Author: BitBoxer | Original Date: 31/03/2022 | Translated by: Sovereign Monk | Medium (BitBoxer)

The original blog post titled "Abgerechnet wird am schluss – Bitcoins verdeckte kosten für die gesellschaft sind enorm" (it is settled in the end- Bitcoin's hidden costs for society are enormous) by Jürgen Schaaf & Ulrich Bindseil of the 'European Central Bank' was published on 23 March 2022. In response to that blog post, BitBoxer analyses the blog post by the 'Central Bank Advisors' in this article as per his viewpoint (a version of this analysis by Bitboxer was originally published in German at Block-Height 729,858).

Definitions used in this article

- Bitcoin: The word Bitcoin, starting with the capital letter 'B', is used to refer to the network.

- bitcoin: The word bitcoin, starting with a lowercase letter 'b', is used to refer to the coin.

- Mining: This refers to the process utilized by Bitcoin to add new transactions to its ledger.

- Proof-of-Work: The proof-of-work refers to the mathematical calculations performed by Bitcoin, to enable consensus on the Bitcoin network.

- Block Reward: The miners are paid with the block reward to secure the network. Till the year 2140, the block reward will consist of the new bitcoins to be distributed and the transaction fees of the transactions included in the blocl (fees paid by users to include their transactions into the blocks, and record them in the open ledger. After that, the miners will only be paid with the transaction fees.

- Hash: A cryptographic hash function is a fixed-length alphanumeric string randomly generated from variable-length input. The SHA-256 hash is used in the Bitcoin network.

- Nonce: The nonce is a variable used to find the hash value in the target area. The abbreviation stands for Number Once, i.e. a number that is only generated once.

The First Impression

After reading the blog article, I get the feeling that this is not an article with a scientific approach written by the two PhD holders (i.e. the authors of the ECB blog post). Here, an attempt was made to mislead the bitcoin-unfamiliar reader using propagandistic instruments of the bottom of the drawer to any existing expectations and assumptions. The blog post claims come from questionable scientific sources and almost always use or reflect pejorative ideas and negative facts about bitcoin. Even if the sources cited draw a differentiated picture of Bitcoin, the best positive feeling that the authors showcase is a small side-note that sounds as neutral as possible. Honestly, the ECB always claims that they started with the Euro for free competition, and thus should not be afraid of it. But when you read the blog post, you get the feeling that the ECB is not confident any longer, and the fear of competition is creeping out of every crack.

Furthermore, it must be noted that the two authors have either no or at most rudimentary knowledge of Bitcoin. The clearest example of this is the word “Awards”.

Since when are “Awards” given to the miners? In the Bitcoin network, the miners receive the block reward. This consists of the block subsidy (newly distributed bitcoins) and the transaction fees of the network participants.

Unparalleled Waste of Energy and Pollution

The very first sentence of the ECB blog post sets the stage: Bitcoin, the polluter, without any precedent. Great opening, but what is then delivered is nothing but cold tasteless brew. As the critics can't come up with anything new, thus the old familiar comparison "Bitcoin uses as much energy as country X", has to be used again. Which country candidates have we already had? - The Netherlands, Switzerland and Argentina come to mind quickly. Due to current events, Ukraine gets the honour this time. What insight does such a relative comparison bring us? Let's look at the data.

The two authors of the blog post compare the electricity usage of Ukraine to that of the Bitcoin network. What result do you get when you compare the Bitcoin network, with its usage of 125 TWh, to the 124.5 TWh that Ukraine uses? Exactly, none at all. Thusm without any precedence, just comparing two random numbers.

So more key figures then have to be compared to understand what that energy is used for. Bitcoin uses electrical energy to secure the network, including transaction history and ownership of the bitcoins it contains. This currently corresponds to the equivalent value of 824 billion US dollars (accessed March 29, 2022). Ukraine uses electrical energy and indirectly utilizes it for the production of a part of its gross domestic product of 155.5 billion US dollars for 2021. Here, one should keep in mind that Ukraine uses other sources of energy, such as oil and gas, to produce its gross domestic product. It is impossible to get a precise breakdown of which energy source has the maximum share of the gross domestic product.

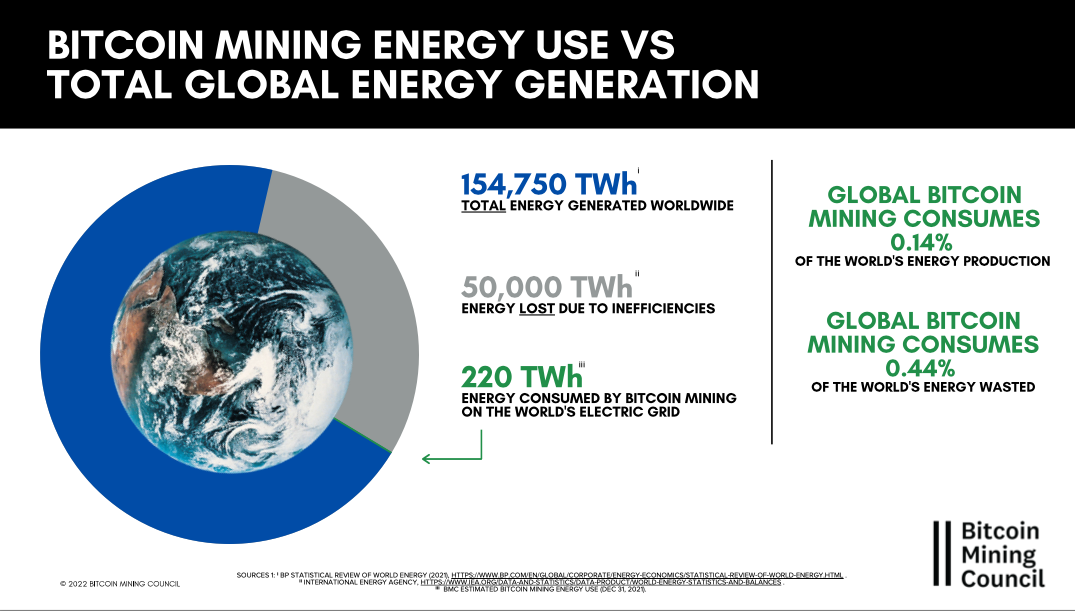

Even if you take this additional data into account, it can be seen that the relative comparison of electricity use does not further improve the knowledge, but is rather used manipulatively. Making such relative comparisons implies that one use of electricity is good and the other is bad. However, this is a subjective assessment of an objective fact based on personal versions of good or bad, which further depends on the personal level of benefits. It only makes sense if you compare the 'use of energy' to the 'amount of energy produced worldwide'. This allows you to objectively determine the relationship between use and the quantity produced. If you do this, however, you quickly come to the realization that Bitcoin uses around 0.14% of the energy produced worldwide, with a usage of only 220 TWh. If you take the value of 125 TWh given by the two authors and assume that the amount of energy produced worldwide has remained the same, then the Bitcoin network requires around 0.08%. Both percentage values are rounding errors based on the total amount of energy produced worldwide. However, the image below provides another very interesting fact: The amount of energy lost due to inefficiencies throughout the energy system. That's around 32%, or to put it another way, the energy losses are 227 to 400 times greater than the amount of energy used by the Bitcoin network. This raises the question of, who really is the energy waster and polluter.

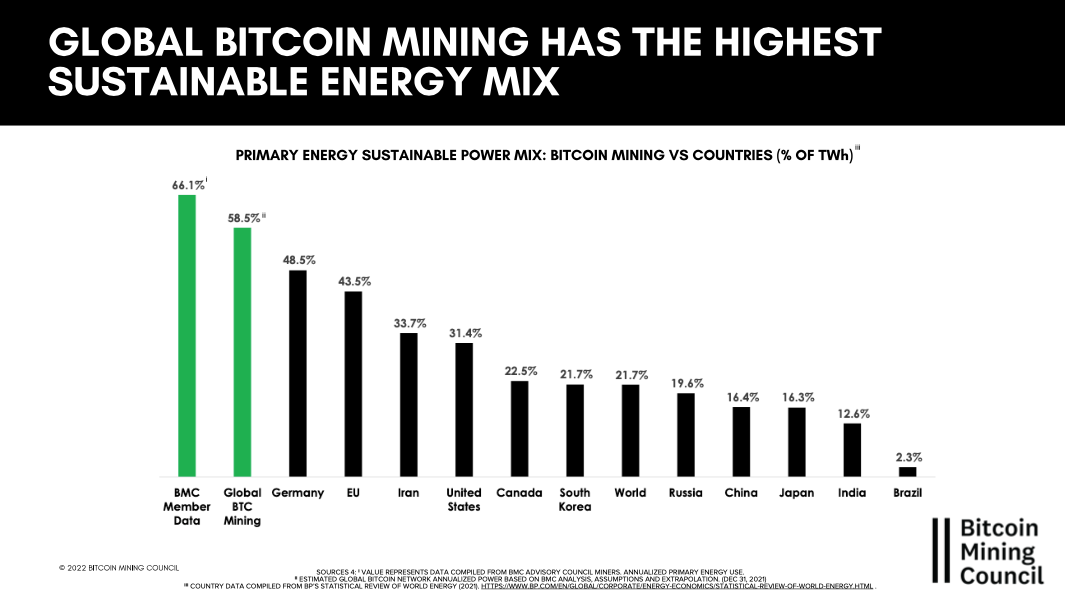

Furthermore, it should be understood that the Bitcoin mining industry uses the most renewable energy sources as compared to whole countries (as can be seen in the graphical representation below).

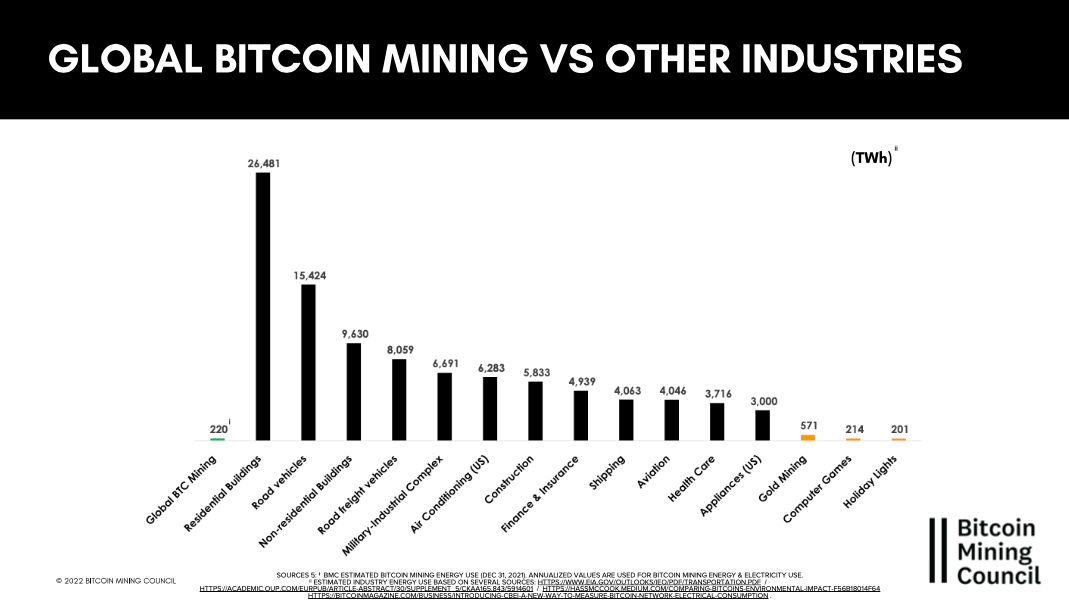

Below is a purely informative comparison of the energy use of Bitcoin compared to other industries. As already described above, such a comparison can be used to get a feeling about the use of energy, since each of the industries shown here, has its benefits for the people and you cannot play them off against each other.

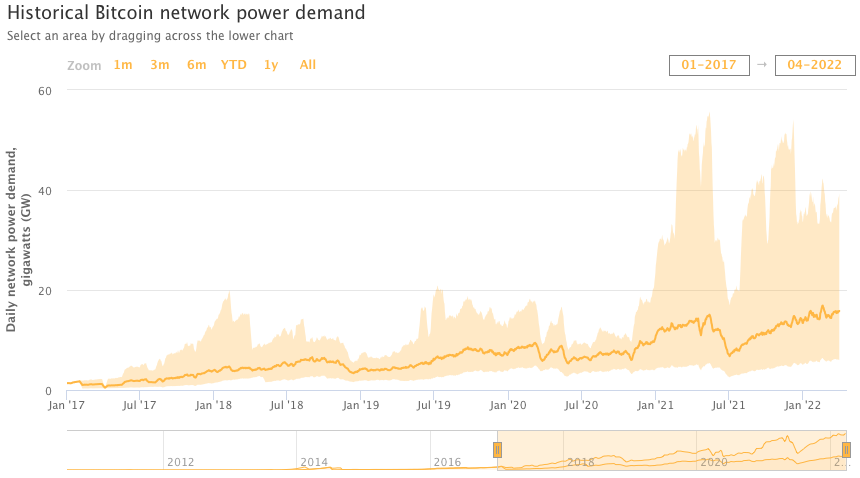

Now one might be startled that in the text above two different energy use values for the Bitcoin network were mentioned, 125 TWh versus 220 TWh. Here it is important to remember that the 125 TWh was the energy use value when China Bitcoin miners were out of the country. At this point, a maximum of 50% of the Bitcoin network's hash rate had been temporarily lost.

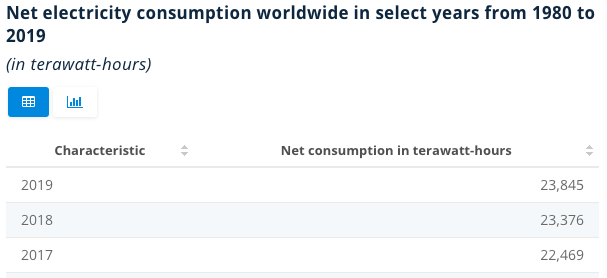

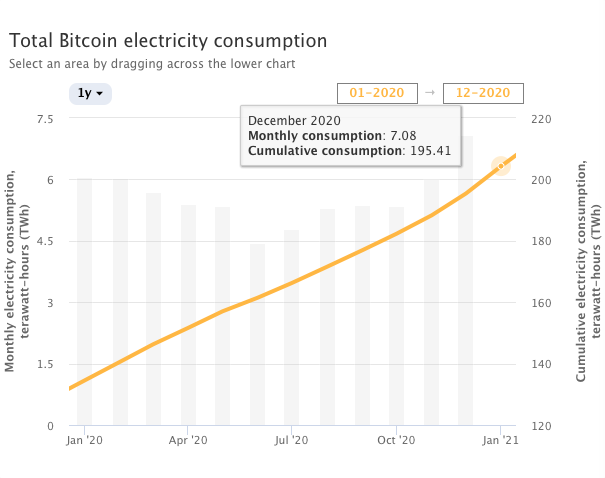

If you now think that you can simply extrapolate the energy use values into the future, you should consider that institutions such as the World Economic Forum had already tried it and made a fool out of themselves to the bone. What happened? In 2017, the WEF published a study that Bitcoin will use more energy in 2020 than all other energy consumers worldwide combined in the year 2017. A few figures: the worldwide energy use in 2017 was around 22,469 TWh, the use of the Bitcoin network in the year cumulatively in 2020 was around 195 TWh, and the forecast was off by a factor of around 115.

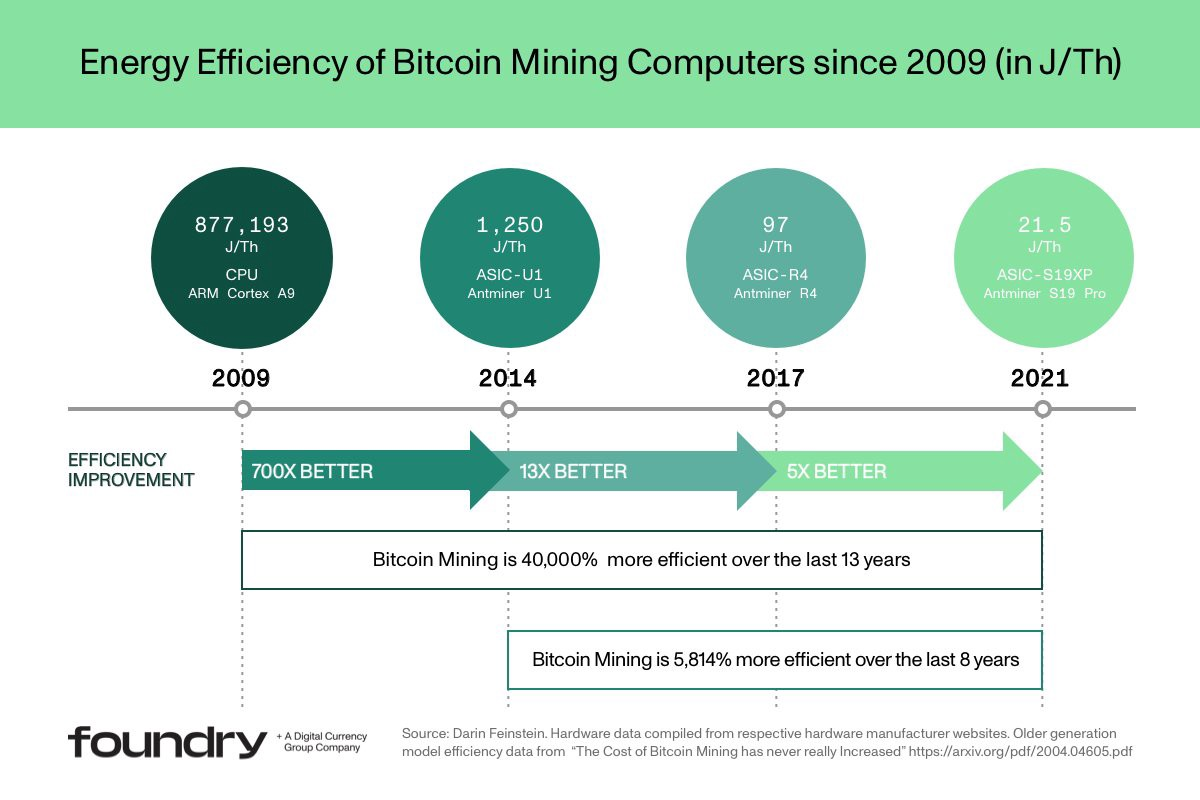

How could this happen? In general, this example shows where it leads someone when you think linearly in a non-linear system. Specific to this case, the authors of the WEF study had forgotten that the efficiency improvements in energy use of Bitcoin mining hardware had improved exponentially. From 2009 to 2021, hardware energy efficiency improved by 40,000%. This means you can compute more hash functions with less energy input.

Then comes the e-waste mace and who is the source for this - Mr. Alex de Vries, who is “loved dearly” by Bitcoiners, with his Digiconomist website (a personal blog with multiple names such as 'Dogeconomist', 'Digiconomist').

While citing this source, it's also worth pointing out that Alex de Vries is a full-time data analyst working for and paid by the Dutch Central Bank.

A study by de Vrie, claims that a bitcoin transaction uses as much hardware as two smartphones. This statement is a recycled variant of his claim that one "Bitcoin transaction uses as much energy as X". At the end of this chapter, I will explain this claim in more detail.

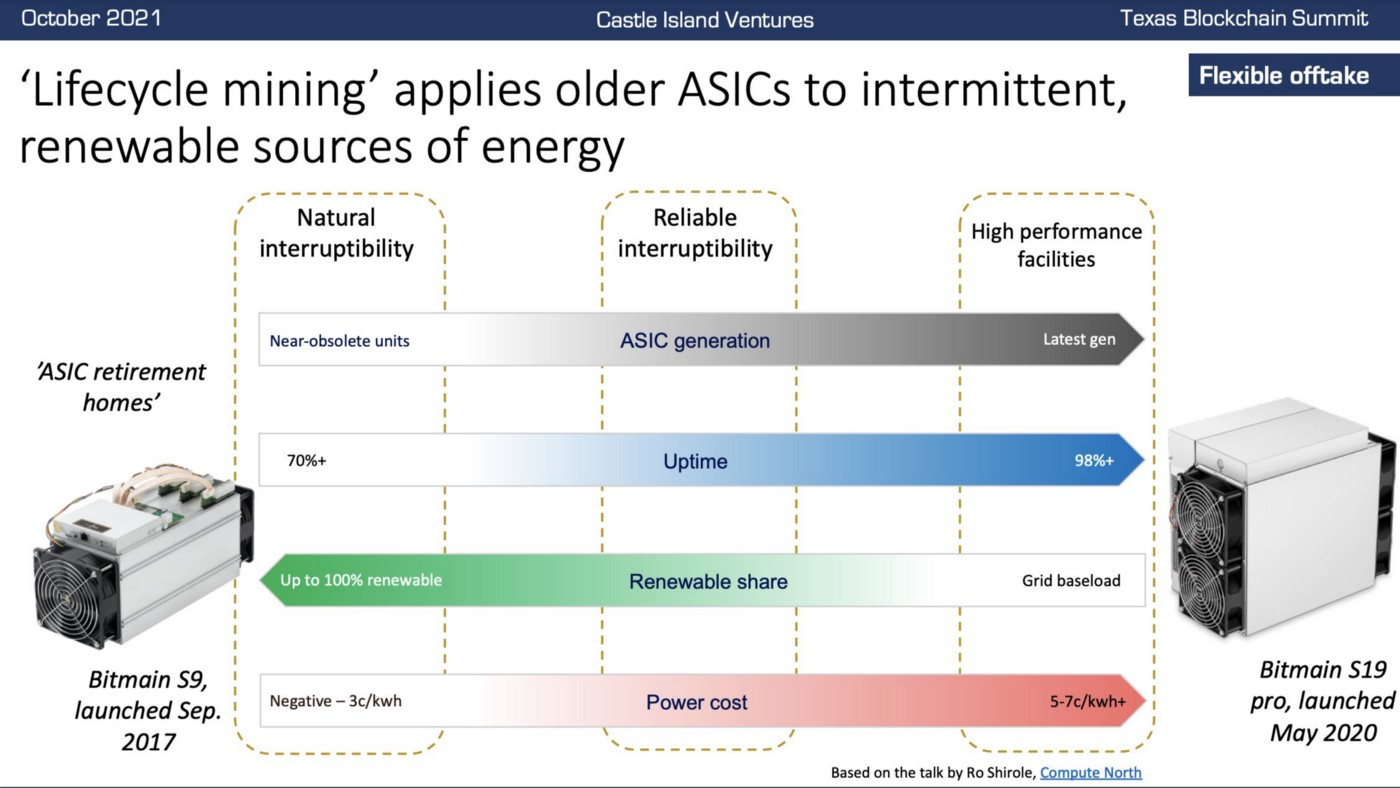

Why is the e-waste mace factually wrong? Mr. de Vries arbitrarily assumes a hardware depreciation period of 1.5 years and that after this period the mining hardware is scrapped. This claim has nothing to do with the reality of the bitcoin mining industry. The big mining companies in the US that are listed on the stock exchange assume a financial depreciation of the machine over 3 years, which they regard as very conservative. This amortization period is an assumption - as listed companies are required to disclose their financial calculations. Financial depreciation has nothing to do with the hardware being scrapped at the end of that period. Around 25% of the mining hardware is still Bitmain S9 machines, which are now 6 years old. In addition, there is a large second-hand market for older machines that can still be used at home, for example. If these machines need to be repaired, they will be repaired. Even if the mining machines have to be disposed of at some point, almost all parts can be reused. These consist mainly of aluminium, copper cables, plastic for the fans and the main circuit boards with the ASIC processors. Older mining hardware becomes less economical to operate over time when energy prices are high. However, if these machines are used where the price of energy is lower, they can continue to operate for many years.

The two authors then attempt to describe the proof-of-work procedure. Unfortunately, they fail. The miners create a block from the transactions that are in the mempool. This packet is hashed, and then the hash of the last block is taken (to make the chain) along with a nonce. From this package, which consists of the three inputs, a hash is calculated again. If the chance works with help of mathematical calculation, the miner will find a hash in the target area. If that fails, only the nonce is changed and the process starts over. If the miner has found the hash in the target area after the targeted 10 minutes, a packet from the input and the output is sent to the network. The network nodes then validate this packet and only then does the miner receive the block reward to which it is entitled. With this, it should be clear that the creation and validation of a block are up to two separate parties in the network. Mathematical chance is needed to solve practically the well-known problem in the information technology of the 'Byzantine generals'. There is no other method of ensuring that a block is created every 10 minutes in a decentralized network with an unknown number of miners at any given time.

Anyone who now thinks of simply buying more mining hardware to get a lot of bitcoins that are still to be distributed (via block rewards) should think about the difficulty adjustment of all 2016 blocks. This ensures that the haystack automatically gets bigger and bigger as more people try to find the needle in it. This means that even if the price of bitcoin keeps going up in terms of fiat, it's impossible to find more bitcoin. That has never happened before.

If you want to learn more about Bitcoin and why only the proof-of-work consensus mechanism can lead to a decentralized, censorship-resistant network, I recommend the book "Discovering Bitcoin" by Yan Pritzker.

Then the hammer of wasting energy is swung again. In purely physical terms, energy can never be wasted, only converted. The two authors of the blog article also have to stick to the reality of thermodynamics. Whether you have a problem with energy use - is and remains a personal problem.

If you ask biologists when a species has evolved, it has always been solely because that species has evolved, and developed the ability to harness more energy. As humans begin to dictate to other humans how energy is used or even restricted, we as humanity embark on a path that leads into darkness.

The authors completely fail to recognize that energy resources are unequally distributed around the world and, unfortunately, are often not found in the vicinity of large human settlements. They also fail to recognize that power grids and generators are always designed for maximum use, for example on the hottest day of the year - when most air conditioning systems are running and consuming maximum energy. However, this inevitably means that the energy network is not operated at the maximum design point for the remaining 364 days and is therefore inherently inefficient. Now, like the authors, you can turn a blind eye to this inefficiency, or you can use this inefficiency, for example for bitcoin mining. This is a constant buyer of excess energy that can be varied quickly in terms of consumption.

A great example is how this year's Texas power grid didn't go down during the winter storm like it did the year before. What happened?

The responsible authorities in Texas have wisely recognized that Bitcoin mining acts as a load balancer in the electricity grid, thereby generating a higher supply of electricity. Last year, power plants set up as a reserve, could not ramp up fast enough to offset the slump in generation and the surge in demand. The result was devastating, the power grid collapsed and human lives were lost as a result. This year, Texas had a buffer in power generation that far exceeded demand. The delta was bought out by the mining plant operators. When the winter storm came, the mining facilities were shut down temporarily and quickly. This enabled the peak in demand and the slump in some producers to be absorbed. The result speaks for itself.

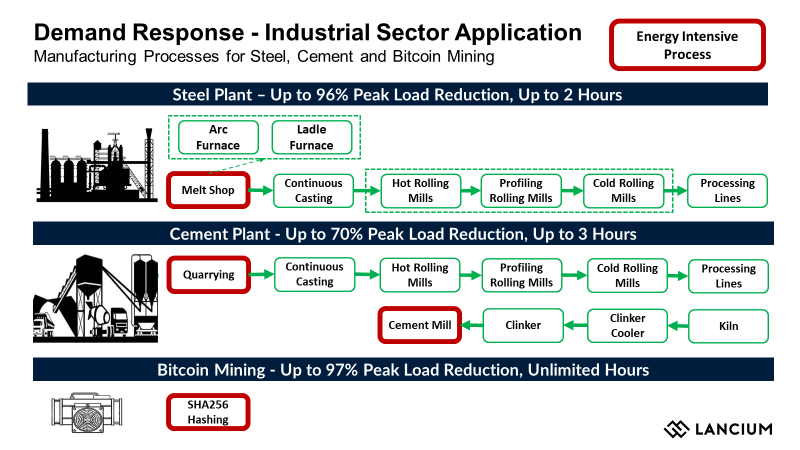

Now you can throw in the fact that you can also shut down other industrial plants to stop the collapsing of the power grid in such a case. Here are a few numbers that show the possibilities without disrupting production:

- A steel mill can shut down 96% of its load for a maximum of 2 hours.

- A cement power plant can shut down 70% of its load for a maximum of 3 hours.

- Bitcoin mining rigs can shut down 97% of their load indefinitely.

One should also consider the capital investment and consumption of scarce resources to settle and relocate other surplus energy buyers, such as aluminium smelters. The latter can happen if other buyers come onto the market who are willing to pay more for the existing electricity.

The only wish the authors have in this paragraph is that the use of energy to be taxed even more. This is inhumane, to say the least.

What the two authors do not address at all is that Bitcoin mining can promote the expansion of renewable energies. It is a fact that the wind is not at its strongest when energy use is at its highest. This requires over-capacity to be built up. The amount of electricity that is not bought by other consumers can be bought up very flexibly by Bitcoin miners. Thus, over-capacity can be operated profitably and without high costs for the other consumers.

Now you might object that you could use the excess energy to produce “green” hydrogen. Here one should familiarize oneself with the inefficient electrolyzers that are needed to produce the “green” hydrogen. Furthermore, the question must be answered as to who is willing to pay the premium for products made from "green" hydrogen. These products can be manufactured more cheaply close to Swedish hydroelectric power stations because there is a constant surplus of energy there. To manage it, there would be the possibility of state subsidies for these products or intra-European customs barriers would have to be introduced.

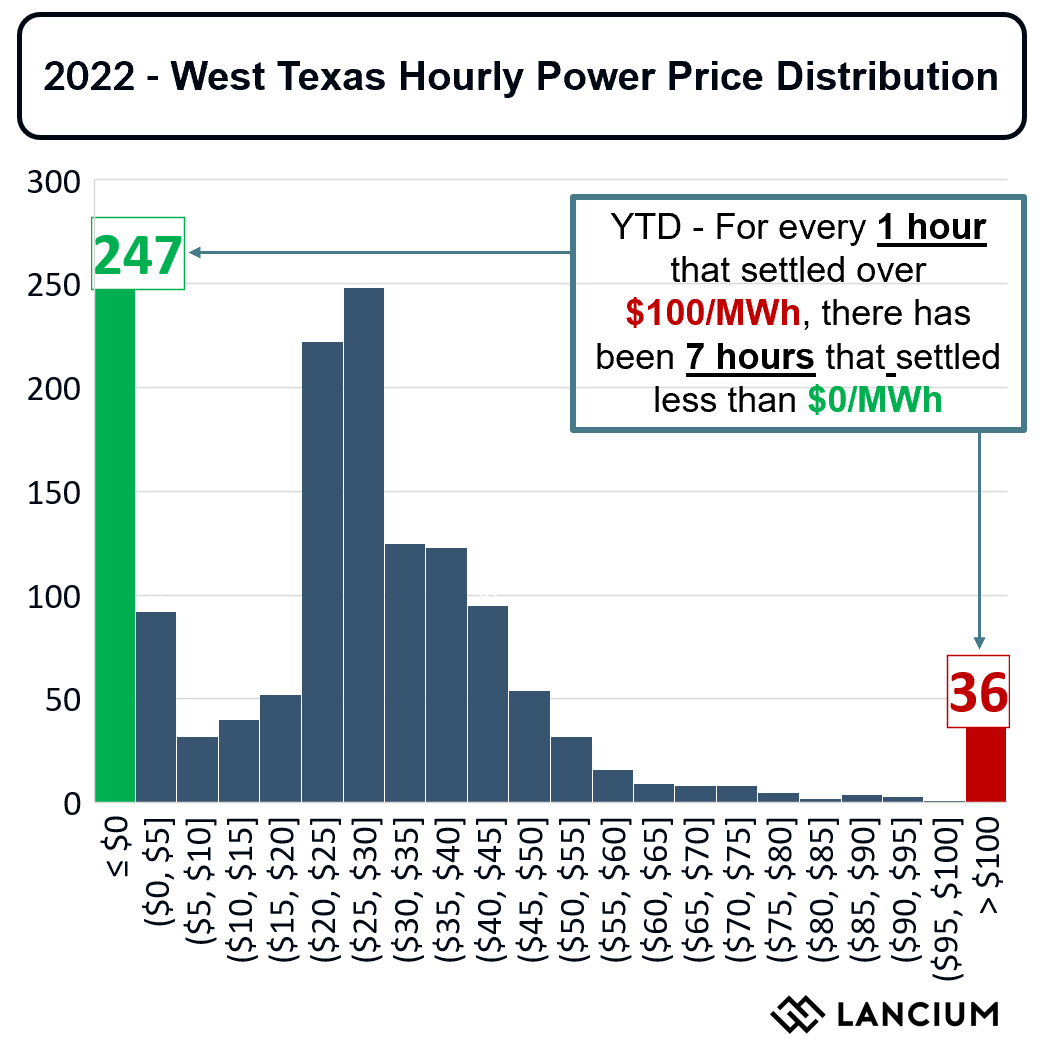

Everyone should be asking themselves how wind power producers are going to survive economically if the demand for wind power cannot be reconciled with the market demand. Here's an example from West Texas, a less populated but windy region. For every hour that was sold at $100 per MWh, there were 7 hours at $0 per MWh. If there is no mobile buyer for this energy in the market, it means:

- either the operator goes bankrupt,

- fewer plants are being built,

- or the end customer is forced to subsidize this directly or indirectly.

If you're interested in learning more about the issue of transmission and follow-up demand not having kept pace with the expansion of wind and solar power generation over the past decade, I recommend this Twitter thread.

The two authors then point out that the Swedish financial supervisory authorities want to ban Bitcoin mining since the climate goals allegedly cannot be achieved without such a ban.

However, the two authors studiously conceal the fact that, as a reaction to this statement, the company Vattenfall, controlled by the Swedish state, contradicted the statements made by this authority two days later and had put forward the following points :

- That mining is an excellent "buffer" in energy production, very useful for controllable load management and a way to monetize excess energy that would otherwise be lost.

- That the power grid is strengthened and not weakened as a result.

- That if the Swedish Financial Regulator and Environmental Protection Agency were concerned about the environment, it would be a wrong decision to ban crypto mining *here (in Sweden)* where there is - a lot of green energy.

- That if countries with good access and good infrastructure for extracting fossil-free energy would ban mining, which would involve the migration to countries where there is a risk that mining would take place with fossil energy and thus with more CO₂ emissions. A ban in Sweden would do more harm than good to nature.

How did this communication disaster come about? Apparently, the regulators' statement was based on a couple of Google searches. This unscientific work by the Swedish authorities now forms the basis for possible regulation in Europe.

Everyone can have their own thoughts about the carelessness shown by the policymakers in Europe.

In this chapter, one has to give the two authors of the blog article credit for circumnavigating a cliff that has already thrown quite a few critics to pieces. They did not cite the 2018 study by Mora et. al, which states that Bitcoin emissions alone will ensure that the global temperature will rise above 2°C. First of all: Bitcoin itself does not cause any emissions. These are caused when the energy is generated. Secondly, if you have carefully read the upper paragraphs in this chapter, then considerable doubts should be there as to how Bitcoin would be able to do this. What is very interesting about the study by Mora et. al, it uses as a reference among other sources, a study by de Vries, A. Joule 2, 801-805 (2018) and the Bitcoin Energy Usage Index from the Digiconomist website, released in 2017.

To confirm the statement made in the Mora et. al, that the "Bitcoin emissions alone will ensure that the temperature will rise above 2 °C", to lead ad absurdum, here is a comparison to total worldwide CO₂ emissions.

The total worldwide CO₂ emissions were 36.4 billion tons in 2021, that is 36,400 megatons.

The energy production of the Bitcoin network has the following carbon footprint:

- Digiconomist, predicts around 114 megatons of CO₂ or 0.3% of total global emissions.

- Coin-Shares, predicts around 41 mega-tons of CO₂ or 0.1% based on total emissions.

How can something that is a rounding error in the total world CO₂ emission could have such a significant impact on temperature as the study by Mora et. al postulated?

One possible explanation is that this study was not written by Camilo Mora himself, but was written by "undergraduate students at the University of Hawaii at Manoa. " If you want to know more about this sleaze comedy, I recommend this podcast episode.

The thesis of Mora et. al and the study by de Vries (2018) cited al is the thesis in which the energy use of the Bitcoin network has been expressed in terms of “electricity consumption per transaction” and formulated in that manner. Here is a quote from the conclusion.

Since the Bitcoin network only processes 200,000 transactions per day, this means that the average electricity consumption per transaction is at least 300 kWh and could exceed 900 kWh per transaction by the end of 2018.

Three comments on this statement:

- First, the bitcoin network uses energy to secure the network against attacks, including transaction history and bitcoin ownership. With this fact alone, the statement of "electricity consumption per transaction" is scientifically untenable.

- Second, The Bitcoin network now has so-called Layer 2 applications such as the Lightning network. This network is theoretically capable of executing up to 40 million transactions per second without affecting the energy usage of the Bitcoin base layer.

- Third, Mr. de Vries later made the following statement in an interview:

Of course, I agree that it is wrong to say that more transactions automatically mean more energy consumption.

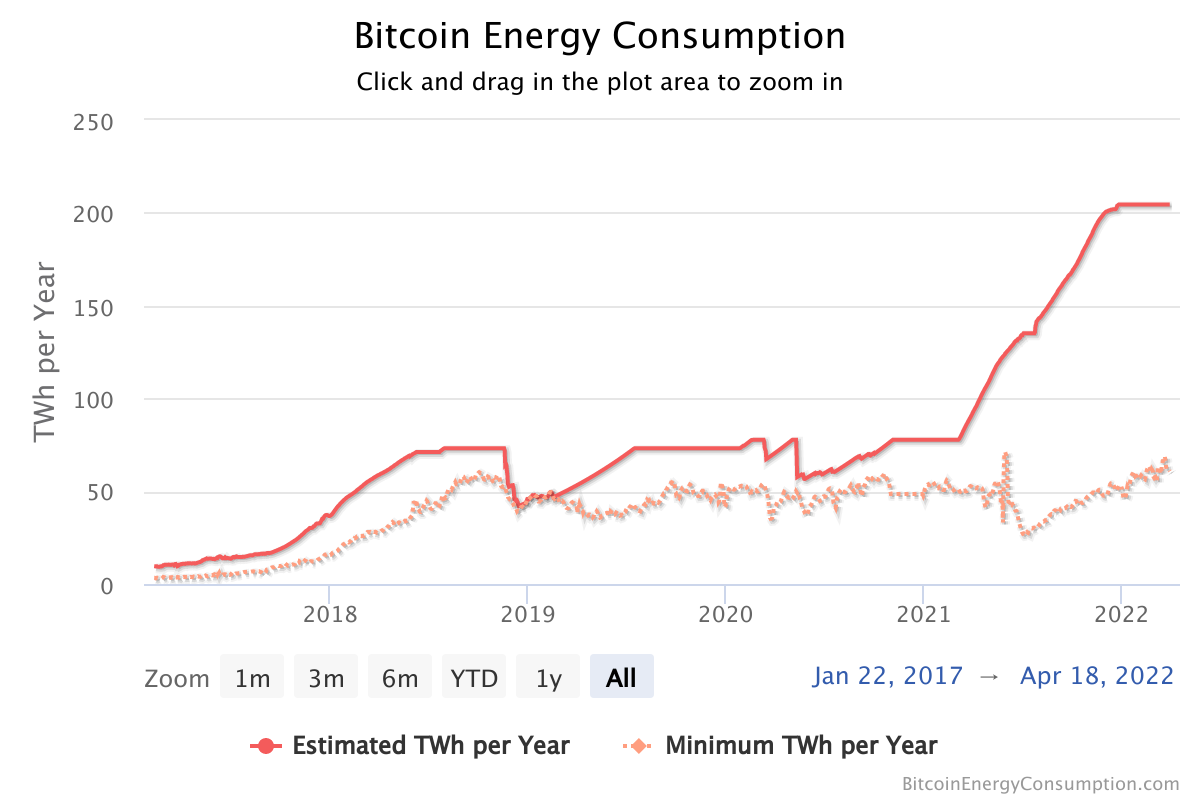

Furthermore, when comparing the Bitcoin Energy Index from the websites Digiconomist and the Cambridge Centers for Alternative Finance (CCAF), the following observations can be made:

- At the end of 2017, Digiconomist reported energy use of around 37 TWh and CCAF of around 40 TWh. It follows that CCAF reported a 7.5% higher value for energy use at this point.

- In mid-November 2018, Digiconomist reported energy use of around 73 TWh, which has dropped to around 43 TWh by mid-December. In comparison, CCAF showed an energy use of 52 TWh, which then dropped to 37 TWh. For this period, Digiconomist reports around 29% higher consumption values for mid-November and around 14% for December. The two points in time were chosen because this is when the Bitcoin market switched from a bull to a bear market. This made mining uneconomic for some operators, leading to a reduction in hash rate and eventually energy usage.

From this, it can be deduced that it is always advisable to consult different sources on the use of energy, especially for a study with such a daring thesis as that of Mora et. al.

However, these two graphs reveal another very interesting fact. In the period from May to December 2021, Digiconomist reported a constant increase in usage from 81 TWh to 201 TWh, however, during the same period CCAF has seen a significant drop in energy usage. This period was chosen because the Bitcoin miners were banned from the PRC during this period. As a result, the hash rate dropped by around 50% at maximum. As of the end of 2018, this should indicate a corresponding slump in energy use. Why doesn't Digiconomist list this? The website Digiconomist publishes the following statement:

Of course, such a sharp drop in active devices also affects the energy consumption of the network. Unfortunately, one can never say exactly by how much. A 50% drop in computing power does not necessarily mean a 50% drop in power consumption.

Any adjustment would be arbitrary due to the difficulties encountered so far in determining the most likely impacts on energy use. For this reason, no adjustments have been made to reflect the immediate impact of the ban.

Now, one should ask why CCAF manages to map the physically required fact that a reduction in the hash rate is accompanied by a reduction in the energy use of Bitcoin and Digiconomist is not? Furthermore, why did Digiconomist do this at the end of 2018? More background on this issue can be therefore found here.

The Danger of Redistribution from Bottom to Top

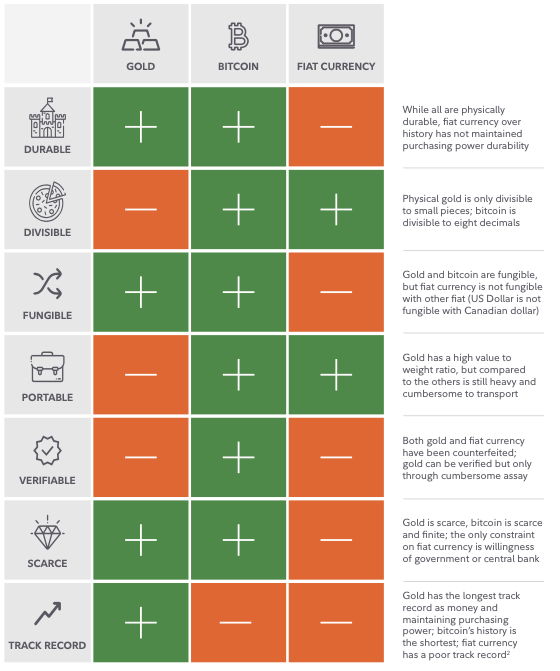

Now the authors write that there is a consensus that bitcoin has not established itself as a currency. One should bear in mind that two economists with a doctorate are writing here and they do not seem to know the difference between money and currency. If they knew, they would have realized how nonsensical their statement is. Bitcoin is money and not a currency.

A currency is issued by a state, its use is enforced by the state through various monopolies and is, therefore legal tender. Money is a form of currency that is widely accepted by the market and is highly liquid. Money can but does not have to be a currency.

To see how bitcoin compares to other means of payment, you have to compare it to others based on various characteristics.

One of the largest wealth managers in the world is Fidelity and they published a study called "Bitcoin First" a while ago, from which I took the following chart. As it stands, bitcoin is the clear winner over fiat currencies in terms of monetary properties. It is very surprising how the two authors came to their conclusion.

Now one can argue that bitcoin is volatile. It is worth remembering here that bitcoin is evolving as money and it must go through various stages before it becomes a general medium of exchange and a unit of account. Vijay Boyapati outlined four stages in his article 'The bullish case for bitcoin'. A good that will develop into money must go through these stages:

- collectable;

- store of value;

- medium of exchange;

- unit of account.

Bitcoin is about to go through the second stage of this development. As bitcoin evolves, its volatility will decrease, but so will its value measured in fiat increases.

A possible explanation for why so many people struggle with bitcoin is that bitcoin is developing into full-fledged money within one, or maximum two human generations. For comparison: gold needed around 5000 years for this.

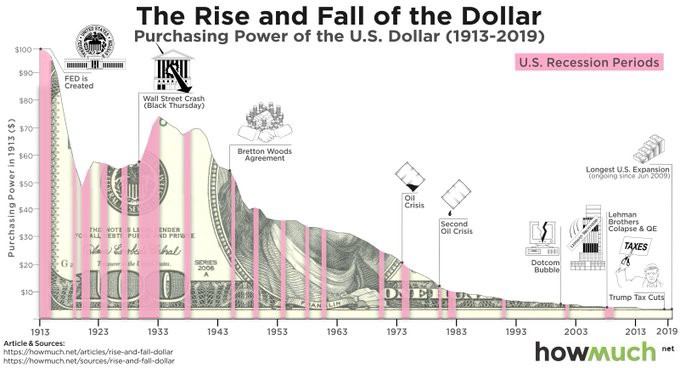

In the 13-year history of the Bitcoin network, it has always been shown that measured in fiat over a maximum period of 4 years, one has never suffered a loss. Since the network effect increases continuously from year to year, it can be assumed that this will also be the case in the future. What is once again striking is, that Bitcoin is presented poorly and not a word is said about the weaknesses of the fiat system's side of the comparison. However, it should be remembered that the Euro has steadily lost purchasing power since its inception. It has lost 32% of its purchasing power since the beginning. If you look at the US dollar, 100 US dollars from 1913 is only worth 3.87 US dollars today. That is a 96.13% loss of its purchasing power.

Could it be that the two authors are desperately trying to distract attention from the obvious weaknesses of the fiat money system?

Now comes the speculative argument. Bitcoin is only a speculative investment and the bubble will burst soon. Now the Bitcoin network has been around for 13 years, with no CEO and no marketing department to put out fancy colourful brochures. Compared to the Euro itself, which has been around only 22 years. Nevertheless, it has grown from zero euros to a market value of around 741 billion euros and the bubble simply does not want to burst, as much as the two authors wish it to. Here the question of why arises.

This is due to the network effect, as more and more people choose to use Bitcoin voluntarily, the network gets stronger and thereby becomes more attractive for other people to maybe also use it voluntarily in the future.

This effect is comparable to the growth of the Internet, e-mail and various messenger services. Now one can make the argument that another better Bitcoin is simply being developed. Bitcoin is open-source software and can be copied and modified by anyone who wishes. Now the tip for those who still want to try it, various people have thought so too and more than 60 projects have all more or less failed. What cannot be duplicated are the users of the network. A Bitcoin user will only use another payment network if it is at least 10 times better in the sum of the individual properties. For example, remember the last time you completely switched messenger services.

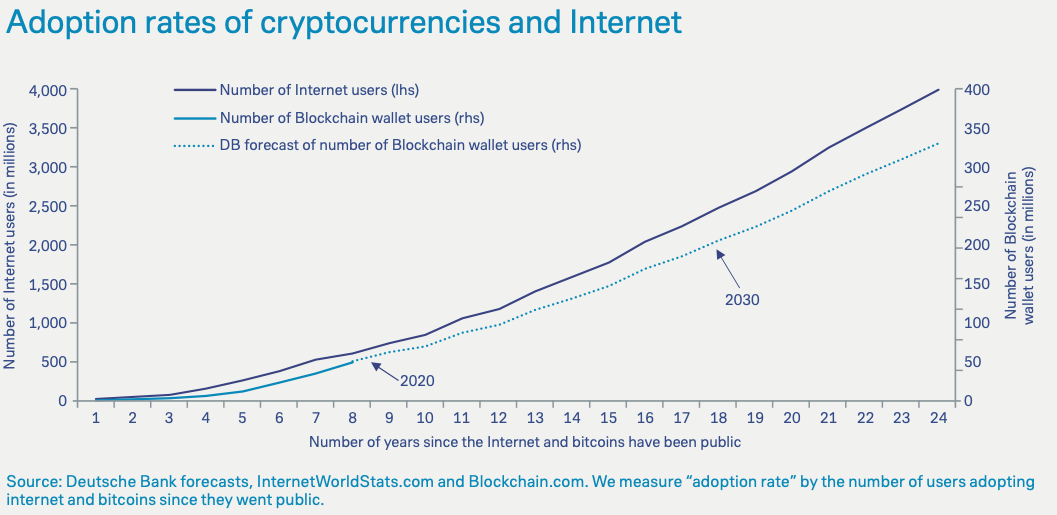

If you compare the adoption rates between the Internet and the bitcoin network, you can see that they are in sync. This can be seen very clearly in the following graphic from Deutsche Bank's research magazine "Concept". This can be found on page 60 of this magazine.

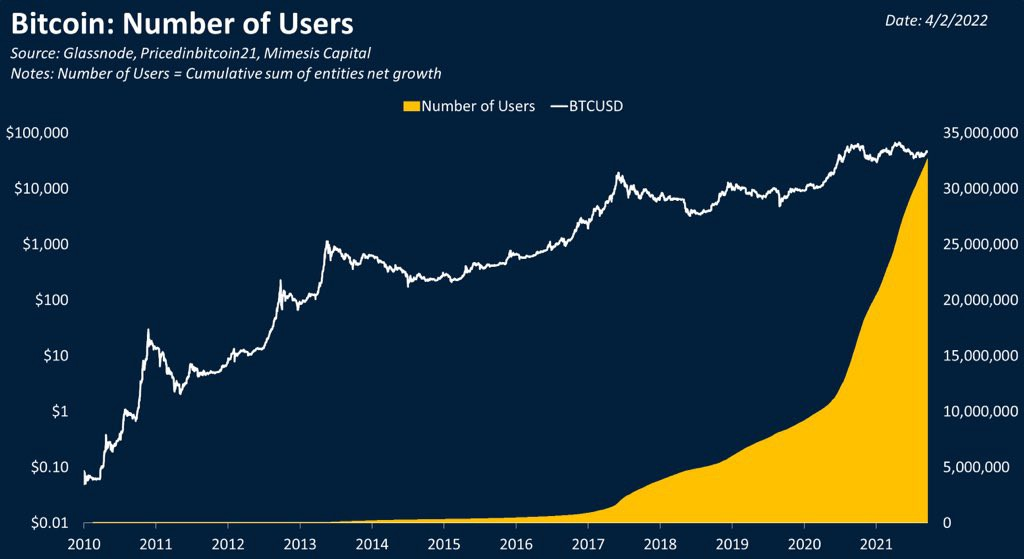

The following graph gives a good overview of the Bitcoin adoption rates; 32.7 million people worldwide are currently using the Bitcoin network.

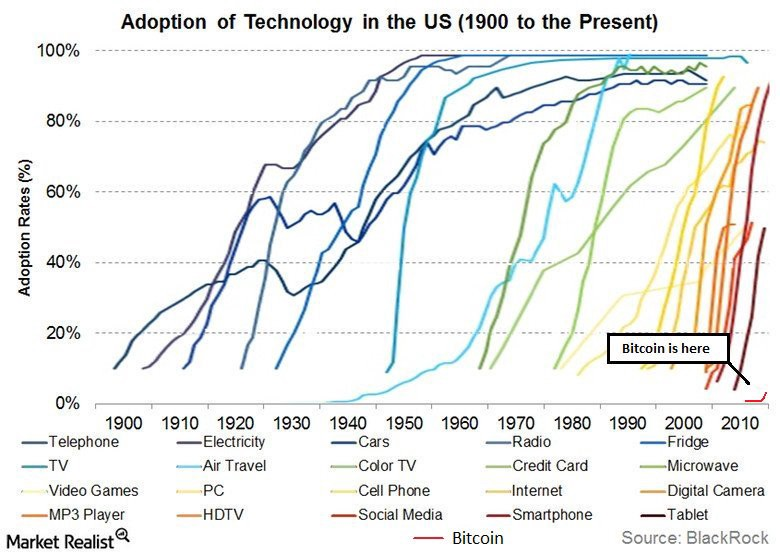

If you think you've missed the boat, I can reassure you that you haven't. Adoption of the Bitcoin network has only just begun, as illustrated in the chart below. This was taken from Davethewave 's article "Mass Adoption, and the S Curve". A second very readable article that I can recommend is "Speculative Bitcoin Adoption/Price Theory" by Michael B. Casey.

The two authors then come up with the argument that social cohesion would be permanently disrupted. The rationale is that people who later joined the network suffered losses. As discussed above, it took a maximum of 4 years in terms of having bitcoin, to even consider any loss in terms of fiat.

Now the question arises, what has more serious consequences for the lasting disruption of social cohesion? That people voluntarily join another money network not under the control of the central bank? Or the irresponsible expansion of the money supply in the banking system, which then shows its socially destructive effects in the Cantillon effect, the overexploitation of resources, asset price inflation and the loss of purchasing power of the national currency?

For me, the gradual and steady loss of purchasing power has the most corrosive and lasting effect on social cohesion. Since it drives people who live at the lower end of our society more and more into the corner of existential distress and makes life and participation in society more and more difficult.

The devaluation of purchasing power is the actual cold monster that supports the state and robs people secretly, coldly and sustainably.

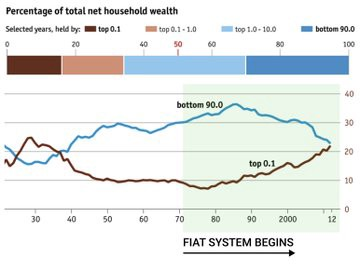

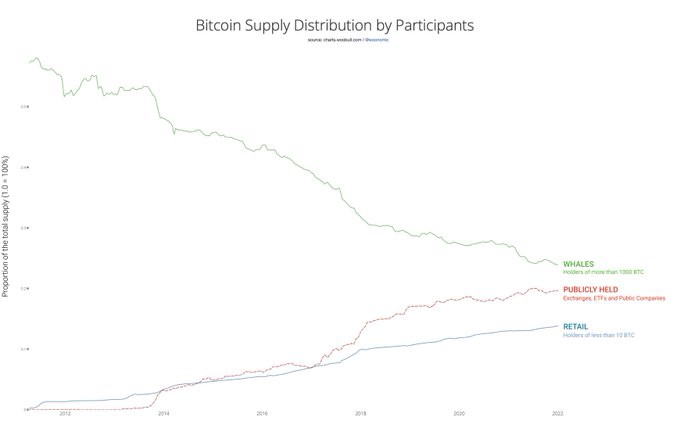

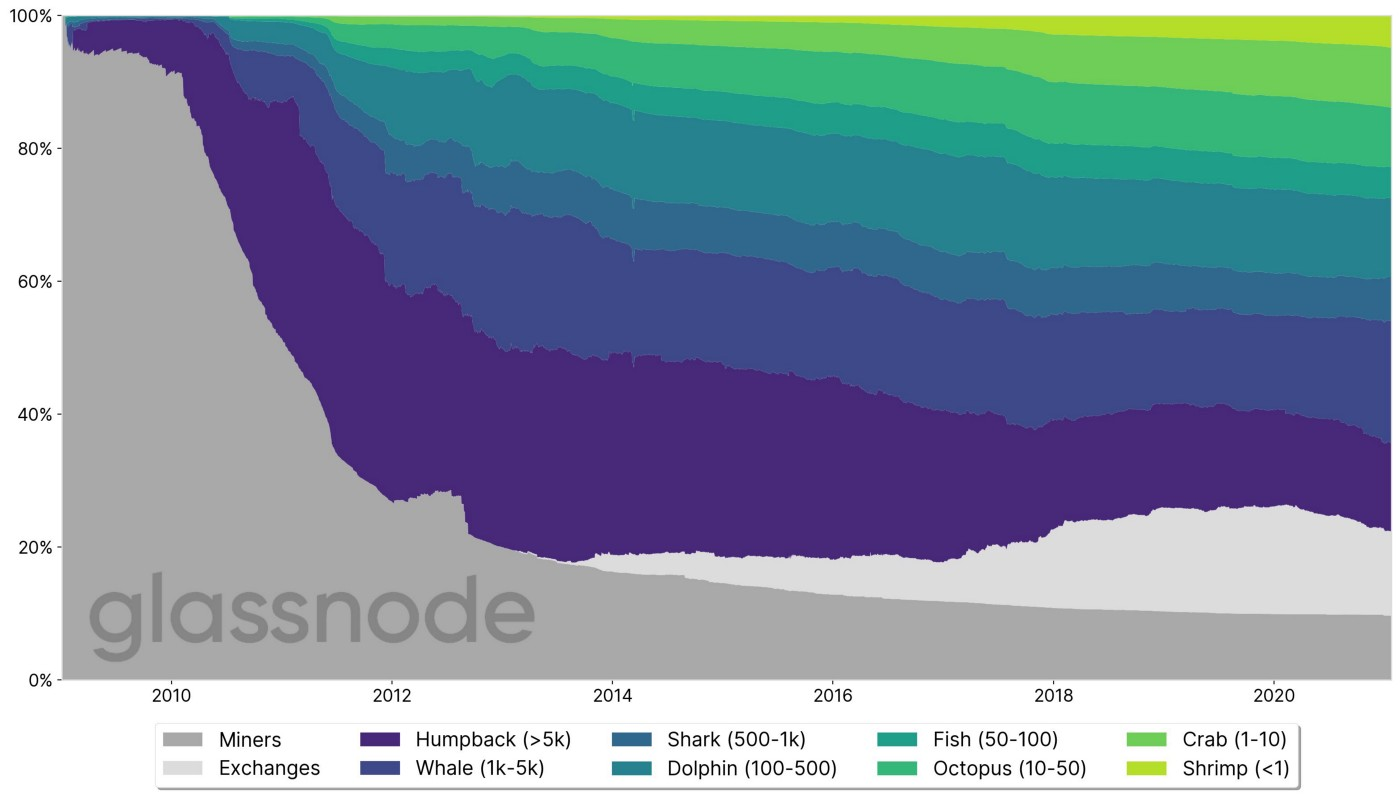

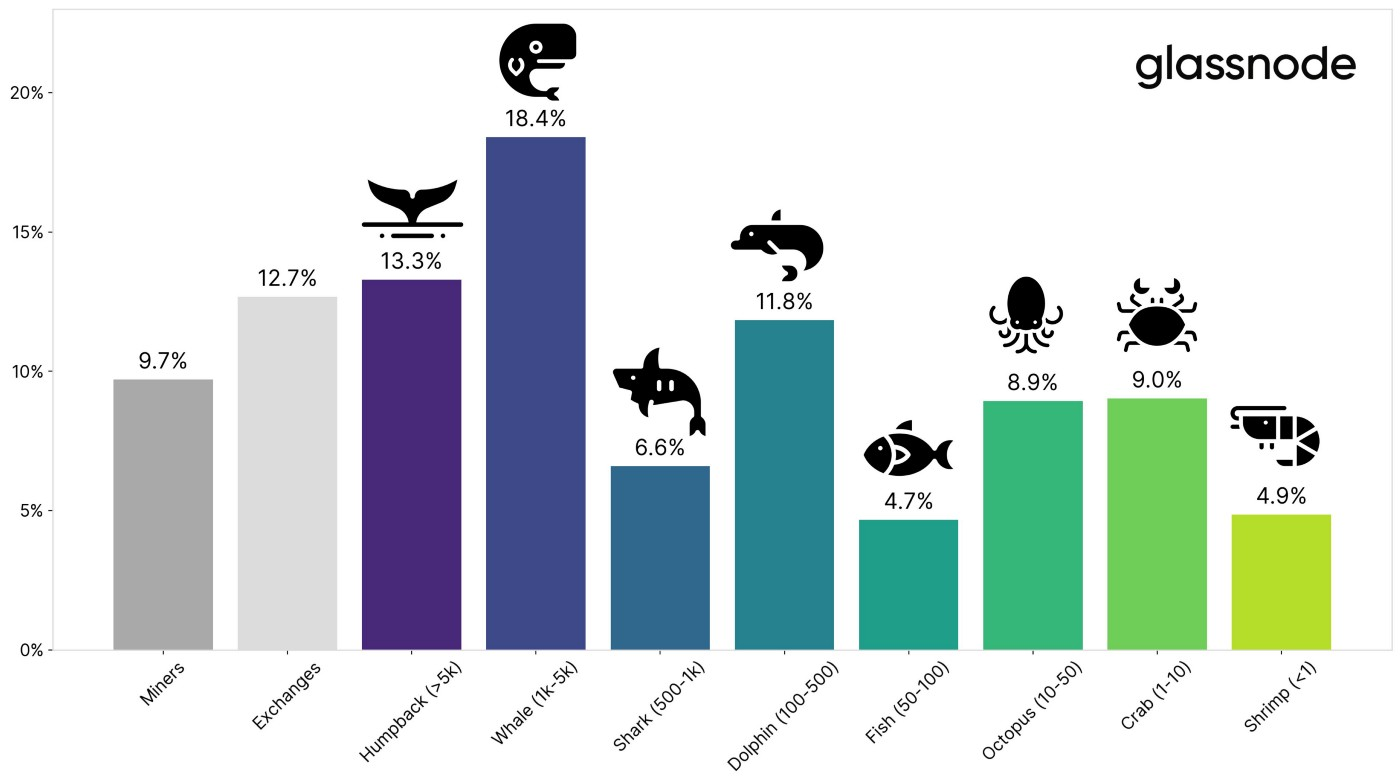

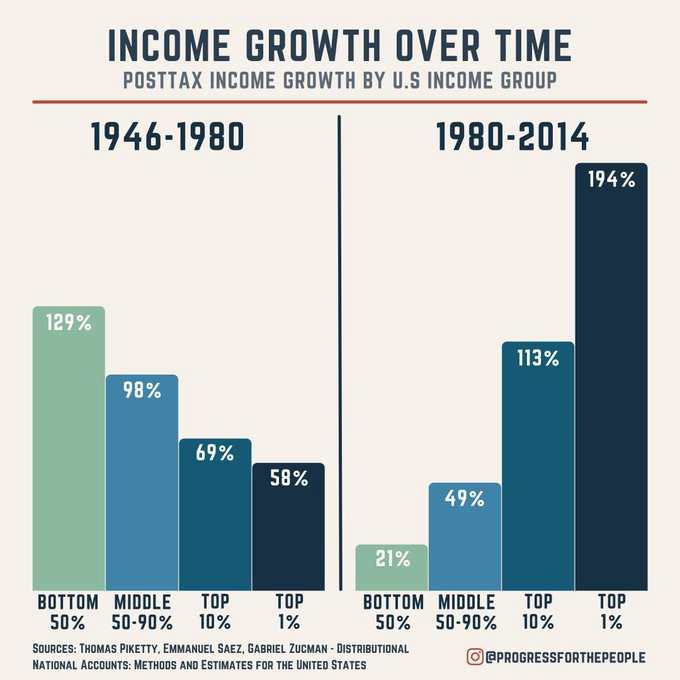

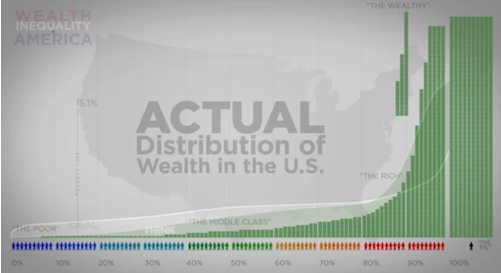

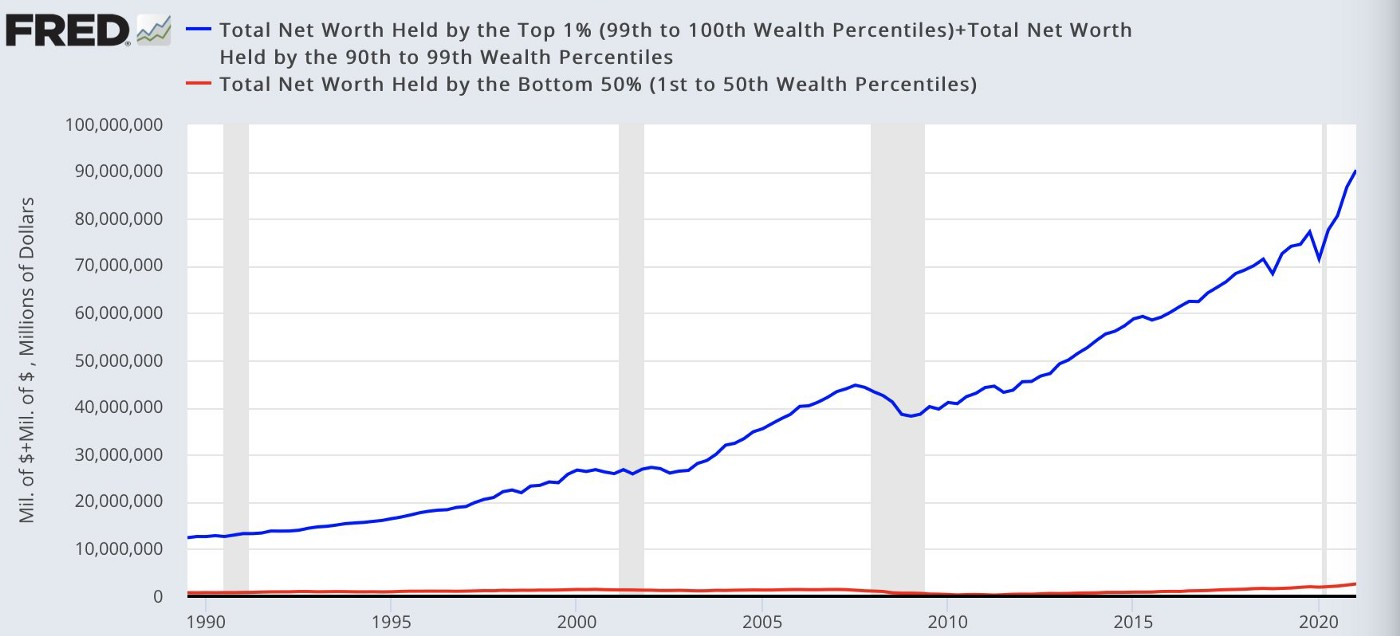

How has the distribution of wealth changed over time? On one side there is the fiat system that came into existence after the gold peg was lifted in 1971. On the other hand, the Bitcoin network has existed since 2008. What you can see very well in the two graphs below is that in the state-backed fiat system, the 0.1% of the richest people are getting richer. In the Bitcoin network, however, the proportion of addresses with many bitcoins, so-called whales, is constantly and steadily decreasing.

Below is another overview that supports the argument that over time, bitcoins will shift from big addresses to small ones.

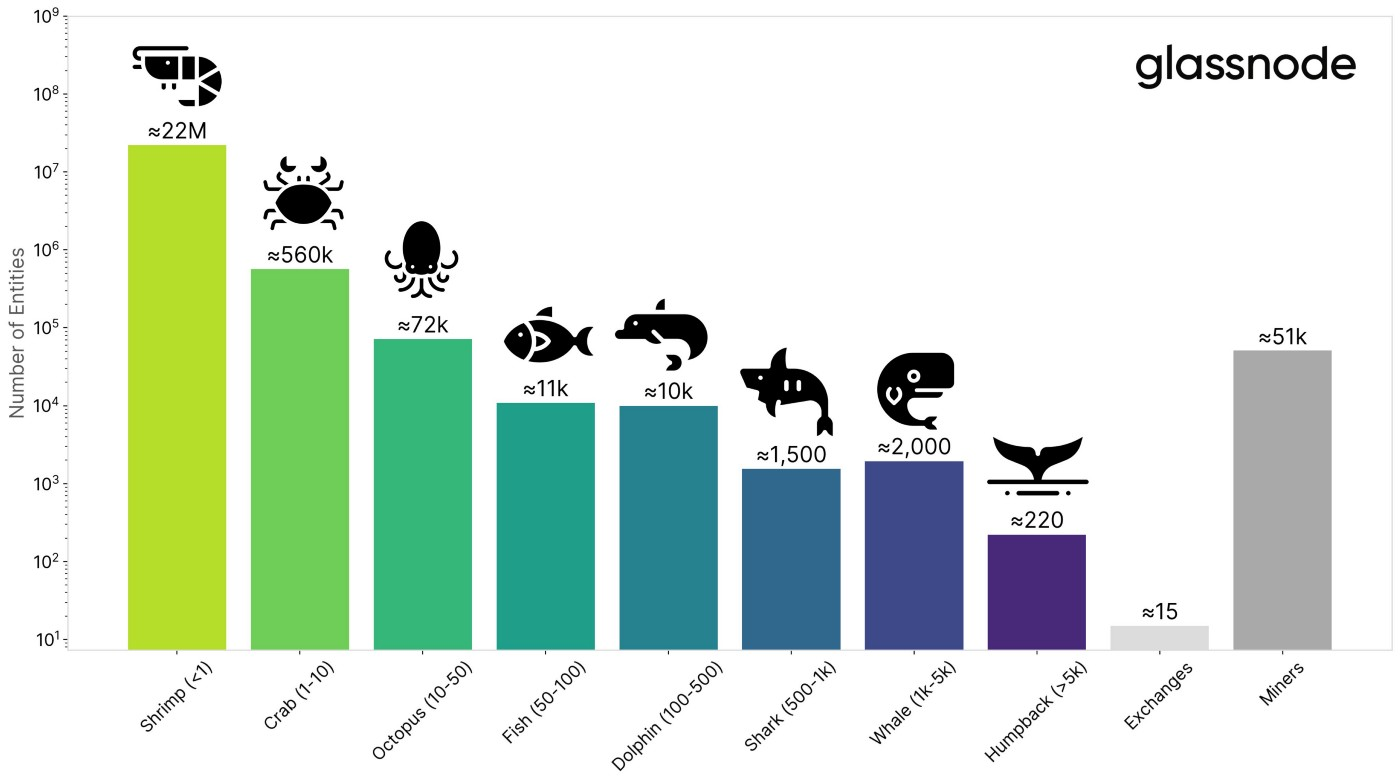

The following overview shows the naming of addresses in the Bitcoin ecosystem.

Here is a similar overview, but this shows the percentage distribution of address sizes in the Bitcoin ecosystem.

If you look at the distribution of wealth among sections of the population in a gold-backed and non-gold-backed government currency system known as the fiat standard, it's easy to see where the problem lies. The money supply expansion in the fiat standard without the paper money being backed by gold plus the Cantillon effect ensures a wealth transfer from the bottom up. This is created and supported by state institutions such as the central bank and the subordinate banking system.

Now the following question arises. Can we blame the richer people for the unequal distribution of wealth? I think no, there were, are and always will be differences in society. As can be seen from the figure above, before the gold standard was abolished, the growth in wealth among the population was distributed in such a way that the poorer sections of the population were able to increase their wealth more in percentage terms than the richer sections of the population. In my opinion, the disproportionate wealth increase of the richer people in the fiat standard is a symptom, not the cause. This must be sought in the underlying financial system. One possible candidate for this is the expansion of the money supply. Now the following question must be asked: How is the expansion of the money supply ensured?

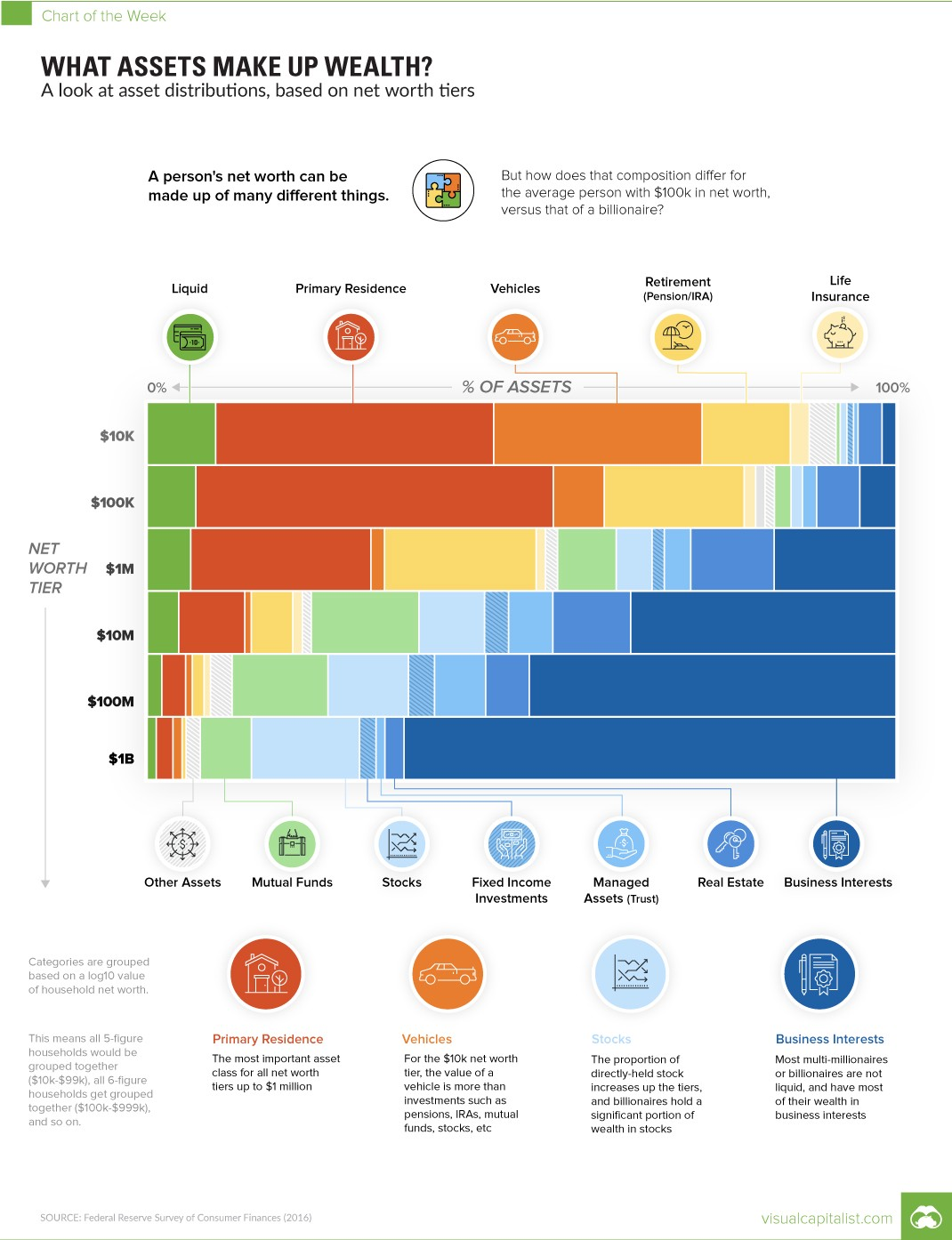

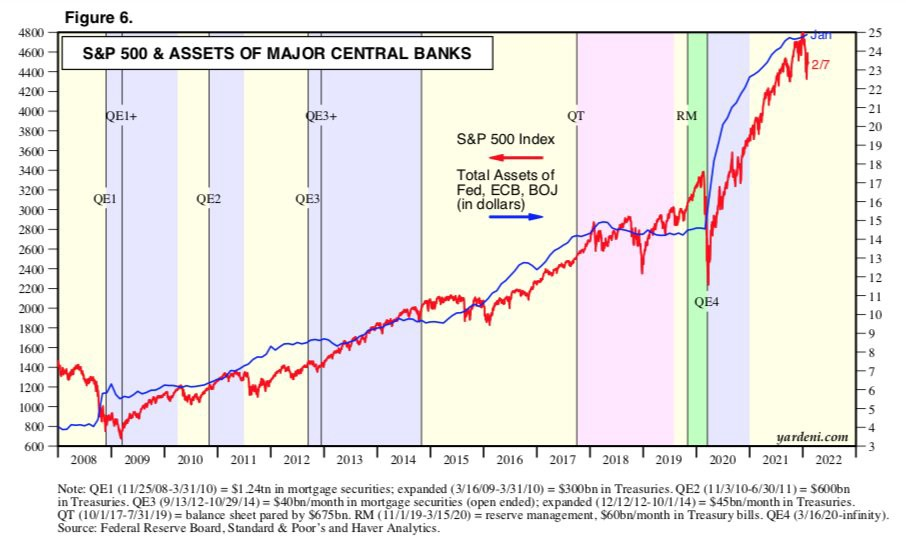

One possible explanation is that richer people own stocks, real estate, and businesses. These goods have one thing in common: they are rare. This means that they cannot be reproduced easily, arbitrarily and at a low cost. As the available money supply in the market expands and then encounters these scarce commodities, the price one has to pay for these scarce commodities is bound to increase. Here are a few pictures that illustrate this, using the example of the USA.

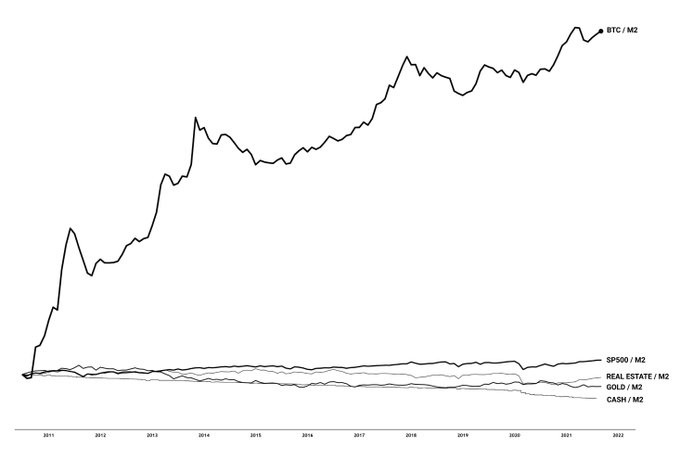

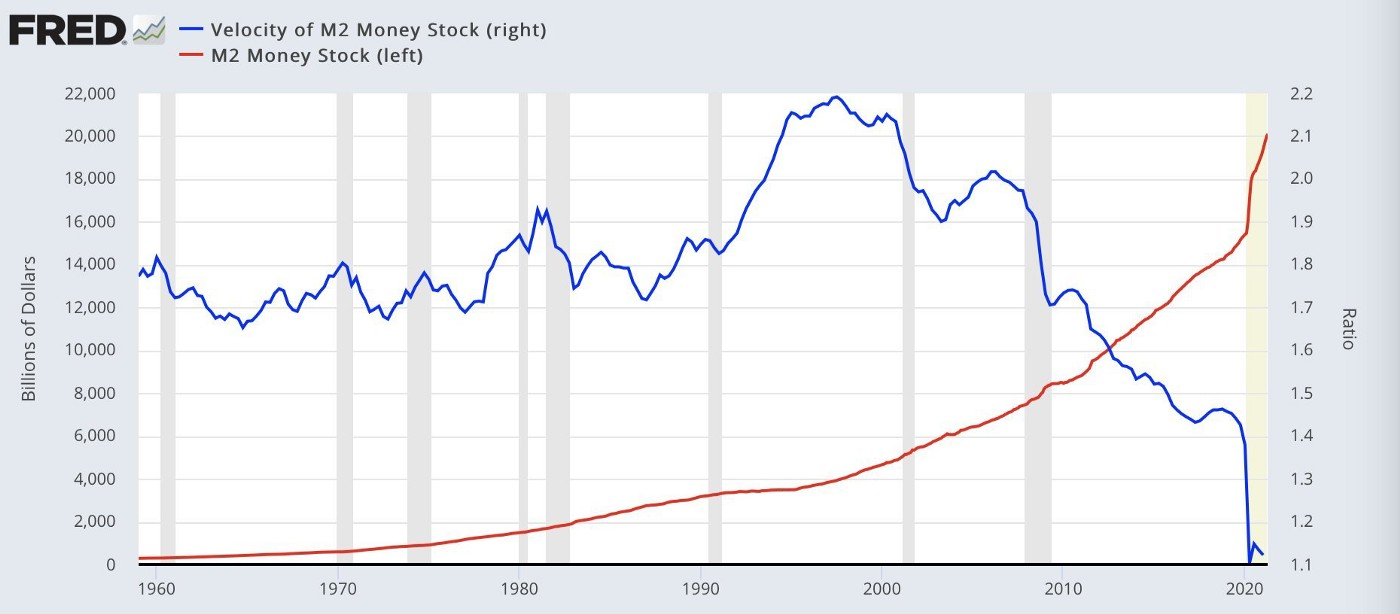

Now the following question inevitably arises. Can a stockholder add value when a constantly expanding money supply meets this scarce commodity? If you look at the development of the S&P 500 stock index measured in US dollar money supply M2 since 1997, then you have to come to the following conclusion. Shareholders, if they bought at the right time, could increase their wealth, others could maintain it, and others suffered a loss.

If you compare the top graph with the one below, you can see a semblance that gives us the illusion of something that doesn't exist, the increase in prosperity for shareowners. The chart below shows the same S&P 500 stock index, but this time measured in US dollars. What can be seen here is no matter which moment in time you invested your money during this long period, you could always benefit from a price increase.

One might think that one would have preferred to bet on gold or real estate, but here too, measured in terms of the M2 money supply, the curves for these asset classes are almost flat, if not slightly negative. What is interesting to see is that only bitcoin has been able to add value as measured by the money supply expansion. Why? The better, harder, rarer money will prevail, even if the "mainstream" economists do not want to admit it.

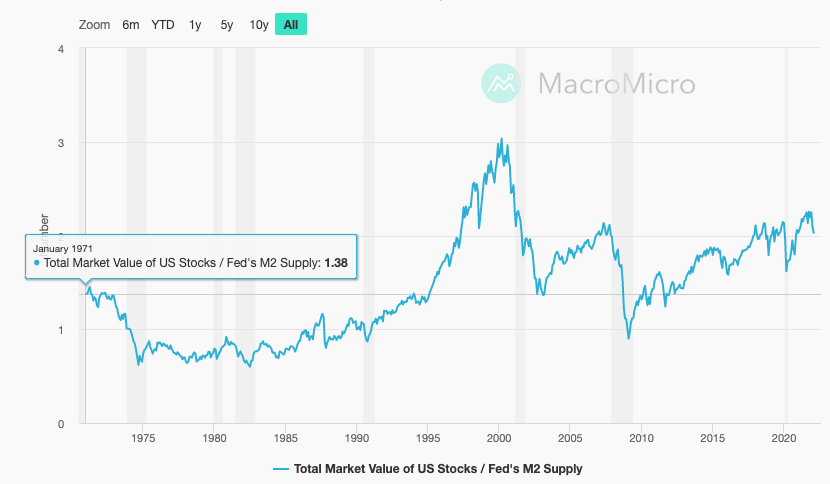

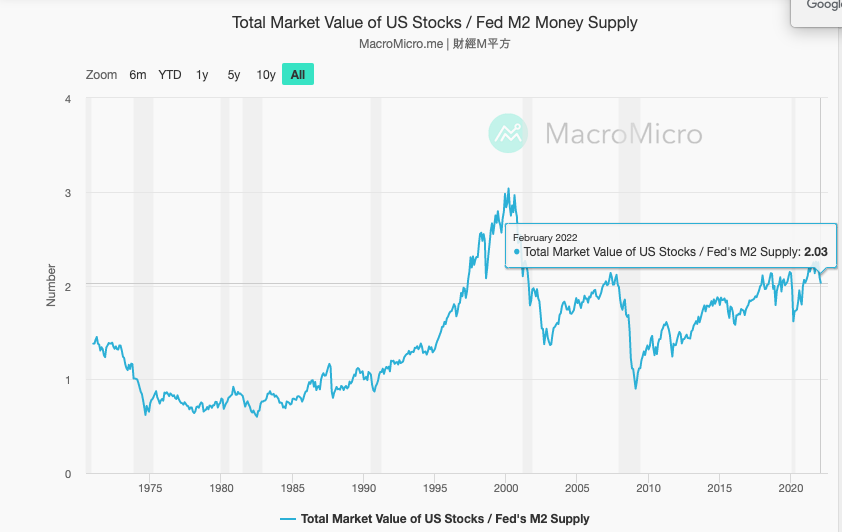

The graphs above refer to the period from 1997 to today, what was it like before? The following charts show the development of the entire US stock market, measured in M2 money supply, from 1971 to 2022.

In January 1971, the ratio between the two was 1.38. In February 2022, this increased to the ratio of 2.03. This means that the market value of the entire US stock market has increased at a rate of 0.012 per year. Over the entire 51-year period, the ratio has increased from 0.65.

What happened in 1971? US President Richard Nixon had temporarily lifted the gold backing of the US dollar.

As it can be seen from the two charts above, after the bursting of the "dot-com bubble" the US stock market was unable to record any added value compared to the money supply M2. How could this happen? This is where quantitative easing in monetary policy comes into play. This is nothing more than a euphemism for an unconventional form of central bank expansion of the monetary base, or money supply expansion for short.

Now one might object that the monetary units newly created at low cost seep through the system, at some point enter the economic cycle. However, if you look at a comparison of the money supply M2 and the velocity of circulation of the US dollar, then you can see that this is not happening. The newly created money goes straight into investments such as stocks, real estate, gold and so on.

Since so much has been written about the M2 money supply and its growth in this article, here are some details.

The money supply M2 for the US dollar has the following values:

- in January 1971 it was 632.9 billion (US: trillion) US dollars;

- in January 1997 it was 3,834.6 billion (US: trillion) US dollars;

- in January 2022 it was 21,728.8 billion (US: trillion) US dollars.

It follows that this money supply has had a compound annual growth rate of around 7.2% over the 51 year period, including the last 25 years.

For comparison, the US gross domestic product from 1997 to 2022 has the following values:

- In 1997 it was $8,577.55 billion;

- In 2021 it was $24,796.08 billion.

This equates to a compound annual growth rate of around 4.3% of US gross domestic product for the last 25 years.

What is the situation in the euro area? The money supply M2 in the euro area has the following values:

- In 2009 it was 8,208.8 billion euros;

- At the end of 2021, it was 14,692.6 billion euros.

It follows that over a 12-year period, this money supply has had a compound annual growth rate of around 5%.

For comparison, the gross domestic product in the euro area has the following values:

- In 2009 it was 9.27 trillion euros;

- In 2021 it was 12.26 trillion euros.

This results in a compound annual growth rate of around 2.4% of the gross domestic product in the euro area for the last 12 years.

Now the final question for this chapter. Which system is fairer in the long term?

Let everyone make up their minds based on the arguments presented in this chapter.

Since the birth of the fiat system, the money supply M2 has grown faster than the gross domestic product and ensures that there is asset price inflation. As mentioned earlier in the chapter, those who own scarce goods such as stocks, real estate, and gold can possibly offset the growth in the money supply and it fits with the illusion that the richer people can increase their wealth faster.

For me it is clear that the bitcoin network is developing in the right direction, and how are bitcoins distributed within the network. Which also makes physical sense, distribution always takes place in a closed system. Accumulation can only happen if you supply energy, or either you exchange your fiat for bitcoins. You can also do work that is demanded by a free market and be rewarded in bitcoin. Another option is to become a bitcoin miner. If you don't produce anything that is in demand, then you can only save or consume your bitcoins. However, when you save, you have to earn a living from other sources, otherwise, you will inevitably starve.

However, I do not want to close the chapter without thanking the two authors for not making the “tulip mania” argument. For those who want to learn why “tulip mania” which is always used by sceptics of bitcoin - never existed in reality, I recommend Lorraine Boissoneault’s wonderful article “There Never Was a Real Tulip Fever” in Smithsonian Magazine.

Financing of Criminal Activities, Terrorist Organizations and the Rogue States

In this chapter of the blog post, the two authors postulate that the Bitcoin network has become the vehicle of choice for criminal activities to launder money or for other illegal activities. If you had a little more knowledge of the Bitcoin network, you would realize that this statement is nonsense. The Bitcoin network operates pseudonymously. This means that when the addresses are created, the owners are not known. However, all transactions between these addresses are stored in the bitcoin network's ledger (a public record of all transactions) for everyone to see as long as the bitcoin network is operational. In comparison, the 'cash' in the fiat system operates anonymously, which means it is very difficult, if not impossible, to understand how and where the money flows. Based on this simple comparison, it should be clear to everyone.

I wrote above that the address holders are not known, but that is only half the truth. The address is generated anonymously, but as soon as this address comes into contact with the outside world, i.e. the Fiat system, it can be associated with real names through the KYC ("Know Your Customer") guidelines. Through this connection, almost anyone who was mentally challenged enough to use the Bitcoin network for their illegal activities has been hunted down over the long term.

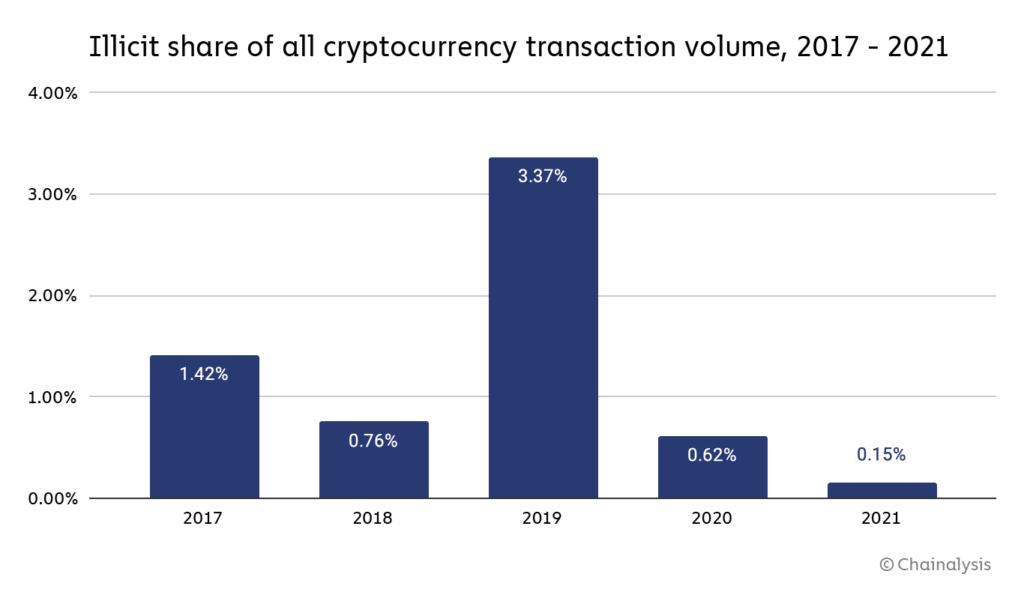

One source for finding out how large the proportion of illegal Bitcoin transactions is via the company 'Chainalysis', which is very unpopular among Bitcoiners. In their latest “Crypto Crime” report, they highlight that in the entire crypto ecosystem, 14 billion US dollars came from illegal activities in 2021, a percentage that is 0.15% of the total transactional volume. Since Bitcoin is part of the ecosystem, these values have yet to scale and showcase what percentage of that 0.15% is Bitcoin. Finally, the bitcoin dominance chart can be used to make a meaningful statement. Bitcoin’s share varied around 40%, down from 70% in 2021. As a result, it is believed that absolutely $5.6 billion (in terms of 40% dominance) to $11.9 billion (in terms of 70% dominance period) was used for illegal purposes via the Bitcoin network. In percentage terms, this is 0.06% to 0.105% of the total transactional volume.

To be able to judge this fact, these values must be placed in relation to the Fiat system. Therefore, it makes sense to consult a United Nations report on the estimated damage caused by tax evasion, money laundering and corruption. I take the liberty of quoting an entire paragraph from the report here. May everyone make up their minds and thoughts on it.

According to the report, governments are unable to agree on either the problem or the solution, while resources that could help the world's poor are drained through tax abuse, corruption and financial crime. The estimates include:

- $500 billion in losses to governments each year from corporate profit shifting;

- $7 trillion in private wealth hidden in tax havens, with 10% of world GDP held abroad;

- Money laundering of around $1.6 trillion per year, which is 2.7% of the world's gross domestic product.

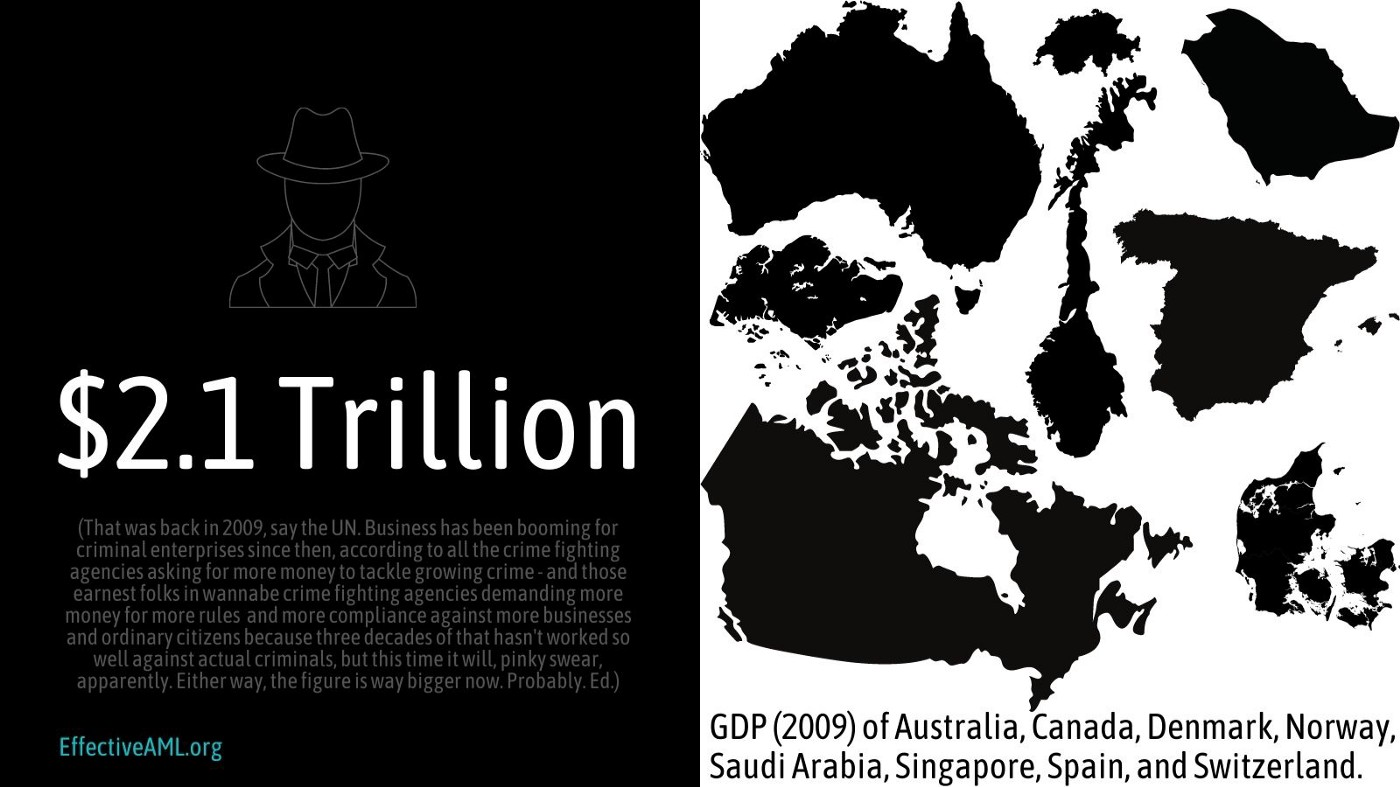

Another source for guessing how big the problem of illegal transactions in the fiat system is a meta-analysis of various studies. This shows that illegal activities account for an average of 3.6% (with a range of 2.3% to 5.5%) of global gross domestic product. For 2009 it was 2.1 trillion US dollars. To get a sense of the scale, that's the cumulative gross domestic product of Australia, Canada, Denmark, Norway, Saudi Arabia, Singapore, Spain and Switzerland.

Now to compare the two systems. To not make things too disastrous for the fiat system, I just took the number for money laundering from the UN report, which is US 1.6 trillion dollars. The US 11.9 billion was used for illegal transactions on the Bitcoin network. This means that 134.45 times more money is used for illegal purposes in the fiat system.

Now one might argue that the global gross domestic product is higher than the Bitcoin transactional volume. If you compare the two systems in percentage terms, in the Fiat system 2.7% of the global gross domestic product is used for illegal purposes, while in the Bitcoin network transactions related to illegal purposes account for a maximum of 0.105% of the transactional volume. This means that 25.7 times more money is used for illegal purposes in the Fiat system.

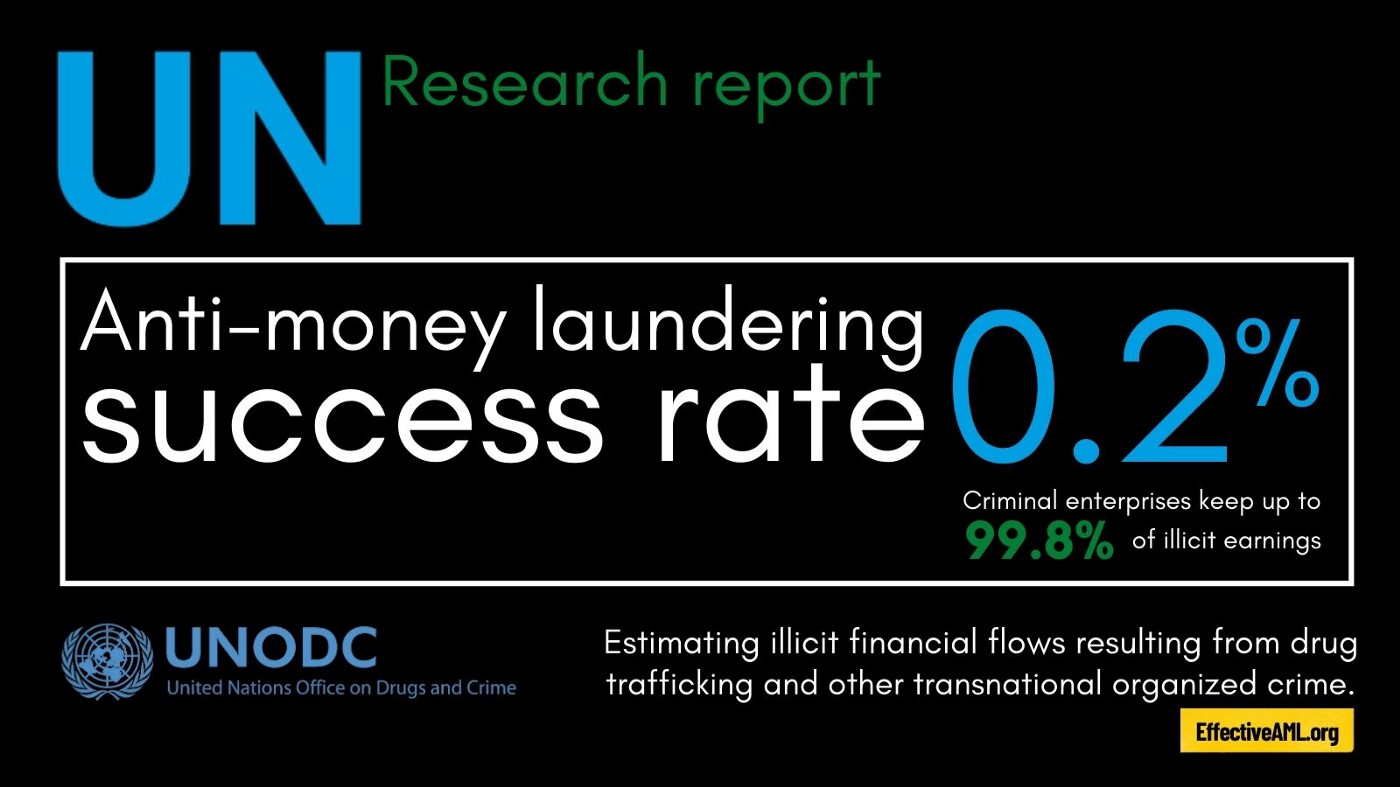

Now comes the disastrous factual detail. The clear-up rate of the AML (“Anti Money Laundering”) guideline, which was specially created to better clear up the illegal money flows in the Fiat system, is an incredible 0.2%. Taking the US $1.6 trillion for money laundering from the UN report, the criminal people were able to keep the US $1.599 trillion. This means that in the fiat system, criminals can keep 134.37 times more US dollars than the entire value of the Bitcoin network used for illegal activities.

What about the other weapon against illegal transactions in the fiat system, the infamous Know Your Customer (KYC) policy? Here are a few facts:

- What did it achieve?

Almost nothing, see AML result. - What does it cost the user?

All of their private information must be disclosed upon registration. Again, this data is a honeypot for hackers, who often manage to hack and sell it. The users are responsible for the damage, not the institutions and companies that keep this data. - What does it cost the companies?

The total cost of this policy is estimated at $2 trillion per year. That is around 2% of global gross domestic product. Who bears the costs? The users have to pay more expensive prices for all consumer goods. - Does this policy spur corporate innovation?

No, the administrative effort increases and the innovative power decreases. - What are the side-effects of it in third world countries?

This policy is killing people who we should be helping. What happens if a country gets on the non-compliant list and the banks refuse to transfer money back to those countries so that people there can buy food or medicine? Anyone can imagine that. - What does this policy do?

A global surveillance system that massively and permanently restricts our freedom. We give up our freedom for a ridiculous gain in security.

If you want to know more about the AML and KYC guidelines, you should read this CoinDesk article and follow Dr. Ron Paul on Twitter (@ronpaul).

According to the two authors of the blog article, “ Bitcoin has proven itself as a means of payment for criminal purposes ”. Honestly, I am at a loss for words about such a statement by two paid representatives of the Fiat system, given the facts. Here, desperate attempts are made to distract everyone from the real evil in the world.

A study is then quoted that 90% of transactions in the Bitcoin network are used for illegal purposes. We have a study here from scientists and on the other side, we have the data from Chainalysis. Chainalysis, a company that works for the US government and other governments worldwide and is the first choice when it comes to investigating illegal activities in the crypto space. Well, who to trust?

For me, it is clear that the source I trust more is the people who work in this area daily and who are familiar with it.

In the following paragraphs, the authors show again that their knowledge of Bitcoin can only be described as inadequate. Again to repeat: Bitcoin works pseudonymously and not anonymously, there's a huge difference. They also try to scare the reader that $2 million has been confiscated by the US government from crypto accounts attributed to terrorist organizations. If we recall the numbers from the Bitcoin dominance chart, the share was between 40% and 70%. This means that the scaled bitcoin share can be estimated at around $0.8 to $1.4 million. If you put that in comparison to the sums given in the UN report mentioned above and recall the clear-up rate of the AML directive, you can see the factual difference.

What is striking here is: that the authors want to put Bitcoin in a bad light and always quote “crypto”. If you only want to criticize bitcoin, then please go through the trouble to calculate the bitcoins' share. Why don't they do it? Too lazy, too incompetent or it just doesn't fit into the agenda? Let's be honest: you can expect a little more scientific work from two seasoned men with a doctorate.

Finally, it is then assumed that the sanctions can be circumvented using "crypto-assets". Here again, two facts are mixed up and the reader's ignorance about sanctions is played with or even worse, the two authors did not understand this fact themselves. In short: if a US-initiated sanction is imposed on individuals or legal entities, the names of those who are sanctioned end up on a list. Any legal or natural person who nevertheless trades with the sanctioned persons and helps them avoid the sanctions ends up on the same list. As a result, this company is then excluded from international trade. It is irrelevant how the merchandise is paid for, i.e. Fiat, Bitcoin, crypto, gold or something else. One can assume that the two authors are trying to impute something to Bitcoin only. Bitcoin is a tool, which is neutral. People can use it for good or bad.

Conclusions

Will the Bitcoin Bubble Really Burst? Even many respected economists, including winners of the “Prize of the Swedish National Bank in Economics in Memory of Alfred Nobel”, have made a fool out of themselves with such a steep thesis.

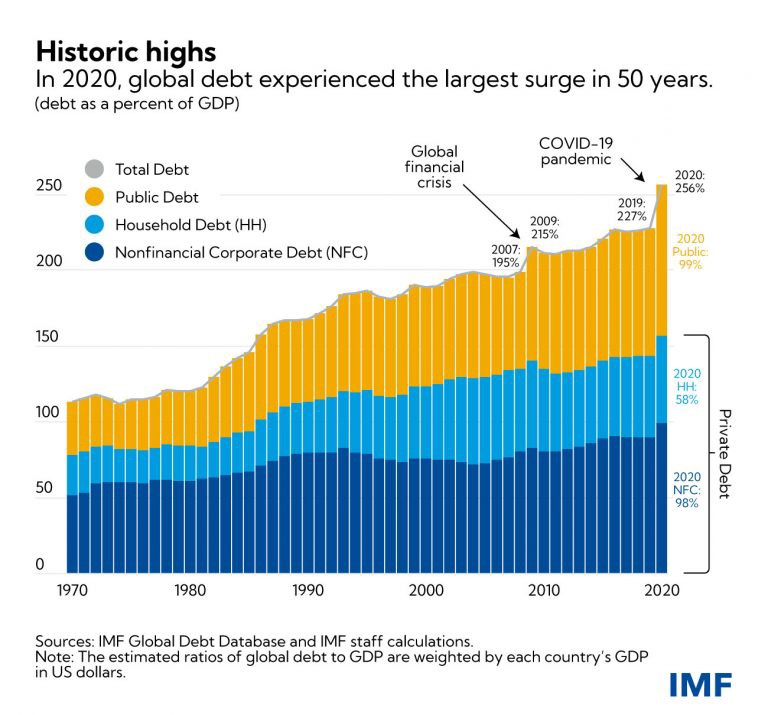

For those speculating that such an event will occur, please consider that the global debt level in the fiat money system has reached its highest level in 50 years. In 2020, this had grown to 256% of global gross domestic product. Based on the following facts:

- that the printing presses did not stand still in 2021 either;

- at the beginning of 2022, new global crises broke out;

- and their effects can already be seen on the horizon;

It is s unlikely we will see a slow global debt growth due to the death spiral of this Fiat bubble. What happens when the fiat bubble bursts from limitless growth. What damage will society endure and the environment will suffer as a result?

If they halt monetary expansion or raise interest rates to curb inflation, we will see the consequences in the stock, property, gold and of course Bitcoin markets. The question is: will we just have a recession or will we have a depression? The pain is akin to taking a drug addict's drugs away and going cold turkey.

Of course, if you work for and are paid by a central bank and live in a first-world country where there is a functioning centrally controlled monetary system, you may not have the mental capacity to imagine a decentralized, censorship-resistant monetary system like Bitcoin has any utility. The people who adhere to this attitude should ask themselves why the bitcoin adoption rates are highest in countries that do not have a functioning central monetary system and are also far from a stable democracy?

Let us recall Article 1 of the Universal Declaration of Human Rights :

“All human beings are born free and equal in dignity and rights. They are endowed with reason and conscience and should treat one another in a spirit of brotherhood.”

Based on this fact alone, every person should be free to choose which monetary system they want to use voluntarily. He is thus free to choose in which system he wants to save his unused working time or how he wants to pay for the goods that need to be consumed.

My Conclusion of The Article

According to the two authors, Bitcoin is said to cause a great deal of social damage. In this article, I've tried to generate a few different angles on this statement. The reader should form his own judgment as to which of the two systems causes the greater damage to society and the environment.

I would like to expressly thank the two authors of the blog article for the steep submission of the title "You Will Be Billed At The End"; I couldn't have chosen it better.

If you've made it this far, one more request at the end: I've given my point of view on things here. The saying "Don't trust, verify" well-known in the Bitcoin space also applies to this article. Please embark on your own journey, there are many branches in this article, follow these paths to search for the truth.

I would like to end this article with a quote from Lewis Carroll's Alice in Wonderland :

"Those who follow the white rabbit see the wonderland of reality with new eyes."