'Absolute mathematical Scarcity' achieved by consensus in a sufficiently decentralized distributed network was a discovery rather than an invention. It cannot be achieved again by a network made up of participants aware of this discovery since the very thing discovered was resistance to replicability itself.

Decentralized systems, by definition, do not have a single source of truth. Satoshi's discovery was to build a system that allows all participants to zero in on the same truth independently. Proof of work is what allows this to happen.

The point of 'Proof of Work' is to create an irrefutable and immutable history. If two histories compete, the one with the most work embedded in it wins. The chain with the most work is the truth, by definition. Computational work requires energy which is the foundation for the security of bitcoin. PoW makes the cost of writing a block extremely high and the cost of verifying its validity extremely low, almost eliminating the incentive for anyone to try to create invalid transactions. If they tried, they would be wasting electricity and processing power without receiving the block reward. Bitcoin can thus be understood as a technology that converts electricity to truthful records.

In Bitcoin, work is computation. Not any kind of computation, but computation that has no shortcut: guessing. There is no shortcut because there is no progress. Every guess stands on its own. The beautiful thing is that the computational work itself is embedded in the solution leading the generation of a new block. The work is implicit in the data due to the probabilistic nature of guessing a large random number. Therefore your private key for your cyber vault is so hard to guess that your BTC are safe to hodl.

Other mechanisms, such as proof of stake, don't have this property. You can never be sure that what you are looking at is actually the truth since there is no external cost to create an alternative truth. Basically it is money out of thin air = fiat. Computation is the only bridge between the realm of information to the physical realm. When dealing with information, all we have is information and the transformation of information: computation. Computation requires energy. Energy is the bridge. Energy is real. Therefore Bitcoin has an inherent energetically value costly to produce and is inelastic to increased demand for sound money leading to verifiable scarcity.

Additionally proof of stake has plenty of other problems, such as fair validator selection (who decides?), naturally centralizing effects (more stake = more reward = more stake), and having no natural resistance to timestamp manipulation attacks, for example. Not to speak of the huge premines, venture capitalist, leverage traders, rug pulls and so forth.

This leads to question of whether proof of work computation is wasteful or not can't be asked without understanding the problem it solves. Understanding the problem of trust properly will lead you to the conclusion that there is no other way to solve it in a trust-less manner with proof of work. It decentralizes the selection process, creates physical proof of what happened, has real externalized costs, and decentralizes time. Thus, the question becomes: How useful is trust-less digital sound money? Is it worth the energy expenditure?

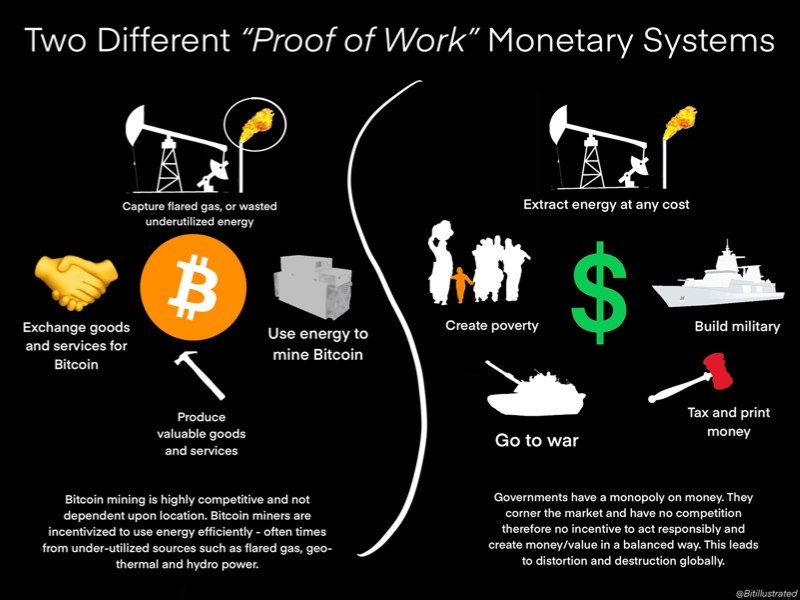

For a Bitcoiner the societal benefits of sound and censorship-resistant money leads to the conclusion that it is well worth the energy in relation. Therefore you can not argue about proof of work with a real bitcoiner. Proof of work is not only useful but absolutely essential. Trustless digital money can't work without it. You always need an anchor to the physical realm. Without this anchor, a truthful history that is self-evident is impossible. Energy is the only anchor we have. Proof of work means to trust in physics and mathematics whereas proof of stake trusts humans to determine what happened. Bitcoin is therefore rooted in computational power, whereas fiat is rooted in military power. History made it very clear what humans will do with power and ingenuity. The days of clipped gold coins, unlimited spending on wars and unlimited money supply debasing the peoples value of time and savings shall have passed.

The halving based monetary policy enforces the rule that every 210 000 blocks the supply inflation or else block reward gets halved. Ultimately this leads to a constant base money supply of less than 21 million coins and a final debasement of your precious satoshis with 1 satoshi or else a 100 millionth BTC every 10 minutes.

This concept is what we call Nakamoto consensus. People that agree with this social consensus are true bitcoiner. Our goal as bitcoiner should be the spread of hope for sound money since the BTC share of total extractable value is still miniscule. We are all satoshi and demand free(dom) money for free people. Rules instead of rulers with a single satoshi as the standard unit for measuring value. Your act of stacking sats is the greatest proof of your work and the value you have already created for mankind. This is our bitcoin standard for the current epoch of digitalization and technological progress.

Sinautoshi

#Bitcoin only - #GetOnZero - united we fix the money (supply to 21M BTC)

Related Posts

Mapping Stats on Bitcoin Professional Frontier

Jan 27, 2026

Epoka Zależności

Dec 04, 2025

Napraw pieniądze, Napraw Świat: W stronę osobistej odpowiedzialności i zmiany systemu

Dec 02, 2025