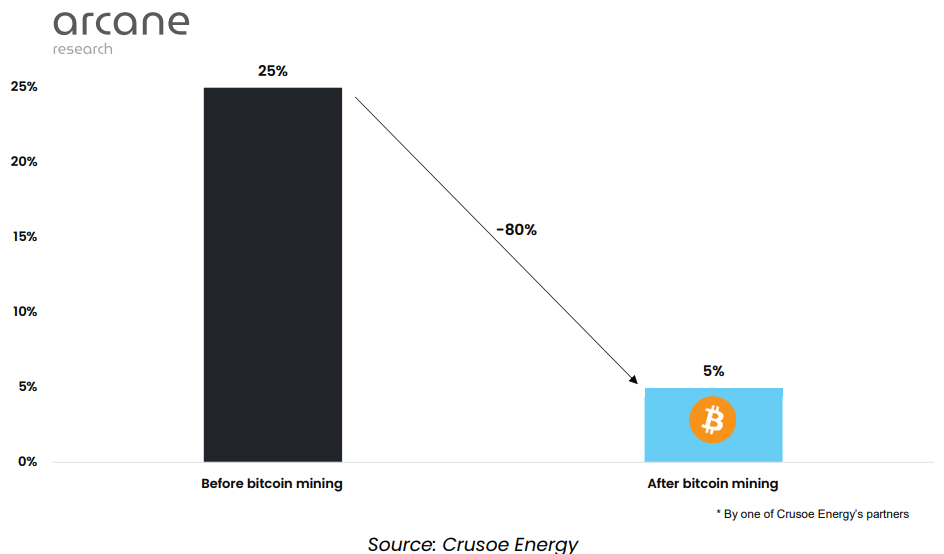

For example, by burning the natural gas in a controlled environment inside an electric generator, Crusoe Energy's Digital Flare Mitigation® technology can combust 99.89% of the methane, compared to only around 93% with flaring³⁷. This reduces CO2 equivalent emissions by about 63% compared to continued flaring.³⁸ In addition to reducing emissions by preventing methane leaks, oil field bitcoin miners outcompete grid-connected bitcoin miners and thus offset their energy consumption.

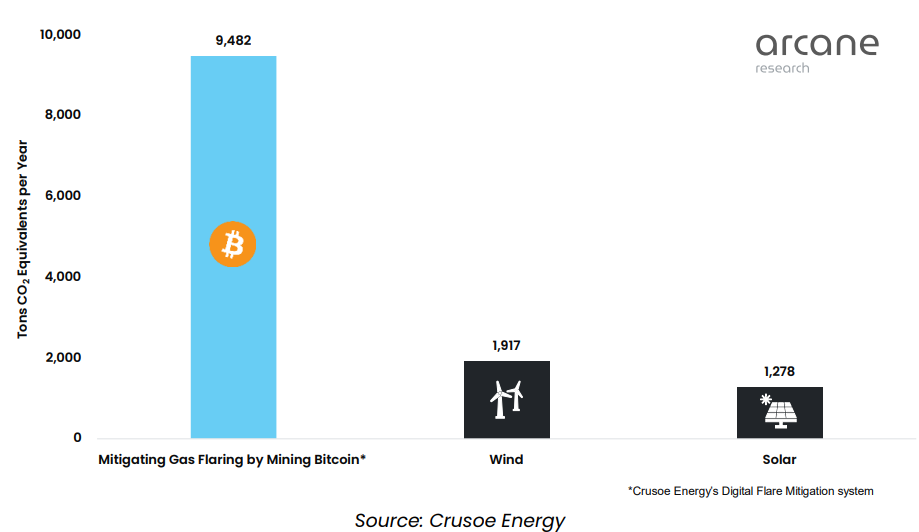

Numbers show that mitigating gas flaring by mining bitcoin is perhaps the most powerful tool in our toolbox for reducing greenhouse gas emissions. Per megawatt capacity installed, a bitcoin mining system can provide a yearly reduction of 9,482 tons of CO₂ equivalent emissions, compared to 1,917 for wind and 1,278 for solar.

It's also by far the most cost-efficient way of reducing emissions. Per $1,000 investment, a bitcoin mining system reduces emissions of 6.32 tons of CO2 equivalents per year, compared to 1.3 for wind and 0.98 for solar.

Bitcoin mining serves as a customer that can monetize the natural gas and help finance the required infrastructure to reduce emissions from flaring. At the end of this chapter, we explain why bitcoin mining is the superior customer for this stranded natural gas.

We have seen massive oil field bitcoin mining growth over the past few years. The growth is concentrated in the United States and Canada, but we have also seen some projects in other regions where flaring is a big problem, like Russia and the Middle East.

Both economic and environmental forces drive the rise of oil field bitcoin mining. Flaring natural gas on-site is a waste of an economic resource that the oil producer would instead want to sell for income. By mining bitcoin, either by themselves or through a third party, the oil producer can earn some money off the gas instead of letting it go to waste.

Environmental concerns and flaring regulations play the most prominent role in pushing oil producers to dip their toes into bitcoin mining. This is especially true in the United States, where state-specific regulations limit how much oil producers are allowed to flare as a percentage of their total production.

Several of the world's biggest oil-producing countries and companies have endorsed the World Bank's "Zero Routine Flaring by 2030" initiative and the "Global Methane Pledge." These initiatives are major drivers for reducing flaring and will likely result in even more stringent regulation as we approach 2030.

Several companies and business models have emerged in this rapidly growing niche. The biggest company, Crusoe Energy, signs gas purchase agreements with major oil producers, installs its flare mitigation system close to the oil wells, and operates it. Crusoe Energy has termed the concept "Digital Flare Mitigation."

Crusoe has helped several oil companies reduce flaring from their United States operations, including ExxonMobil³⁹ and Equinor.⁴⁰ Crusoe plans to enter the Middle East through an office in Oman as part of its partnership with the Oman government⁴¹.

Another leading company in this niche is Upstream Data, which pioneered the concept in 2017⁴². This Canadian company's business model differs from Crusoe's in that instead of simply purchasing the gas, it sells equipment directly to oil producers so they can mine bitcoin themselves. Other companies with similar business models include E.Z. Blockchain, Giga Energy, and Jai Energy.

Which properties of bitcoin mining make the process a superior customer of stranded natural gas? Oil wells are often located in remote places where it is difficult to set up and operate other energy-intensive power-to-x operations. Because bitcoin mining is an unconstrained location-agnostic process, bitcoin miners can come directly to oil wells to eat up the excess natural gas. In addition, since oil sites typically produce declining amounts of excess natural gas as they mature, an offtaker must be able to scale down its operation modularly. Bitcoin mining is a modular process since you can combine different numbers of machines into varying energy usage levels. Also, when oil wells deplete, the consumer should be able to follow the oil producer to a new site. A bitcoin mining system can be built into a container, making it highly portable.

Bitcoin mining's combination of location agnosticism, modularity, and portability makes it an ideal offtaker at scale for stranded natural gas. This makes it a valuable tool in our toolbox for mitigating gas flaring.

5 Repurposing waste heat from Bitcoin mining

Providing heating for homes, industries, and other applications is the world's largest energy end-use, accounting for almost half of global final energy consumption in 2021.

Industrial processes are responsible for 51% of the energy consumed for heating, while another 46% is consumed in buildings for space and water heating and, to a lesser extent, cooking. The remainder is used in agriculture, primarily for greenhouse heating.

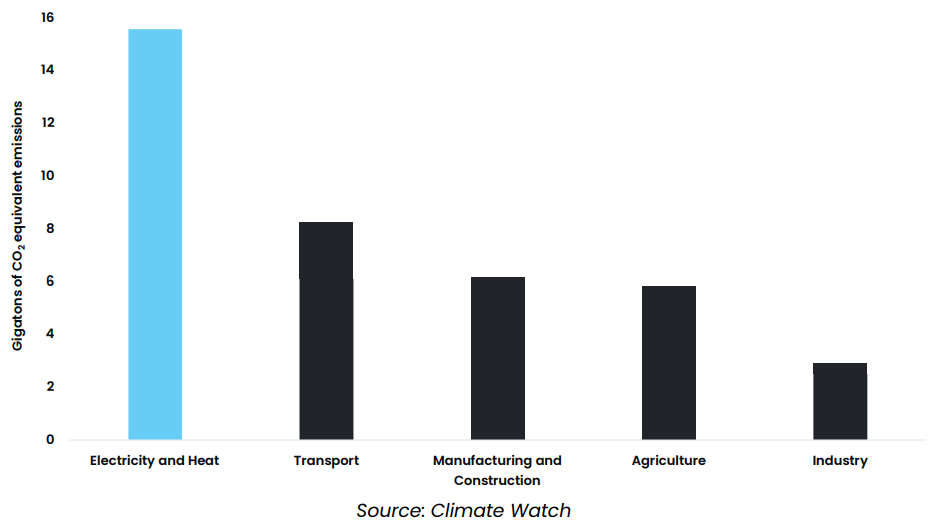

Unsurprisingly, accounting for half of the world's energy use, heating is also the single largest source of global CO₂ emissions. Heating accounts for roughly 40% of the world's CO₂ emissions and 30% of CO₂ equivalent emissions.

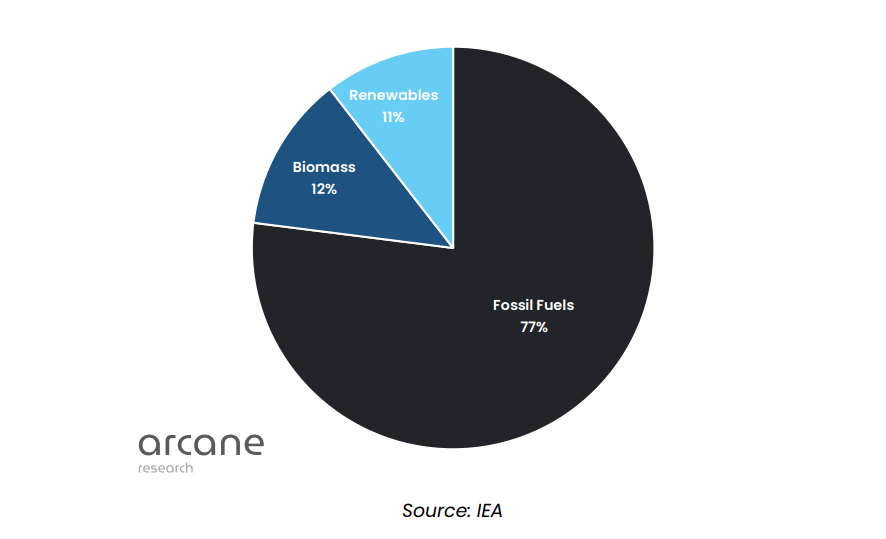

Fossil fuels are the most common heating energy source, accounting for about three-quarters of the energy mix. The remaining quarter is almost equally split between traditional use of biomass and modern renewables.

5.1 Bitcoin mining generates a lot of heat

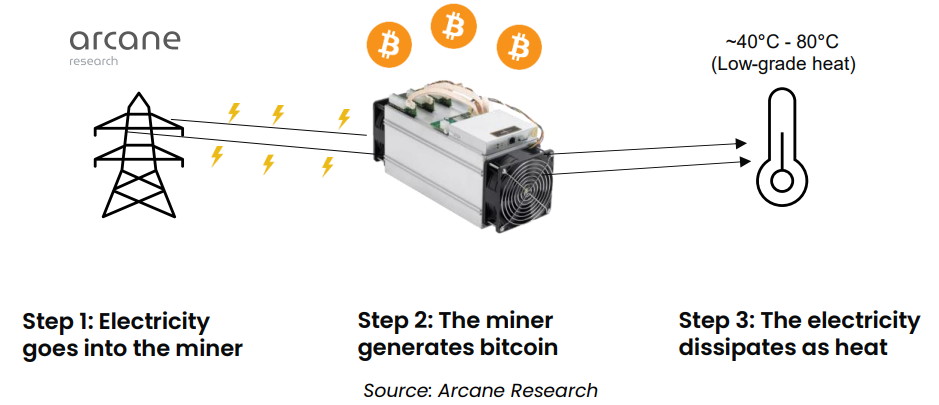

Have you ever wondered what happens to all the electricity that goes into the bitcoin mining machines? The electricity goes through hashboards to produce hashes that the miner sells to a mining pool that sends a continuous stream of bitcoin back. Not only does the machine generate bitcoin, but also a large amount of heat as the electricity dissipates on the resistive dashboards.

The bitcoin mining industry generates about 100 TWh of heat annually⁴³, which is sufficient to heat Finland⁴⁴. Most of the heat from bitcoin mining is not captured and repurposed but pumped out from the data centers into the air

5.2 Bitcoin miners can repurpose their waste heat for district heating or food production

Bitcoin miners are starting to see the potential in recovering the heat. This growing focus is primarily driven by a potential for lowering costs as the industry becomes increasingly competitive, but the possibility of reducing carbon emissions is also a driving force. Unsurprisingly, most innovation happens in colder areas like Canada and Scandinavia, where heat is more valuable than in hotter bitcoin mining hubs like Texas.

Disposing heat is the biggest engineering challenge in mining, which is why the first industrial mining facilities were built in cold environments. Miners can utilize two different technologies to cool down their machines. The most common is air cooling. Immersion cooling is a new method in which the machine is fully submerged in a thermally conductive liquid with greater insulating properties than ordinary air. It's much more expensive to build an immersion cooling system than a traditional air-cooling system, but it also provides superior cooling capabilities.

When repurposing heat, a miner should ideally use immersion cooling since the fluid carries heat much more efficiently and is easier to direct than air. It's still possible to repurpose heat from bitcoin mining using air cooling, but it's much less efficient than immersion cooling, which can recover 96% of the heat.⁴⁵

Another factor to remember is that bitcoin miners generate heat between 40॰C and 50॰C, although it's possible to run the machines as hot as 80॰C. This is considered low-grade heat and can't be used for some purposes that require higher temperatures. Still, bitcoin miners generating low-grade heat can provide baseload heating for many purposes, including district heating and food production. We will now go through some examples.

District heating

The Canadian company Mintgreen is a pioneer in repurposing waste heat from bitcoin mining. This leading position has allowed them to work with the city of North Vancouver to supply heat for 100 buildings with 7000 apartments⁴⁶. This involves a heat purchase agreement over 12 years, in which Lonsdale Energy Corp., the city-owned district heating company, purchases a baseload of heat generated by Mintgreen's proprietary Digital Boilers® that are powered by renewable energy. The Digital Boilers® contain bitcoin mining machines that are immersion-cooled. A pump moves the non-conductive cooling fluid to a heat exchanger, which imparts heat directly to Lonsdale Energy Corp's district heating system.

Food production

Many food production processes require low-grade baseload heat that bitcoin miners can provide. In 2020, Mintgreen started working with Shelter Point Distillery to supply their whiskey production process with bitcoin mining-generated heat.⁴⁷ The whiskey producer requires thermal energy for the barrel aging process. Mintgreen designed a bitcoin mining-powered whisky aging machine that allows them to age the whisky faster than they would have been without the extra heat.

Several miners in Scandinavia are either actively repurposing their excess heat or planning to do so. Genesis Mining is participating in a research project in northern Sweden which studies the prospects of repurposing waste heat from bitcoin mining to grow fruits and vegetables in greenhouses. They do this by piping the hot air from the machines into a greenhouse. The project found that a relatively small mining container of 600 kW provides sufficient heat for a 300m² greenhouse, even at winter temperatures as low as -30॰C.⁴⁸

Most miners in Norway are planning how to repurpose waste heat from bitcoin mining for food production. Plans include supplying heat to greenhouses, algae farmers, and salmon farmers. Norwegian miners are presently under heavy political pressure due to their energy consumption, and repurposing the excess heat from their operations is a way to show that mining provides environmental benefits. Due to these political incentives, we will likely see massive bitcoin mining heat innovation in Norway during the coming years.

5.3 Repurposing waste heat from bitcoin mining lowers heating costs and reduces carbon emissions

Repurposing heat from bitcoin mining has three main advantages. First, the income from bitcoin mining subsidizes the cost of the electricity used to produce the heat. Mintgreen can compete in the district heat market and use the payment from selling the heat to lower its electricity rate to among the lowest in the bitcoin mining industry.⁴⁹ Their bitcoin mining competitiveness further reduces risk so they can enter decade-long heat purchase agreements.

The reduced heating costs also allow for increased food production in northern regions historically considered too cold for extensive food production. According to Mattias Vesterlund, a senior researcher at RISE in Sweden who cooperated with Genesis Mining in their greenhouse project, "a 1 M.W. data center would have the ability to strengthen the local self-sufficiency up to 8% with products that are competitive on the market". A bitcoin mining facility of 1 M.W. is relatively small, so we can only imagine what a 100 MW data center could do.

In addition to lowering heating costs, using bitcoin mining for district heating can reduce carbon emissions if the machines are powered by renewable electricity. Mintgreen's CEO Colin Sullivan estimates that the company saves 20,000 tons of carbon emissions over the expected 12-year term of the district heating partnership. The CO2 savings come from replacing the natural gas boilers the city's district heating system is using⁵⁰. Thirdly, repurposing the heat from bitcoin mining is essentially using the same energy twice. This offsets energy used by the bitcoin mining industry since it outcompetes other miners that are not repurposing their heat.

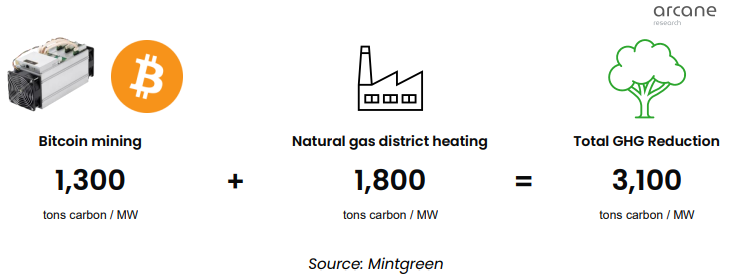

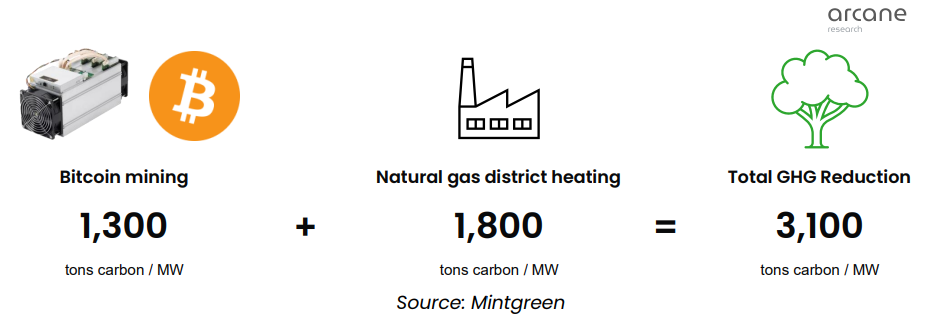

Mintgreen estimates that their bitcoin mining district heating system provides a yearly reduction of 3,100 tons of CO2 per M.W. Of this amount, 1,300 tons come from 1 M.W. of offset energy consumption in the bitcoin mining industry and a 1,800-ton reduction from 1 M.W. of reduced natural gas heating.⁵¹

In addition to reducing heating costs and mitigating carbon emissions, repurposing the excess heat from mining operations can impact the geographic distribution of the bitcoin mining industry. Currently, bitcoin mining operations are centered in regions with abundant and cheap electricity. Since heating costs and electricity prices are correlated, a miner that repurposes its heat can operate in places previously considered unsuitable for bitcoin mining due to high electricity prices.

Two main properties make bitcoin mining superior for heat recovery compared to other energy-intensive industries. First, the location agnosticism of bitcoin mining means that a bitcoin miner can take its operation anywhere heat is needed. Secondly, bitcoin mining is a modular process and can be scaled to give just the amount of heat required. These characteristics of bitcoin mining have allowed companies like Mintgreen to build bitcoin mining-powered heaters, which subsidize their heating costs with income from bitcoin mining.

We will likely continue seeing massive innovation in repurposing heating from bitcoin mining. Surging electricity prices and heating costs will drive both bitcoin miners and consumers of heating to seek creative solutions to reduce costs.

6 The future of bitcoin mining

Bitcoin mining possesses a combination of properties that makes it a uniquely flexible energy consumer. This flexibility allows bitcoin miners to provide positive externalities to various energy systems globally, including strengthening vulnerable electricity grids, improving the economics of renewable energy, mitigating natural gas flaring, and lowering heating costs by repurposing waste heat.

Not only do bitcoin miners have the opportunity to add value to energy systems – they are economically incentivized to do so. As the bitcoin mining industry matures, it will likely become the most competitive industry ever. Bitcoin miners produce a commodity that can't be differentiated and can only compete on costs. It's also a global industry that is hard to regulate and has low barriers to entry. Due to these industry characteristics, ruthless competitive forces will gradually erase miners' profit margins, except for those with access to exceptionally cheap electricity.

As profit-maximizing entities, miners will leave no stone unturned in their hunt for cheaper electricity. By getting paid to stabilize the grid, selling waste heat, or offtaking stranded natural gas or renewables, a miner can achieve significantly lower electricity costs than a miner who passively draws energy from the grid.

This report highlighted four ways bitcoin mining can provide value to energy systems, but we could have added several more. We chose to limit our report to these four because they are already happening at scale. Still, other ways to exploit the flexibility of bitcoin mining to benefit energy systems might emerge and become even more significant than those we focus on in this report.

An example is bitcoin mining financing energy infrastructure in developing countries with little local electricity demand. Some renewable energy sources like geothermal and hydro require enormous financing costs, but when the power plants are built, they provide energy at zero marginal cost. Due to the limited local electricity demand, many developing countries have vast hydro or geothermal potential but little to no development. The global nature of bitcoin mining means that such infrastructure could be partially financed by bitcoin mining.

What makes bitcoin mining such an aspiring energy tool isn't simply that it's a uniquely flexible energy consumer but that the financial incentives add up. With similar incentives, the bitcoin mining and energy industries are bound to work together to solve some of our biggest energy problems.

Numbered footnotes

- IEA: Electricity generation by fuel and scenario 2018 - 2040

- Hashrate Index: Bitcoin Mining Energy Consumption Index

- Our World in Data: Energy Production and Consumption

- Hashrate Index: Bitcoin Mining Energy Consumption Index

- Braiins: So You Think Bitcoin Mining is Wasteful?

- Galaxy Digital: On Bitcoin's Energy Consumption – A Quantitative Approach to a Subjective Question

- The International Energy Agency: Pulp and Paper

- University of Cambridge: 3rd Global Cryptoasset Benchmarking Study

- University of Cambridge: 3rd Global Cryptoasset Benchmarking Study

- Arcane Research: Bitcoin mining around the world - Norway

- ASIC Miner Value: Miners profitability

- University of Cambridge: New data reveals timeline of China's bitcoin mining exodus

- IEA: Electricity generation by fuel and scenario 2018-2040

- IEA: Electricity generation by fuel and scenario 2018 - 2040

- The University of Texas at Austin Energy Institute: The Timeline and Events of the February 2021 Texas Electric Grid Blackouts

- PR Newswire: Lancium and MP2 Energy Offer Unique Energy Demand Response Solution for High-Throughput Computing and Cryptocurrency Miners

- ERCOT: Apr 26, 2022 – Large Flexible Load Task Force (LFLTF) Meeting

- CoinDesk: Bitcoin Mining Farms in Texas Offline From Winter Storm

- DataCenter Knowledge: Most Texas Data Centers Weathered the Storm, But Things Did Not Go Smoothly

- CNBC: Bitcoin miners are helping the Texas grid brace for winter storm impact

- CNBC: Crypto mines help ERCOT keep renewable energy operational, says interim CEO

- IEA: Demand Response

- IEA: World Energy Outlook 2018

- ERCOT: Long-Term West Texas Export Study (January 2022)

- U.S. Energy Information Administration: Levelized costs of new generation resources in the Annual Energy Outlook 2022

- ERCOT: Historical RTM load zone and hub prices

- Potomac Economics: 2021 State of the Market Report for the ERCOT Electricity Markets

- S&P Global: Texas support for massive transmission boost for renewables in question

- On the Brink with Castle Island: Stabilizing the Grid with Bitcoin Mining with Ray Cline and Shaun Connell

- Riot Blockchain – North America's Largest Bitcoin Mining Facility by Developed Capacity

- EIA: Electric Power Monthly – Capacity Factors for Utility Scale Generators Primarily Using Non-Fossil Fuels

- ERCOT: GIS report May 2022

- Energy Storage News: Texas' largest battery project to date brought online by Vistra

- CNBC: Tesla, Block and Blockstream team up to mine bitcoin off solar power in Texas

- Gas flaring emissions

- https://www.epa.gov/greenvehicles/greenhouse-gas-emissions-typical-passengervehicle

- Crusoe Energy: Understanding The Problem Crusoe Solves

- Crusoe Energy

- CNBC: Exxon is mining bitcoin in North Dakota as part of its plan to slash emissions

- CoinDesk: Energy Giant Equinor to Cut Gas Flaring With Bitcoin Mining

- Oman Backs U.S. Firm Mining Crypto to Cut Gas Flaring

- Upstream Data

- Hashrate Index: Bitcoin Mining Energy Consumption Index

- Our World in Data: Finland – Energy Country Profile

- Mintgreen

- Vancouver Sun: Bitcoin mining could be heating homes in North Vancouver next year

- Mintgreen: Shelter Point Distillery

- Nasdaq: How heat from crypto mining farms could be recycled into energy for greenhouses

- Mintgreen: Intro to Mintgreen

- CoinDesk: How a Startup Is Supplying a Whole City With Heat From Bitcoin Mining

- Mintgreen

Sovereign Monk

Bitcoin, Privacy & Individual Sovereignty Maximalist | Founder of European Bitcoiners - for Free and Open Bitcoin Education.

follow me :

Related Posts

La Reforma Del Bitcoin

Feb 22, 2023

La Majorité De L'exploitation Minière Du Bitcoin Est Alimentée Par Des Énergies Durables

Feb 21, 2023

Ein Überblick über Fedimint

Jan 03, 2023